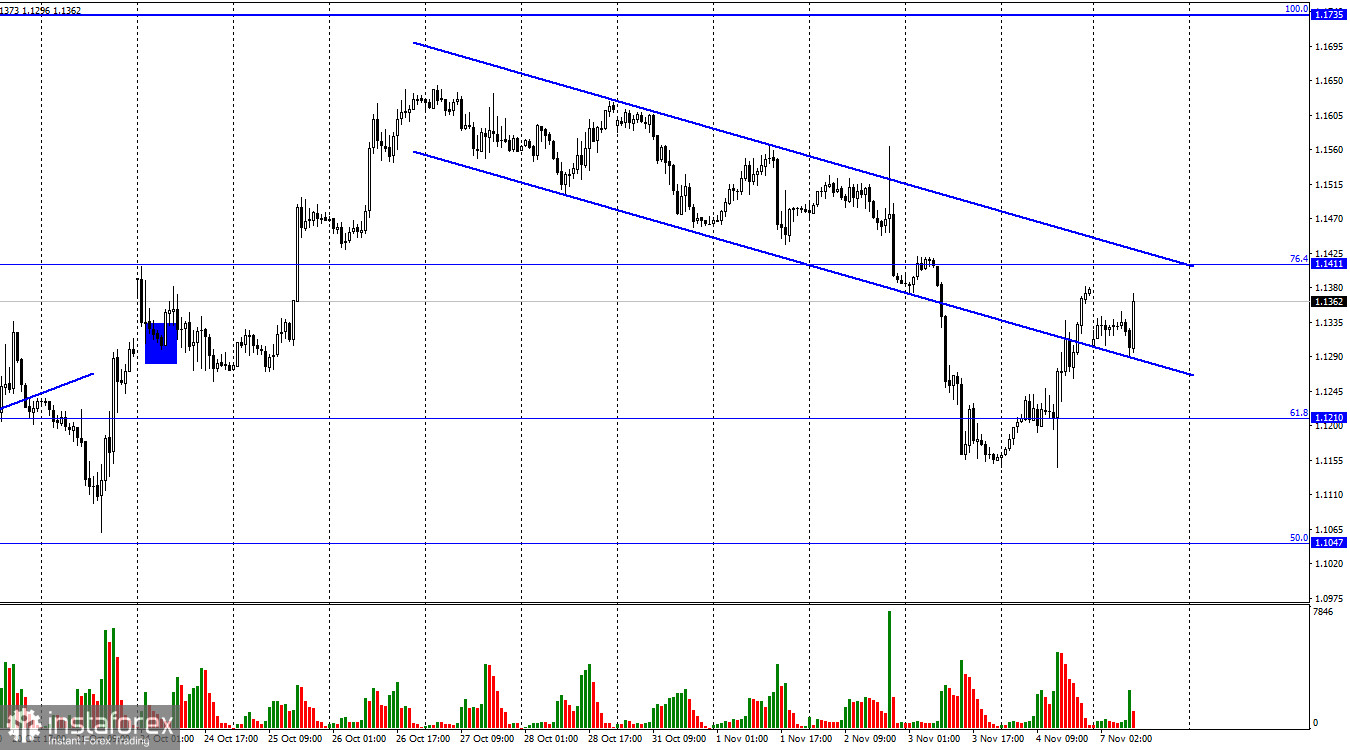

Hello, dear traders! On Friday, on the one-hour chart, the pound/dollar pair reversed and started rising towards the 76.4% correctional level located at 1.1411. Today, the pair resumed climbing toward this level. If the price bounces from this level, the US dollar will have a chance to rise and the price itself will start falling towards the 61.8% Fibonacci level located at 1.1210. If the price settles above this level, it will mean that it is fixed above the downward trend channel. In this case, the pair may climb to the 100.0% Fibonacci level of 1.1735.

On Friday, traders were mainly focused on reports from the US. The unemployment rate increased to 3.7% from 3.5%, whereas the number of new jobs in the non-farm sector added 261K. Although the NFP report was stronger than expected, its reading was lower than a month ago. That is why most traders consider this report a negative one. In addition, the unemployment rate also increased. The US salaries advanced by 4.7%, showing a slower rise compared to 5% in the previous month. Thus, two out of three reports met traders' expectations but were weaker than the previous ones. The third report was below the forecast. In this light, the US dollar dropped.

