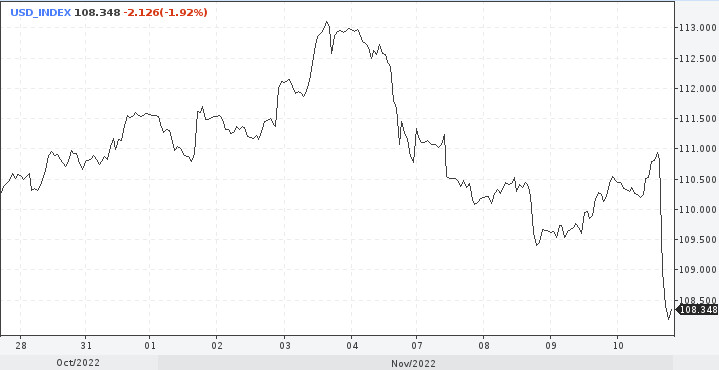

That very day came, the dollar collapsed to the basket of competitors by 2%. Inflation not only slowed down, but also exceeded analysts' forecasts. Traders perceived the declining inflationary pressure as a signal for the imminent end of the rate hike cycle and began to lay down for a smaller monetary step by the Federal Reserve in December.

"Inflation will continue to slow down in the coming months, which will significantly reduce the need to continue aggressive rate hikes. This confirms our opinion about a 50 bps increase in December," DNB Bank noted.

The pound against the dollar rose by 2.40% to 1.1640, the highest level since September 13.

The euro against the dollar rose by more than 1% to 1.0160. The US currency declined by 1.6% against the Australian dollar (0.6534) with a loss of 0.90% against the Canadian equivalent (1.3403).

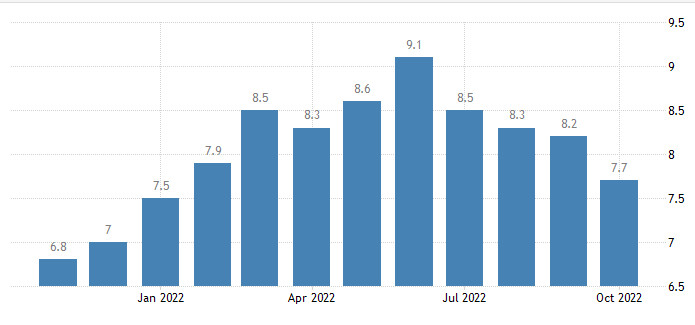

The overall CPI inflation rate rose 0.4% month-on-month in October. This is less than the markets predicted, counting on the figure of 0.6%, nevertheless, the October figure turned out to be equal to the September figure of 0.4%.

In annual terms, inflation increased by 7.7%, despite the forecast of 8%. Here, the value also sharply contrasts with the September data – 8.2%.

As for the basic consumer price index – the indicator that is of the greatest interest to the Fed – an increase of 6.3% year-on-year was recorded here. There is also a slowdown compared to September's 6.6%. Market players expected a smaller decrease in inflationary pressure – 6.5%.

Positive in all three points, the reaction is appropriate – very strong. But the question arises: are the markets really on the verge of changing the course of the Fed's policy and, as a result, changing the trend of the dollar?

It is clear that the markets will take the latest news positively, which should help bonds, stocks and become a headwind for the dollar in the short term. What's next?

Looking ahead, it is worth noting that one good indicator cannot fix the whole situation. Traders should draw the right conclusions from Thursday's news. Obviously, the Fed's fight against inflation is not over.

As noted in HSBC, the US central bank will continue to tighten policy and is unlikely to abandon the intended goal of raising it to 5% or higher. Here, the central bank can hold it indefinitely, it may be the whole of 2023, and maybe longer.

Only when the Fed completes raising rates, and the global economy shows signs of stabilization, will it be possible to take a breath. Yes, there is a confident rebound in the stock market right now, but will it be long and steady? There are doubts about this. This requires a truly turning point in monetary policy and confidence in slowing inflation. One month doesn't mean anything yet. The inflation data for November and December will be the most indicative.

Market players are now paying special attention to the details of the report, noting a slowdown in inflation across a broader spectrum. This includes lower prices for used cars, a reduction in some transportation services, lower prices for medical services, and a smaller increase in the equivalent rent for owners.

Food price inflation has also slowed, but monthly energy price inflation has accelerated.

Yes, inflation could indeed pass its peak, but it will be wrong to wait for an enchanting end. For example, rent, the most important item of expenditure, still showed no signs of weakening in October.

"You should not invest too much in one data point," Commerzbank believes.

Recent data suggest that wage growth is trending downward, while job creation has also peaked.

Economists and analysts will now turn their attention to the December employment and inflation reports, which will be the last important data that the Fed will take into account before its December decision.

If the current promise to reduce inflationary pressure is confirmed, much can be said in favor of a slowdown in the Fed. So far, the baseline scenario is 50 basis points at the next meeting on December 13-14. Even smaller steps should be expected in early 2023.