The price of gold rallied in the short term as the USD depreciated. It's trading at 1,967 at the time of writing. DXY's deeper drop should weaken the greenback, this scenario brings more buyers on XAU/USD.

The yellow metal exploded after the US Unemployment Claims indicator was reported at 261K versus 236K expected and compared to 233K in the previous reporting period. The Final Wholesale Inventories reported poor data as well. Tomorrow, the Chinese inflation data could bring high action.

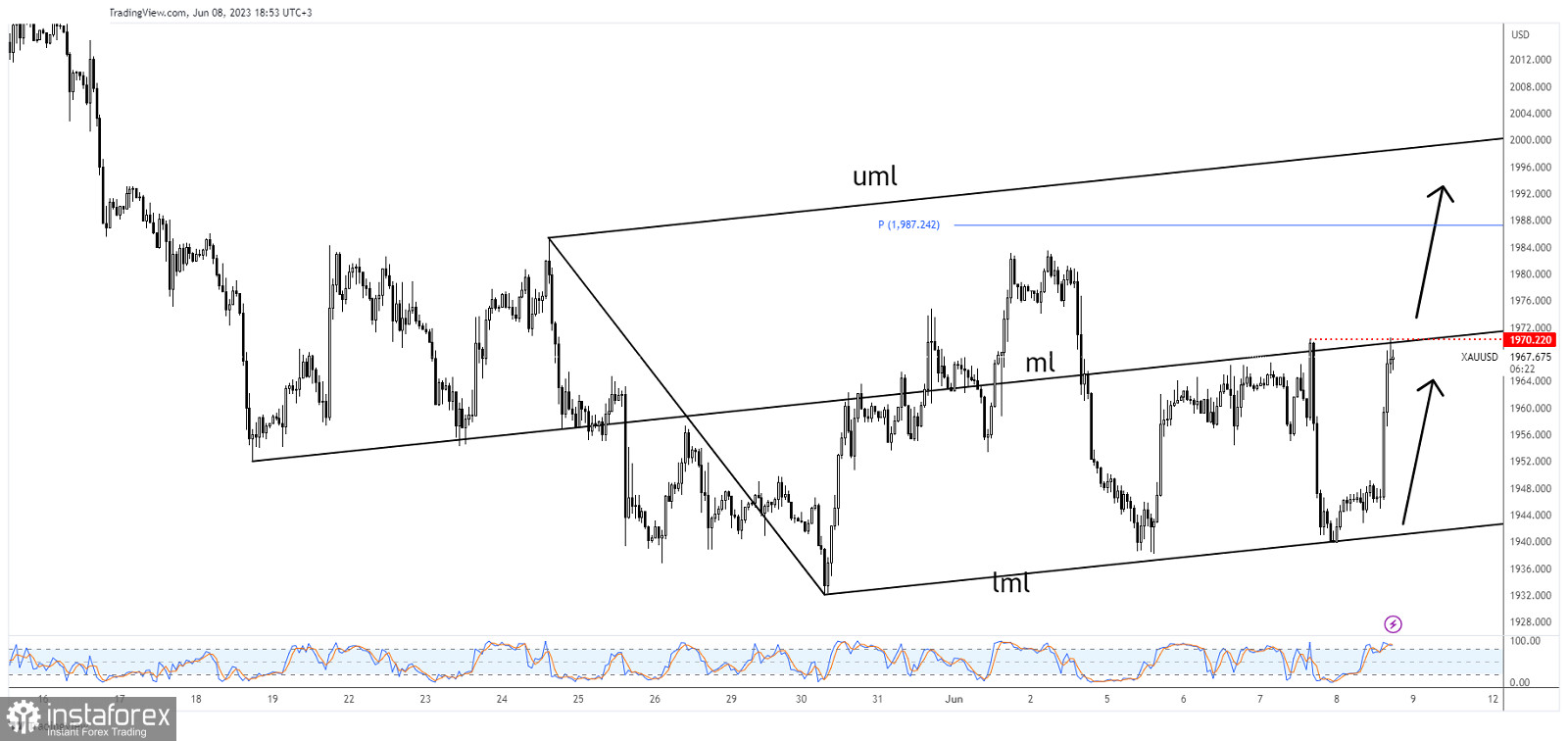

XAU/USD 1,970 Key Resistance!

As you can see on the H1 chart, XAU/USD found support on the ascending pitchfork's lower median line (lml) and now it has rebounded and reached the median line (ml) and the 1,970 former high which represent upside obstacles.

After its amazing rally, we cannot exclude minor retreats. False breakouts could invalidate an upside continuation and may announce a new leg down. Still, staying near the resistance levels may announce an imminent breakout.

XAU/USD Outlook!

A valid breakout above 1,970 and through the median line (ml) is seen as a new buying opportunity.