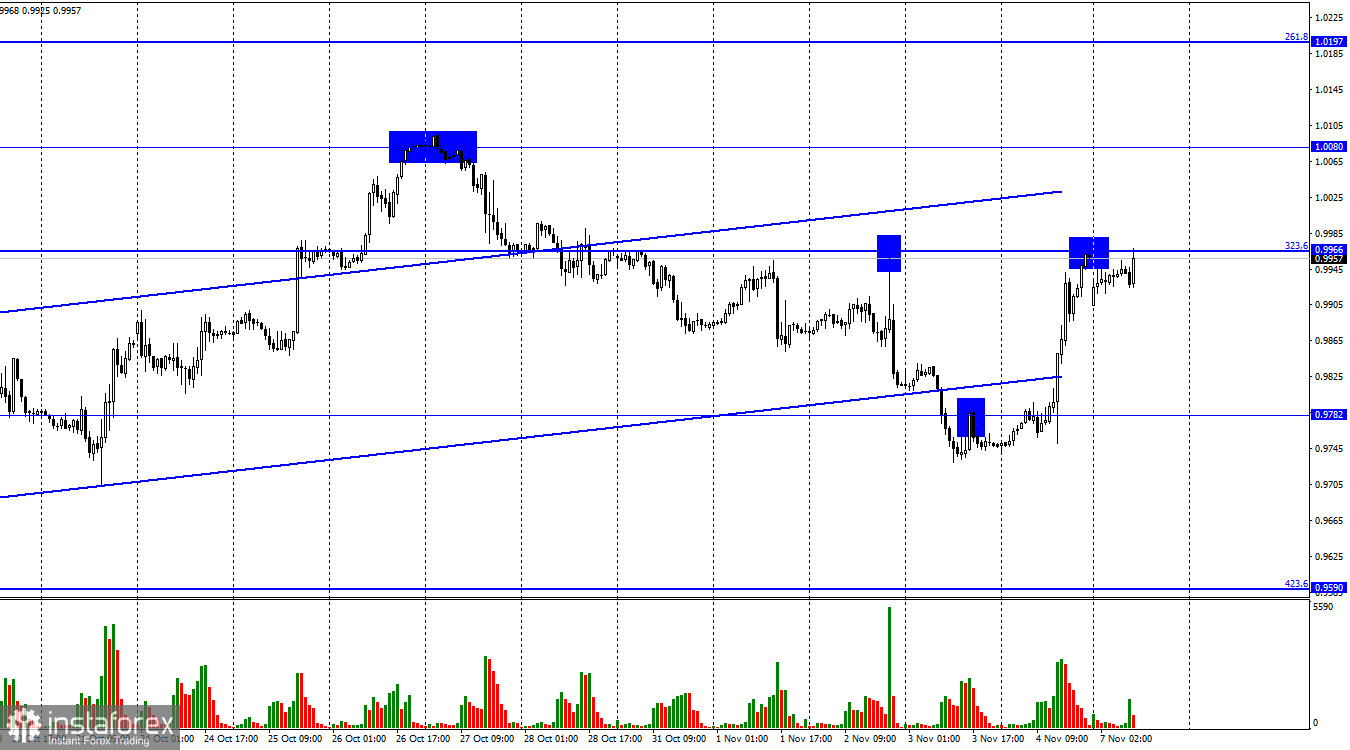

The EUR/USD pair performed a reversal in favor of the European currency on Friday and rose to the corrective level of 323.6% (0.9966). The rebound of quotes from this level will work in favor of the US currency and the resumption of the fall in the direction of the 0.9782 level. Closing the pair's rate above 0.9966 will increase the probability of further growth toward the next level of 1.0080.

Friday turned out to be another very active day. On this day, important reports on the labor market, unemployment, and wages were released in America. We'll talk about them later, but it's worth noting that the pair's growth was largely related to these reports. At the same time, an unscheduled speech by ECB President Christine Lagarde took place on Friday. She said she "sees the likelihood of a mild recession" but does not believe a downturn in business activity will help bring inflation back to the target of 2%. She also noted that the ECB could not let inflation control out of its hands and let everything take its course.

