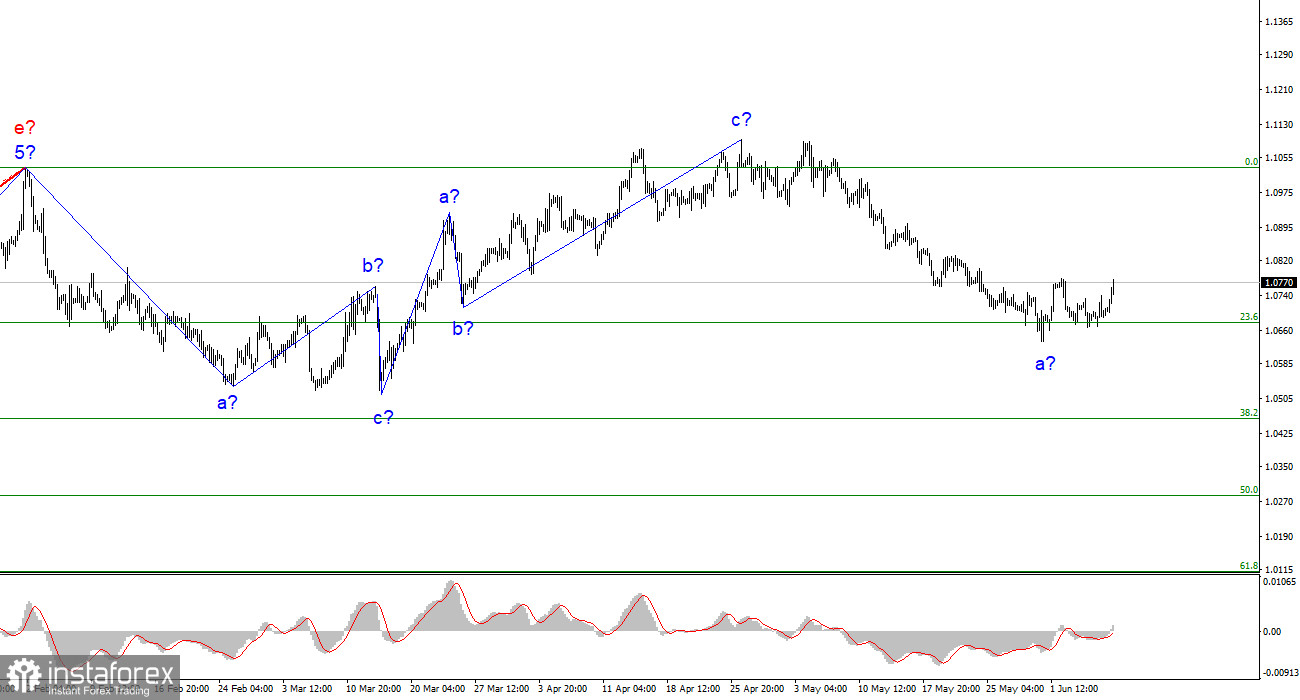

The wave count on the 4-hour chart for the euro/dollar pair continues to be somewhat non-standard but quite understandable. The quotes continue to move away from the previously reached highs, so the three-wave upward structure can be considered complete. The entire ascending trend, which started on March 15, may have a more complex structure, but at the moment, I expect a downward trend to form, which will likely also be a three-wave structure. Over the past period, I have consistently mentioned that I expect the pair to be around the 5th figure, where the upward three-wave movement began.

