Fears of a global recession have served the US dollar faithfully for a long time. They were based on the belief that the most aggressive coordinated monetary restriction of central banks led by the Fed would end in nothing but a recession in the economy. As soon as Jerome Powell signaled a slowdown in rate hikes and a strong labor market report confirmed the US's resilience to high borrowing costs, everything turned on its head, triggering a surge in the EURUSD.

When you move through familiar terrain, you can rush headlong. When the territory becomes unfamiliar, it is better to slow down. The Fed knows it takes time for the economy to feel the pain of high rates. When they have already reached 4%, it is better to slow down, assess the consequences. The Central Bank has room for maneuver, which means that a recession can be avoided. Especially in such a busy environment.

Doubts about the global downturn have arisen not only in North America, but also in Asia, as well as in Europe. Rumors that China is abandoning the zero patient policy in the fight against COVID-19 to accelerate GDP growth have increased global risk appetite and supported not only the yuan, but also the euro. These currencies move quite synchronously, which has its reasons. China is the second largest market for Germany after the United States. In addition, the USD index usually falls when economic growth outside the States overtakes the American one. And at the head of the rest of the world are China and the eurozone.

Dynamics of the euro and yuan

A surge of optimism among the "bulls" on EURUSD was caused by information about the improvement in the health of the eurozone economy. Stronger growth in German industrial production and positive dynamics in European investor sentiment are only part of this process. In fact, much more significant is the fall in gas prices against the backdrop of warm weather, the filling of German storage facilities by 99% and increased imports of LNG. As a result, rumors that the currency bloc will be able to avoid a deep recession due to the energy crisis are growing like a snowball.

I wouldn't be so optimistic. First, the improvement of the Chinese economy is a double-edged sword. China is the world's largest consumer of raw materials, and the rise in prices for commodity market assets will further worsen the terms of trade in Germany. The fall of the latter is one of the EURUSD peak drivers.

Dynamics of EURUSD and German terms of trade

Secondly, it is not current gas prices that matter to the eurozone economy, but the size of household bills, which is very high. This reduces the consumption of other goods and will eventually turn into a recession. Finally, who said that all the turmoil in the financial markets is a thing of the past?

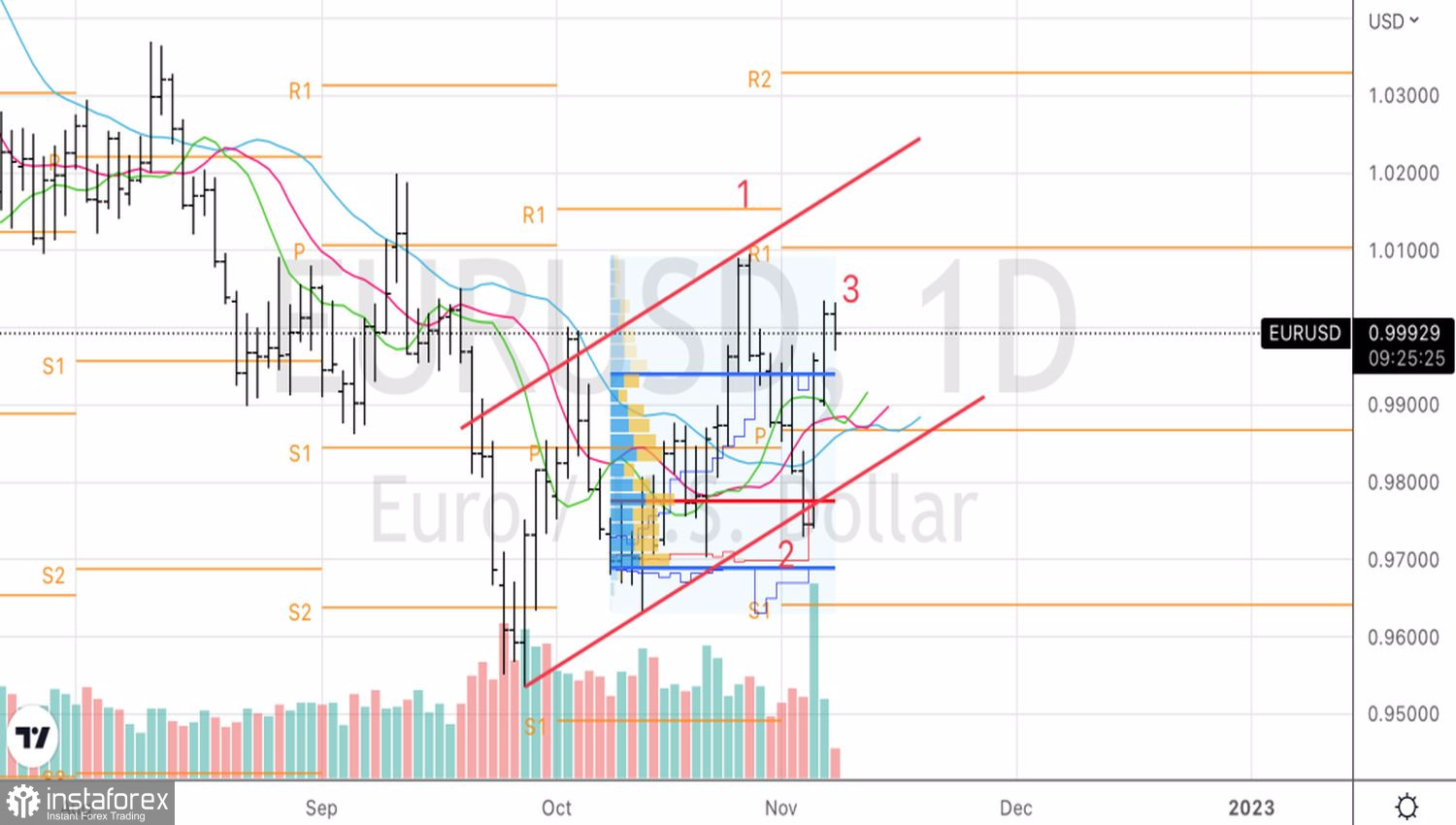

Technically, the inability of the EURUSD bulls to overcome the parity level indicates their weakness and increases the risks of the 1-2-3 reversal pattern. The reason for opening short positions is the successful assaults on the supports at 0.9955 and 0.9885.