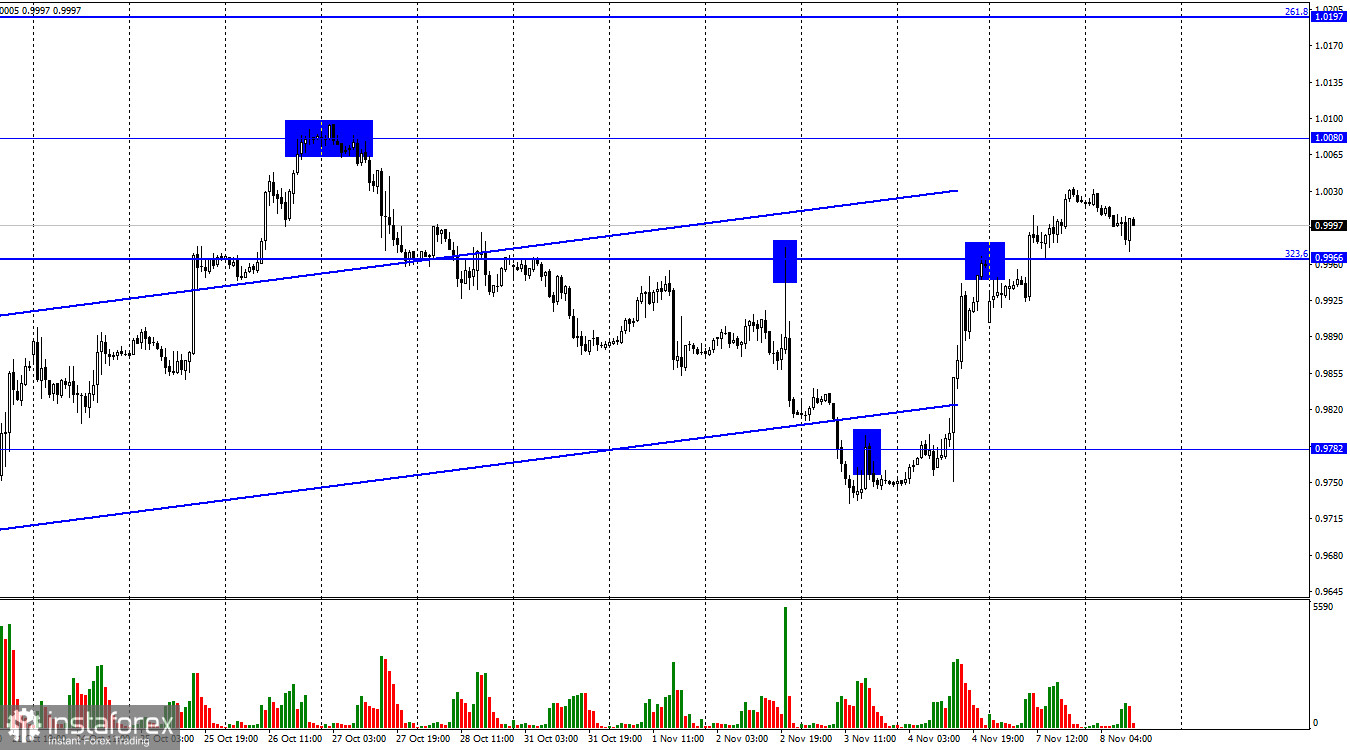

Hello, dear traders! On Monday, the EUR/USD pair continued rising and consolidated above the correction level of 323.6% at 0.9966. Therefore, the euro can increase further towards the next level of 1.0080 in the coming days. This forecast does not meet expectations of all analysts. Many of them still predict the pair will decline as they do not see the news background favorable to the euro. Almost all segments of the euro's growth can be interpreted as a correction. If the pair consolidates below 0.9966, the USD will rise and also the pair will decline towards 0.9782.

Notably, last week the Fed raised the rate by 0.75%, and the number of nonfarm payrolls exceeded traders' expectations. Moreover, the unemployment rate increased to 3.7%. However, if all news is analyzed, it will be at least neutral, but not negative for the USD. Therefore, I believe the current decline of the US dollar will not be long-term. The situation was the same on Monday. There was no news background. However, bulls kept buying the EUR/USD pair as if the ECB again raised the rate.