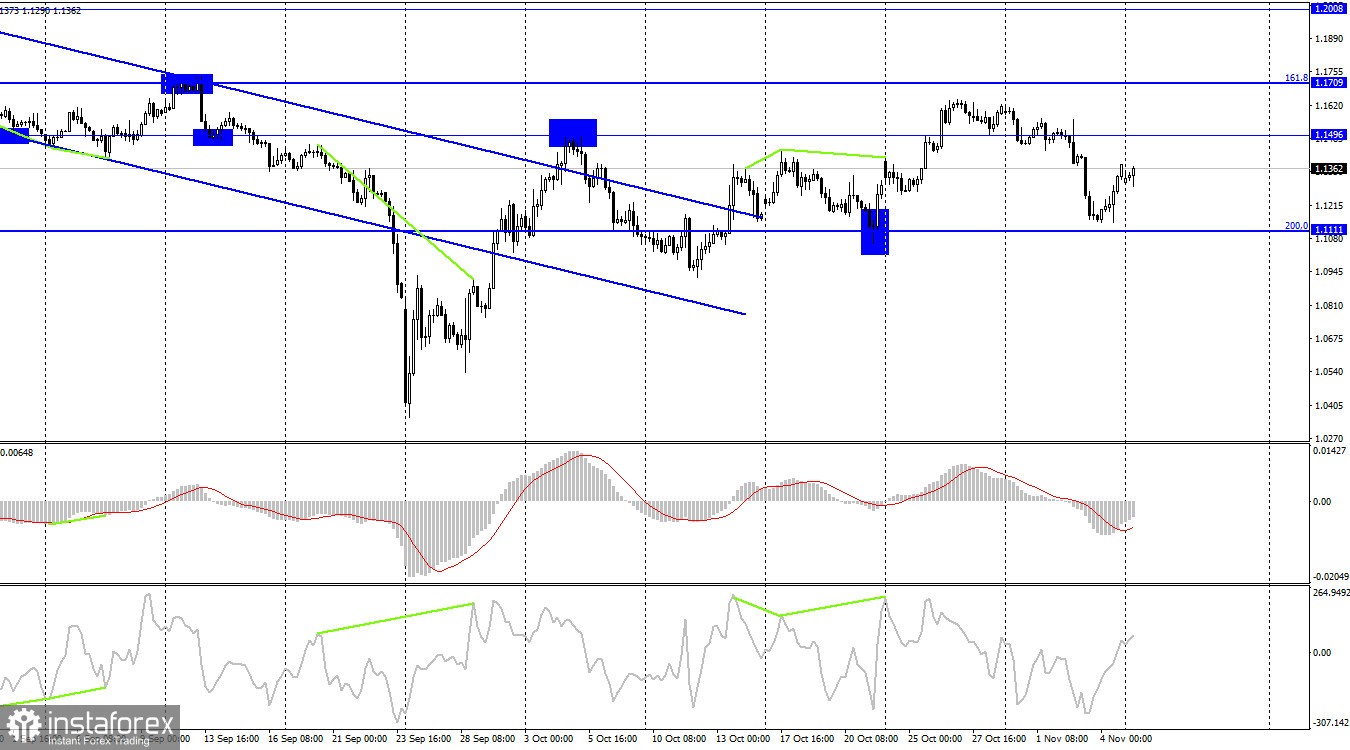

On Friday, traders' sentiment could also be shaped by the key interest rate hike by the BoE, which took place a day earlier. Then, the pound sterling was falling, ignoring the regulator's actions. Today, the pound sterling opened with a rise despite a lack of news from the US and the UK. According to the graphical analysis, the price may continue climbing since, in October, the quote closed within the downward trend channel on the four-hour chart.

On the four-hour chart, the pair reversed in favor of the pound sterling. It started rising towards 1.1496. If the price consolidates above this level, it will have more chances to climb to 1.1496 and 1.1709. The British pound is still gaining in value, though very slowly.

