The annual CPI in the US slowed down to 7.7% in October from 8.2% in September. The core CPI also slipped to 6.3% from 6.6%. Both readings are considerably lower than the expected values, thus setting financial markets in motion. The S&P 500 surged by 5.54% intraday. The Nasdaq 100 jumped a whopping 7.5%. The US dollar index shed more than 2% which is the sharpest intraday fall in the last 7 years.

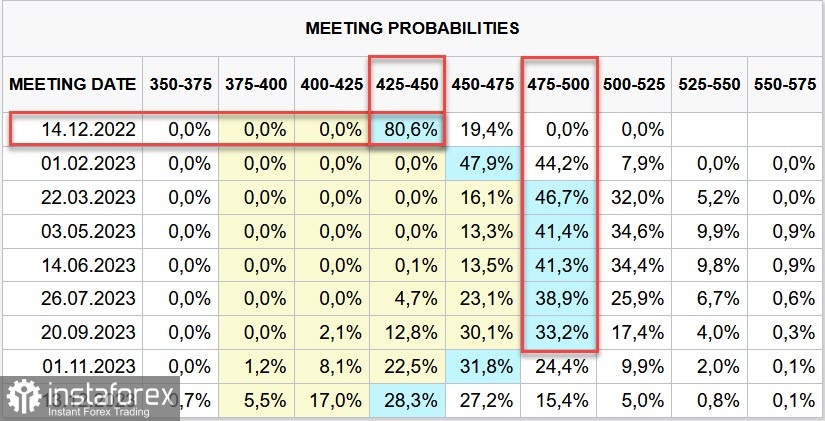

The forecast of the Fed's rate hike has been revised drastically. According to the CME FedWatch tool, the central bank is expected to raise the official funds rate by 0.5% in December that will be followed by a rate hike of 0.25% in February. Interest rates will reach the peak in March 2023. The markets do not foresee interest rates higher than 5%. Analysts predict that the Federal Reserve will launch the cycle of decreasing interest rates from November 2024.

Does it mean that the US Fed has won its battle against soaring inflation? No way! A similar situation was recorded in July 2022. The core CPI eased to 0.3% on year which triggered a crazy rally. Analysts and authorities came up with bold statements on the victory over inflation. Later on, the core CPI accelerated the pace of growth to 0.6% for the next two months. Then, inflation tightened its grip.

Before the FOMC meeting in December, the policymakers will take into account another inflation report. Following the procedure, the FOMC will present their revised forecasts on Friday, a day before the meeting. They won't be able to update the forecasts. All in all, the inflation report for November that will be published right before the FOMC meeting will not influence the forecasts but will certainly make an impact on the final policy decision.

For the time being, the markets are poised to price in a slowdown in the inflation rate and moderation in further Fed rate hikes. However, investors need weighty arguments so that the risk-on mood could become the dominating trend. For that, they need to make sure that a recession threat is at least not escalating.

Today financial markets are shut on the occasion of Remembrance Day in Canada and Veterans Day in the US. So, holiday-thinned markets are going to trade quietly, reacting to yesterday's inflation data.

USD/CAD

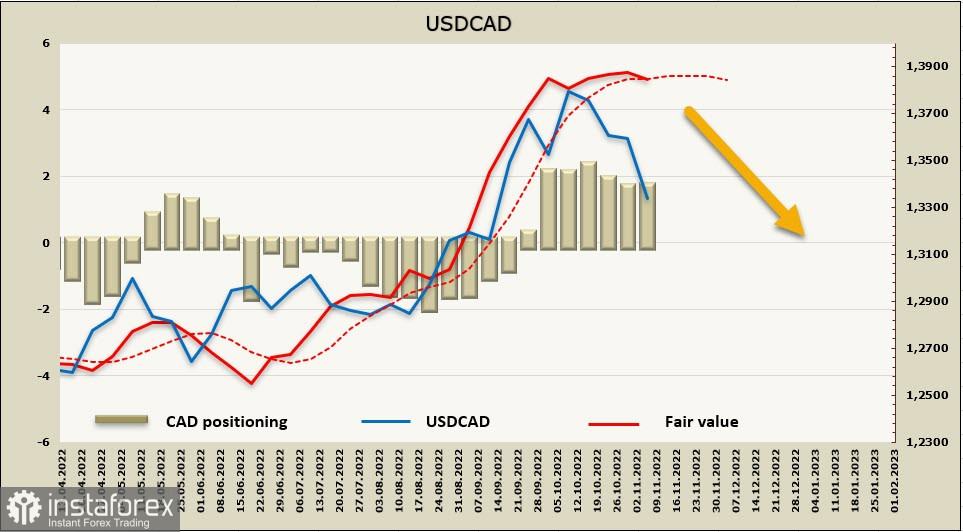

The Canadian dollar strengthened considerably on Thursday, taking advantage of the US dollar's slump. Analysts have grounds to believe that the USD/CAD pair might continue its downward move. It could happen if Canada's inflation report which is due on November 16 will be at least not weaker than projected. Canada's core CPI is expected to grow to 6.3% in annual terms in October from 6% in the previous month. If the forecast comes true, it means tougher requirements for Canada's monetary policy than for the one in the US. This will change the yield spread in favor of the Canadian dollar.