However, even more important were her following sayings. "An increase in rates may not lead to a drop in prices at gas stations and will not lead to the disappearance of problems with supply chains, but it is extremely important for us to abandon the monetary stimulus of recent years so that people do not think that high inflation will now be with us forever," she said at a press conference on Friday. I believe that this speech was also partly the reason for the growth of the European currency at the end of last week. Christine Lagarde made it clear that the ECB will continue to tighten monetary policy, which is very good for the euro. It still occupies an extremely weak position in pair with the dollar, and the ECB's support is necessary and important. Bull traders can feel the support of the European regulator, and we can still see a certain growth in the euro currency.

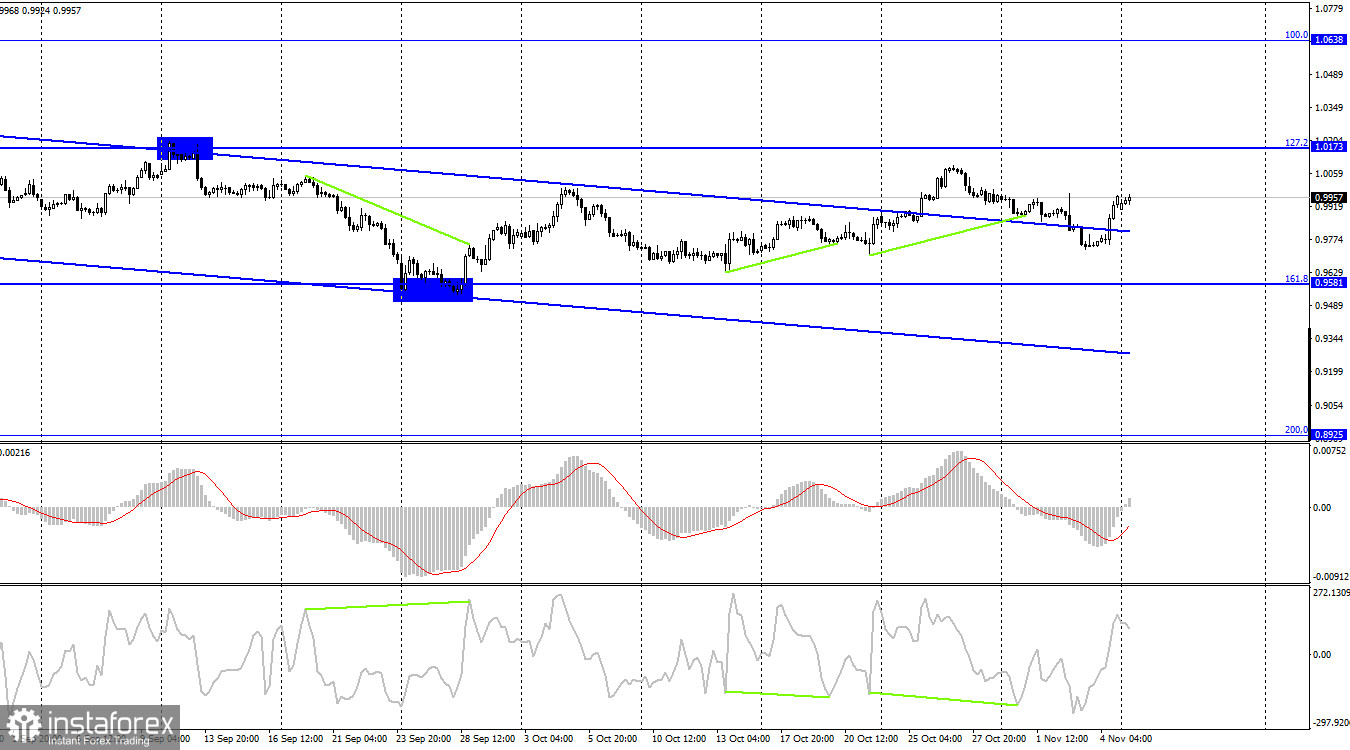

On the 4-hour chart, the pair performed a new reversal in favor of the EU currency and resumed the growth process towards the corrective level of 127.2% (1.0173). Earlier, the pair performed a consolidation over a descending trend corridor, which is an extremely important moment since it changes the mood of traders to "bullish." A rebound from the 1.0173 level may work in favor of some fall.

