US stock index futures rose on Tuesday as investors continue to assume that the outcome of the midterm elections will favor an early rally in the stock market. Treasuries also increased slightly and yields fell ahead of the publication of US inflation data due this Thursday. This will help determine the Federal Reserve's future scenario and policy.

S&P 500 and Nasdaq 100 futures were up 0.1% each after rising in yesterday's trading session. The Dow Jones Industrial Average is trading almost unchanged. Two-year Treasury bond yields fell by 1 basis point. The dollar stabilized after a two-day decline.

According to the latest polls, Republicans could win the race, thereby seriously affecting the future policy of Democrats. Currently, investors consider several scenarios. In the best-case scenario for Treasuries, Republicans may control both the House of Representatives and the Senate, while the US dollar could get support if Democrats keep both chambers under their control.

The US heavy debt burden could obviously prevent Democrats from enacting many of the economic reforms they would have enacted if Republicans had failed to win in the midterm elections. Sentiment remains volatile as the Federal Reserve's monetary policy is the most significant obstacle to the stock market.

As I noted above, the Consumer Price Index data will be a signal of further moves of the market and what traders should focus on. Many economists expect inflation to continue rising, though they assume that it might reduce at some point. This will cause another rally in the stock market, but it could not remedy the situation. The swap market supports a 50 basis point Fed rate hike in December after a fourth consecutive large increase to the 4% target range at last week's meeting. Rates are expected to peak above 5% around mid-2023.

While many experts have warned of the risk to the stock market from the Fed's continued hawkish stance, it is clear that investors are increasingly expecting the regulator to loosen its stance and announce the end of the rate hike cycle in early 2023. Currently, there are obvious signs of severe stress in US corporate activity. Out of the 441 S&P 500 companies that released quarterly results, nearly a quarter failed to meet earnings forecasts. Further policy tightening will cause even more serious problems for tech companies.

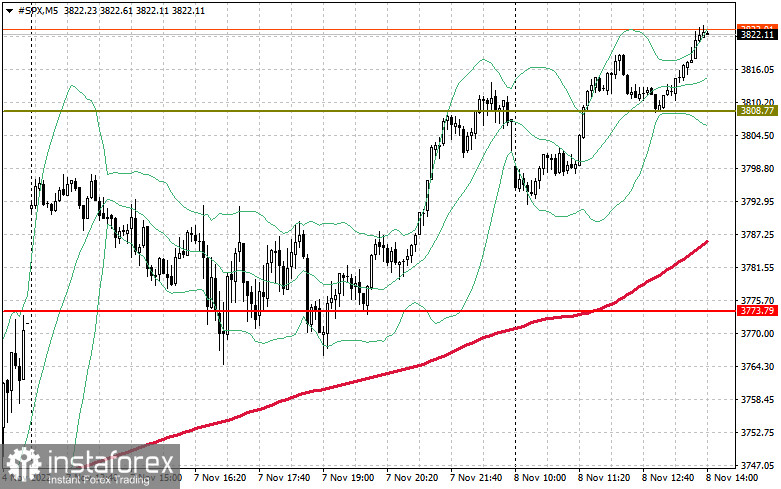

As for the technical picture of the S&P500, prices have stabilized after yesterday's upward pullback. The main target for buyers now is to protect the support of $3,808. While trading will be conducted above this level, further demand for risky assets is likely if there is no significant US data. This will offer good chances for strengthening of the trading instrument and return under the control of $3,835, just above which the level of $3,861 is located. The breakout of this area may lead to the upward correction to the resistance of $3,905. The most distant target is $3,942. In case of downtrend, buyers should be active near $3,808 and $3,773. A breakout of this range will push the trading instrument to $3,735 and $3,699, and it will also provide the opportunity to update the support at $3,661.