Importantly, the economic conditions in Canada are healthier than in the US. So, the Canadian economy can tolerate aggressive monetary tightening without sacrificing GDP growth. Besides, employment in Canada improved in October to a record high level accompanied by rapid wage growth. Bank of Canada Governor Tiff Macklem pointed out in his recent speech that wages would reach peak levels soon. On the other hand, the number of vacancies remains at high levels, thus reinforcing inflation expectations.

Net short positions on CAD did not change last week and remained at -1.3 billion. More traders are now betting on CAD growth with higher chances of a downward move in USD/CAD. Nevertheless, the steady trend is not clear yet.

Following the US CPI report, the loonie strengthened towards the support of 1.3310/30, but traders need extra grounds for a full-fledged correction. Traders might receive such arguments on Wednesday. If Canada's CPI is not weaker than expected, there is a fair chance for USD/CAD's decline to support at 1.3230. The currency pair is likely to settle below this level. If so, the price will find it easy to fall to 1.30. Otherwise, if the CPI is downbeat, the USD/CAD pair could consolidate at the current levels and resume attempts to go up.

USD/JPY

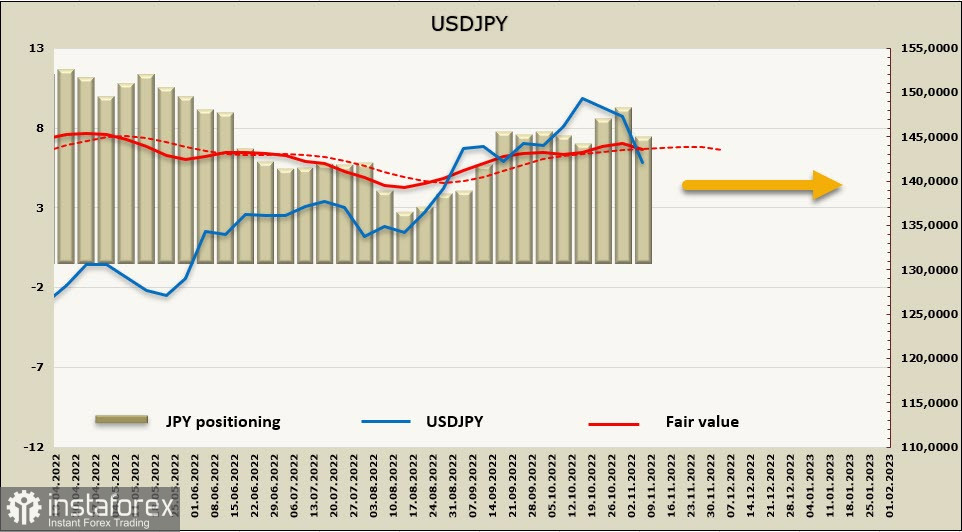

The yen also asserted its strength on Thursday as it benefitted from the US inflation data and revised forecasts for the US dollar. The yen's strength was also propped up by another FX intervention by the Bank of Japan. The actual amount of cash injections is unknown. Apart from the forex intervention, the regulator purchased a bond package with the aim of controlling the yield curve.

What has actually happened? Nothing! The current retracement is of a technical character. If global markets regain the risk-on mood, the yen will be hit by selling as a safe haven asset. The Bank of Japan has not revealed any signs of changing its monetary policy. The central bank is focused on boosting consumer activity, domestic demand, and wage growth. Until the goal is achieved, the regulator will not give up the QE program. In other words, it means further weakness of the yen.

Net short positions on the yen contracted last week by 2.1 billion to -6.6 billion. It is a strong correction which cannot be neglected. Traders are betting on the yen's strength in the short term. Therefore, the downward correction in USD/JPY is not complete yet.

Nevertheless, as long as the Bank of Japan's monetary policy remains ultra-loose, we cannot speak about a steady downward move of USD/JPY. The ongoing decline could be used for buying the currency pair because the support of 140.30 was protected. However, a lower decline would be possible only on condition of a new FX intervention by the Bank of Japan. I suppose that the consolidation period won't be too long and USD/JPY will resume its growth soon. I don't foresee a sharp climb. It is more likely that the pair will trade mainly sideways with a slightly upward bias.