Today, the Senate elections are held in the US. Republicans might win and control both chambers. This probably will cause changes in the economic policy. Notably, the British pound recovered when Liz Truss resigned and Rishi Sunak took up her post. However, the US dollar is currently falling. Is the policy pursued by Democrats better for the US economy? Many Americans have a different view. Therefore, the current movement of the EUR/USD pair has no connection with the elections in the US.

The EU retail trade report was released today. September growth totaled 0.4% m/m and -0.6% y/y. Traders expected these figures. Thus, the euro neither gained nor declined amid this report. Today, the EU economic calendar contains no more significant data.

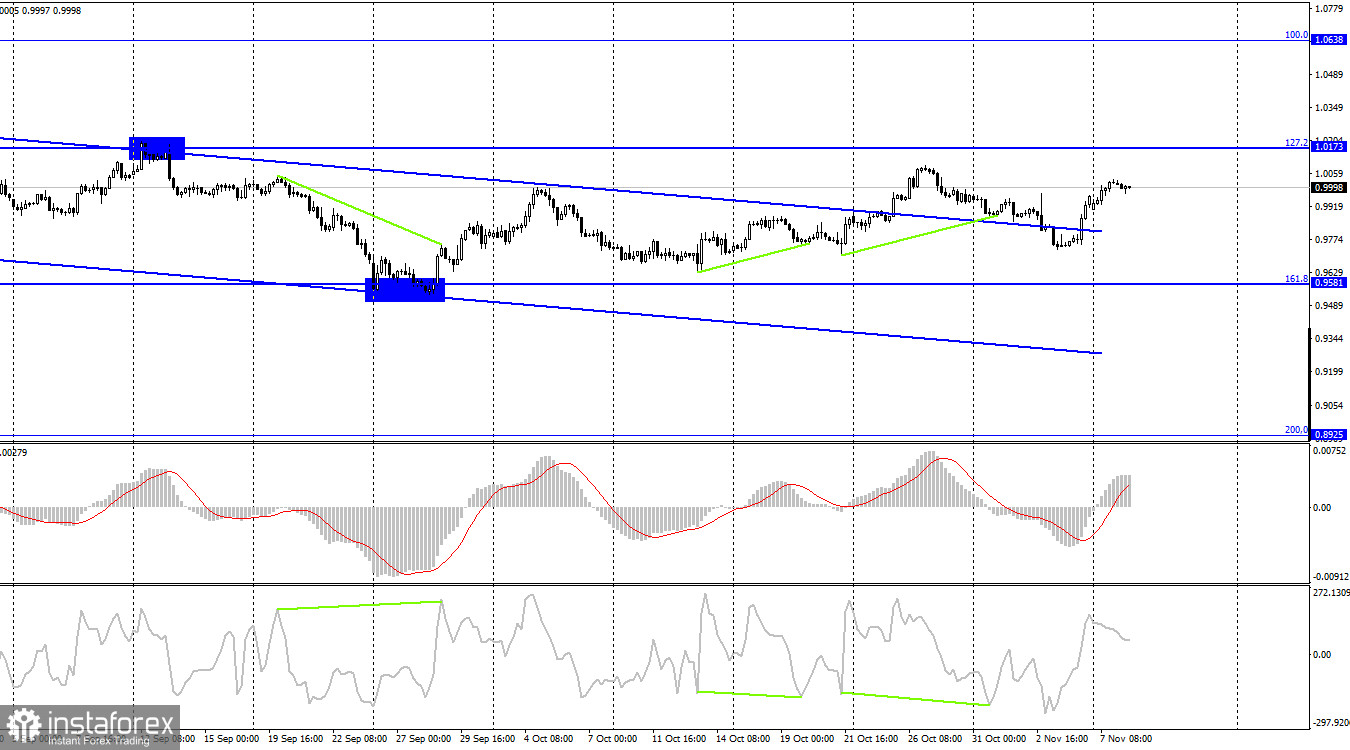

On the 4H chart, the pair performed a new reversal in favor of the EU currency and resumed its growth towards the correction level of 127.2% at 1.0173. Earlier, the EUR/USD pair had consolidated above the descending trend channel. This is extremely important as it changes traders' sentiment to a bullish one. A rebound from the level of 1.0173 may be a reason for a slight decline.

