The USD/CAD pair fell almost 300 points on Friday, reacting to the release of data on the growth of the labor market in the US and Canada. While traders were disappointed with the US nonfarm data, the Canadian release turned out to be surprisingly strong. Almost all components of the report came out in the green zone, exceeding the expectations of most experts. The result was not long in coming: hawkish expectations about the further actions of the Bank of Canada intensified. But opposite sentiments prevail about the US Federal Reserve: many experts are confident that the US central bank will slow down the pace of tightening monetary policy in December, that is, at the next meeting. Such conclusions allowed the USD/CAD bears to organize a downward rally on Friday: if the pair was trading around the 37th figure in the morning, then by the close of trading the price was already at 1.3478 (a 2.5-month price low).

Let me remind you that last month the Bank of Canada gave USD/CAD bears a "dovish surprise": contrary to the expectations of most experts, it did not raise the interest rate by 75 points, limiting itself to a 50-point hike. At the same time Bank of Canada Governor Tiff Macklem said that the central bank "is nearing the end of the tightening phase," and the decision to slow down the pace of the rate hike was made "against growing fears about the deepening of the global economic downturn." At the same time, he noted that the process of tightening the monetary policy has not yet been completed - the central bank is simply trying to balance the risks of "insufficient and excessive increase in the rate."

Such dovish messages put pressure. There was talk in the market that at the next meeting in December, the Bank of Canada would raise rates by only 25 points, marking a new pace of tightening monetary conditions. Amid such assumptions, bulls on USD/CAD were able to develop the upward movement, reaching the 38th figure. It is noteworthy that the pair grew even amid a general weakening of the greenback ahead of the Fed's November meeting. That is, the main locomotive of price growth was the loonie, which was under pressure from the dovish position of the Canadian central bank.

However, Friday's reports still managed to change the situation. Market confidence has increased that the Bank of Canada will keep the 50-point rate hike. In particular, this opinion was voiced by CIBC bank analysts who commented on the data. The sharp increase in the number of employees may be a sign that the declines seen in the summer were just "statistical noise", they said.

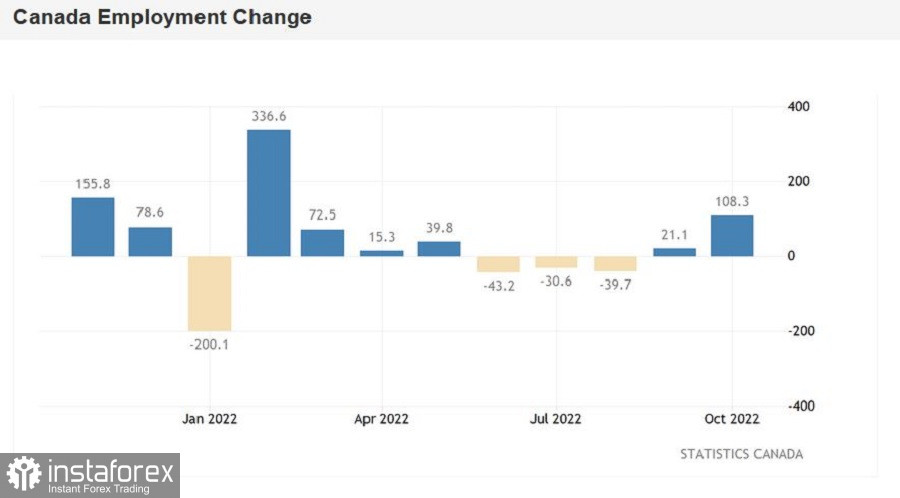

The growth rates are indeed impressive. So, with a growth forecast of 11,000, the number of employees increased by 108,000 (!). Moreover, this increase was driven by an increase in the full-time component, while the part-time component decreased by 11,000. As you know, full-time positions offer higher salaries and social security, having a beneficial effect on the consumer activity of Canadians and, ultimately, on inflationary growth in the country. Therefore, the figures are positive (for the loonie) in this context as well. The majority of jobs were created in the private sector, although public employment and self-employment have also increased. Another positive moment is the increase in the proportion of the economically active population. This figure rose to 64.9% (the highest since June). The unemployment rate remained at 5.2%, with an increase forecast to 5.3%.

Thus, the strong data on the growth of the Canadian labor market, the growing hawkish mood regarding the further actions of the Bank of Canada, the controversial US Nonfarm - all these factors allowed the USD/CAD bears to seize the initiative and win back almost 300 points. The loonie also received indirect support from news that China may be easing its zero-tolerance policy on the coronavirus.

In addition, interest in the Canadian dollar is also growing as the oil market strengthens. In particular, futures for WTI rose on the New York Mercantile Exchange to $92.6 per barrel.

Thus, the prevailing fundamental background for the pair contributes to a succeeding decline. The "dark horse" here is US inflation, the October value of which we will know on November 10th. However, there are still a few days before the release, while all other fundamental factors are still playing on the side of the USD/CAD bears.

From a technical point of view, the pair on the D1 timeframe is on the lower line of the Bollinger Bands indicator, which coincides with the upper boundary of the Kumo cloud (1.3470). If bears overcome this support level, then the next target will be the lower boundary of this cloud, which corresponds to 1.3280.