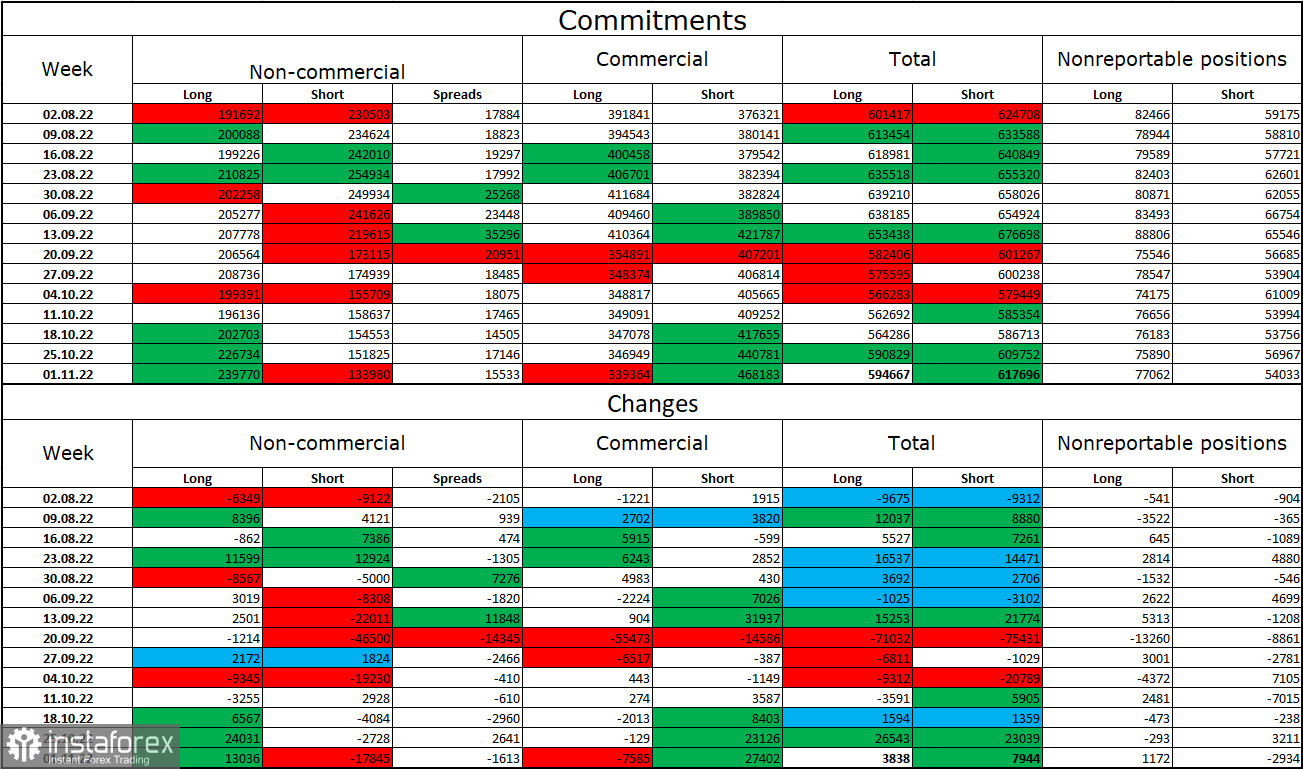

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 13,036 long contracts and closed 17,845 short contracts. This means that the mood of large traders has become much more "bullish" than before. The total number of long contracts concentrated in the hands of speculators now amounts to 239 thousand, and short contracts – 133 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the growth of the euro currency have been increasing, but traders are not ready to completely abandon purchases of the US dollar. Therefore, I would now bet on a descending corridor on a 4-hour chart, over which it was still possible to close. Accordingly, we can see the continuation of the growth of the euro currency. However, even the bullish mood of major players does not allow the euro currency to show strong growth.

News calendar for the USA and the European Union:

On November 7, the calendars of economic events in the USA and the European Union are empty. The influence of the information background on the mood of traders will be absent today.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when rebounding from the 0.9966 level with a target of 0.9782. I recommend buying the euro currency when fixing above the level of 0.9966 on the hourly chart with targets of 1.0080 and 1.0173.