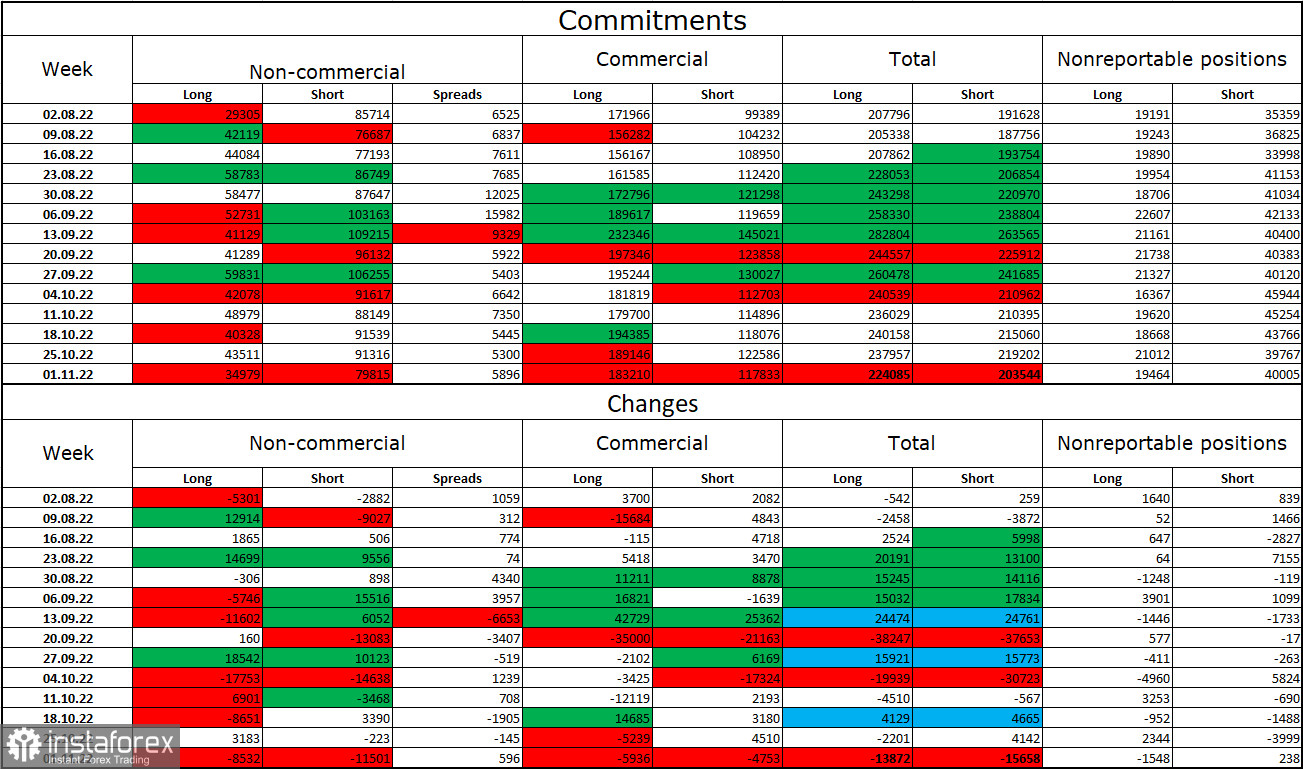

COT report

Last week, the sentiment of non-commercial traders was less bearish compared to the previous week. The number of long positions opened by speculators increased by 8,532, whereas the number of short ones rose by 11,501. However, the sentiment of big players remains bearish. The number of short positions significantly exceeds the number of long ones. Thus, big traders continue to sell the pound sterling and their sentiment is slowly changing to bullish. However, the process is long and slow. The pound sterling may increase only in case of strong macroeconomic data. Notably, the sentiment of the euro speculators became bullish long ago. However, demand for the euro is still very low. Meanwhile, the COT report for the pound sterling could hardly provide a reason to buy the asset.

Macroeconomic events in the UK and the US:

On Monday, the UK and the US are not going to publish any important reports. Today, news flow will have zero influence on traders' sentiment.

Outlook for GBP/USD and recommendations for traders:

Traders may sell the pound sterling in case of a bounce from 1.1411 on the one-hour chart with the target is 1.1210. Buy orders could be initiated with the target of 1.1709 if the price closes above the downward channel on the one-hour chart.