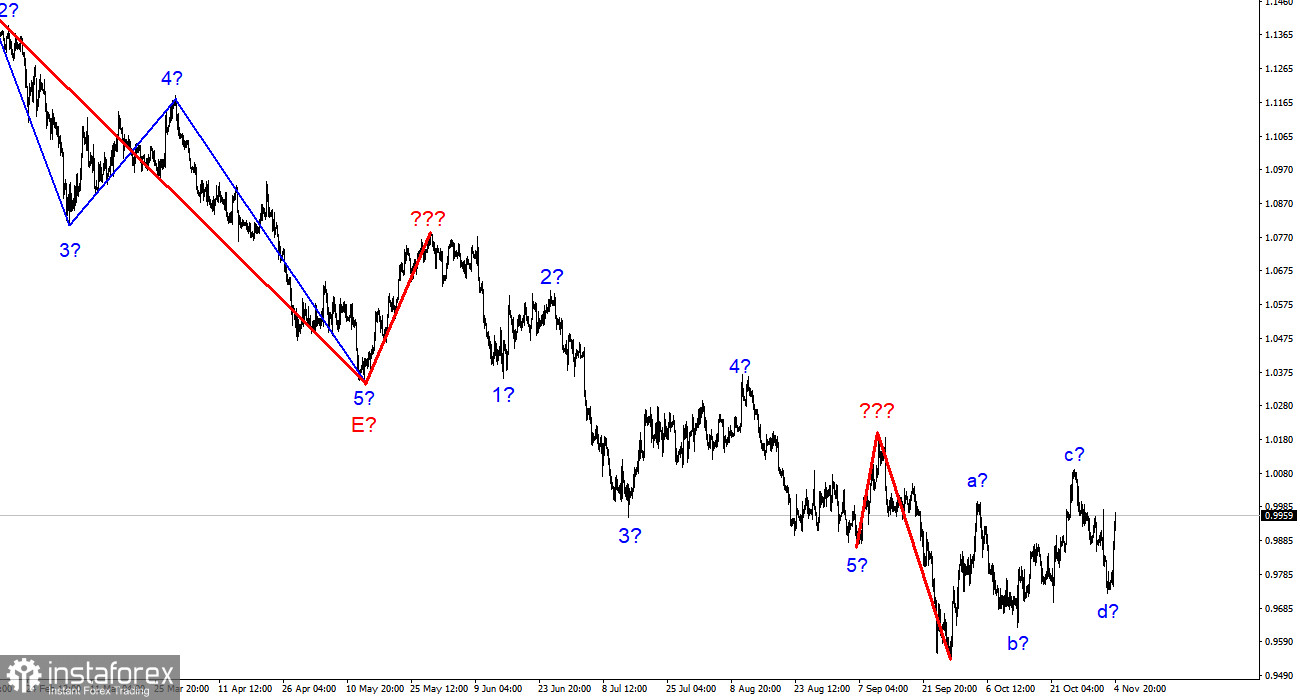

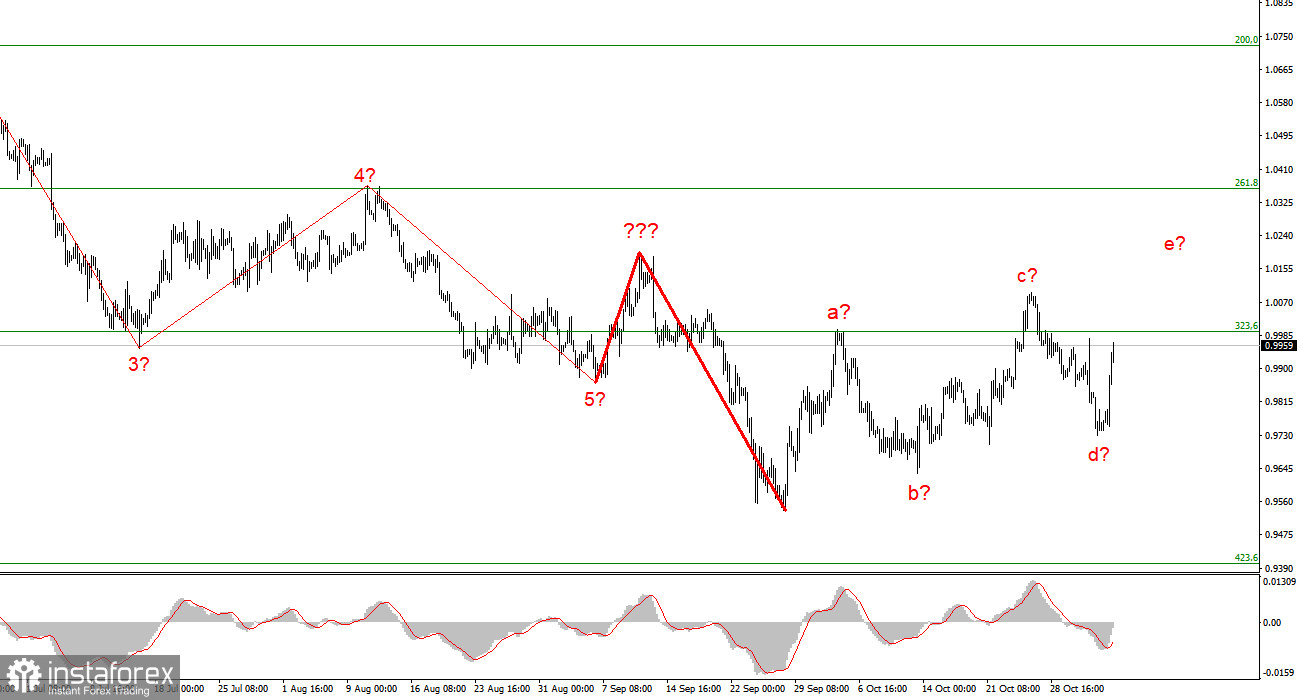

The wave marking of the 4-hour chart for the euro/dollar instrument has undergone certain changes. The upward section of the trend continues its construction, but now it takes on a pronounced corrective form. Initially, I thought three waves up would be built, but now the tool is calling to build the fifth wave e. Thus, we will likely get a complex correction structure of waves a-b-c-d-e. There is also a possibility that the latest increase in quotes is the second wave as part of a new downward trend segment. An unsuccessful attempt to break through the 323.6% Fibonacci level can confirm this assumption.

The most important thing now is that the wave markings of the pound and the euro coincide. If you remember, I have repeatedly warned about the low probability of a scenario in which the euro and the pound will trade in different directions. Theoretically, this is certainly possible, but it rarely happens in practice. Now both instruments are presumably building corrective trend sections. The European currency may rise next week beyond the peak of the expected wave c.

Unemployment in the US has risen again.

The euro/dollar instrument rose by 210 basis points on Friday. Such a strong growth of the euro currency should have been caused by something. However, I didn't have to guess for a long time about this. On Friday, important reports on the labor market, wages, and unemployment were released in the United States. Although, in my opinion, only the nonfarm payrolls report can be considered important. Unemployment is also very important, but it usually either does not change or changes very little. According to the report on payrolls, 261 thousand new jobs were created in the United States in October, which is higher than market expectations. In addition, the value of September was revised upward and now stands at 315 thousand. However, at the same time, the unemployment rate rose from 3.5% to 3.7%. We should have analyzed this data and figured out how to move on.

As you can see, the two key reports of the day contradicted each other. In such a situation, relying on the market was necessary. The market decided that the unemployment rate was more important now and began reducing the demand for the US dollar. It seems that such a reaction was not expected, but you can't argue with the market. I want to note that the growth of the European currency on Friday was stronger than its fall on Wednesday and Thursday, when the Fed raised the interest rate by another 75 basis points. I believe we did not see much of a reaction to the reports on payrolls and unemployment on Friday. After all, the market is now set up to buy a tool to build at least a small ascending section. Therefore, they decided to buy when it was possible to sell.

General conclusions.

Based on the analysis, I conclude that constructing an upward trend section will become more complicated than a five-wave one. At this time, the instrument could start building the fifth wave of this section, so I advise buying with targets above the peak of wave c, according to the MACD reversals "up." The entire trend segment originating after September 28 takes the form a-b-c-d-e, but a new downward trend segment can begin to build after its completion.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. We saw three waves up, which are most likely the a-b-c structure, but two more waves will probably be built in the same structure. The construction of a downward trend section may resume after the completion of the construction of this section.