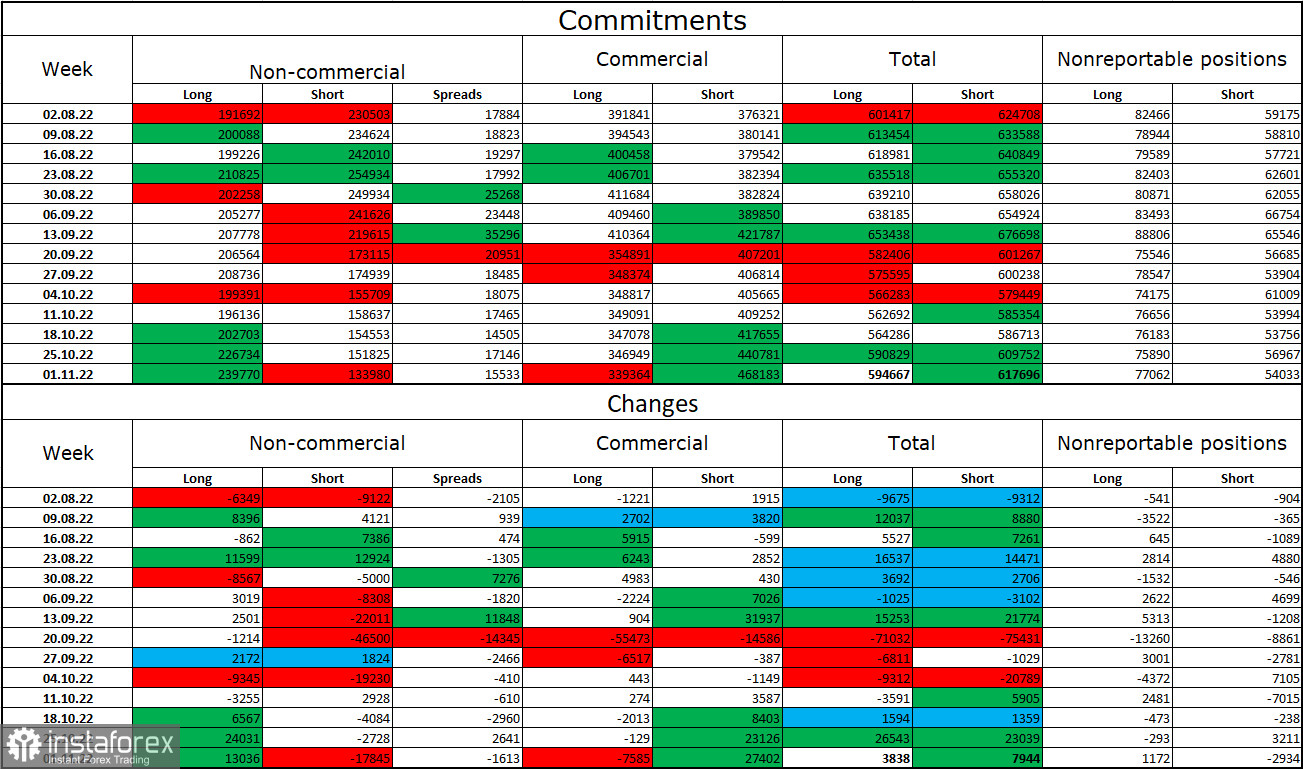

COT report:

Speculators opened 13,036 long contracts and closed 17845 short contracts last reporting week. This means that the sentiment of large traders has become much more bullish than before. The total number of long contracts held by speculators is now 239,000, while the number of short contracts totals 133,000. However, the euro is still facing serious problems with growth. The asset has been rising for the last few weeks. However, traders cannot stop buying the USD now. Therefore, I would focus on the descending channel on the 4H chart, above which the pair managed to close. Respectively, the euro's further growth is possible. However, even the bullish sentiment of major market makers cannot trigger the euro's dramatic rise.

US and EU economic news calendar:

EU - Retail Sales Volume (10-00 UTC).

On November 8, the US and EU economic calendars contain one entry for both currencies. Moreover, this report has been published! The news background will not affect traders' sentiment for the rest of the day.

EUR/USD outlook and recommendations for traders:

I recommend selling the EUR/USD pair when it closes below the level of 0.9966 on the hourly chart with a target of 0.9782. I recommend buying the euro at the close above the level of 0.9966 on the hourly chart with the targets of 1.0080 and 1.0173. This trade can be kept open until the pair closes below 0.9966.