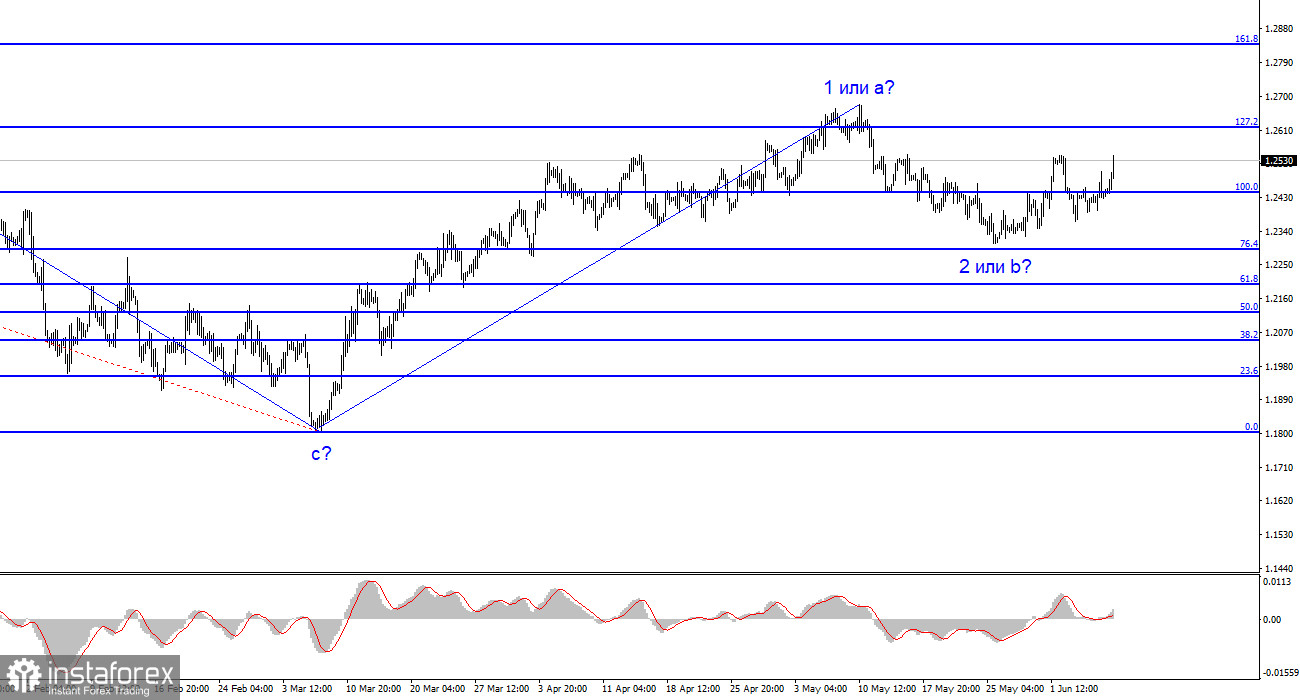

The peak of the last trend segment was only a few dozen points above the peak of the previous upward segment. Since December last year, the pair's movement can be considered horizontal, which will continue. The presumed wave b, which could have started its formation on May 31, currently looks very unconvincing, but there is still an increase in quotes, so over time, it may shape up as expected.

The exchange rate of the euro/dollar pair increased by 75 basis points on Thursday, which could raise a lot of questions. The most important one is why the euro currency has risen. The only explanation is the formation of an upward wave b, which has been brewing over the past two weeks. The news background did not contribute to the increase in euro quotes. This morning, the GDP report for the first quarter was released in the Eurozone, which marked the end of this period. Three estimates are made for each quarter. If the first two indicated zero growth, the third and final recorded a 0.1% economic decline. The European currency rose throughout the day.

Therefore, the market paid no attention to this report, just as it did not pay attention to the American report on initial jobless claims. Based on this, there can be only one conclusion: the market wants to build a normal corrective wave to resume later the downward trend, which, together with the previous two segments, forms a horizontal segment. If this is true, the decline in quotes will resume in a week or two. The resumption of the decline in the euro currency may coincide with the results of the Federal Reserve or ECB meetings, which will take place in a week and two weeks, respectively. Despite the current increase in the pair, I expect it to form a downward wave with targets located around the 5th figure or lower.

General conclusions.

Based on the analysis, the formation of the upward trend segment is complete. Therefore, it is advisable to recommend selling, and the pair has significant room for decline. I still consider targets in the range of 1.0500-1.0600 quite realistic, and I advise selling the pair with these targets. From the level of 1.0678, the formation of a corrective wave has started, so I recommend new sales in case of a successful breakout of this level or after an obvious completion of wave b. Within the correction, the pair may reach the 9th figure or thereabouts.

On the higher wave scale, the wave count of the ascending trend has taken on an extensive form but is likely complete. We have seen five upward waves, which most likely constitute the structure of a-b-c-d-e. Then the pair formed two three-wave movements, downwards and upwards. It is likely in the process of forming another descending three-wave structure.