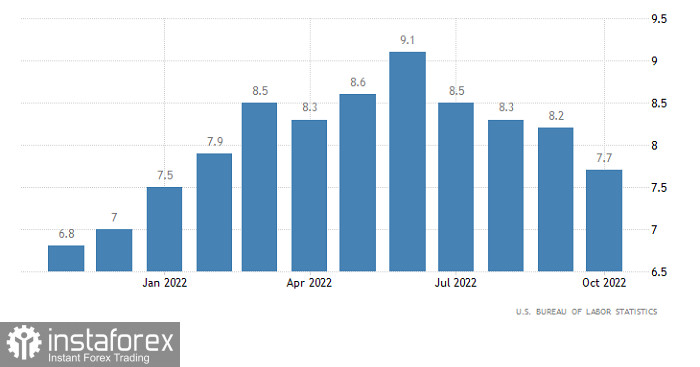

Inflation, or rather the reassessment of the Federal Reserve's succeeding actions, turned out to be much more important for the market than the results of the midterm elections in the United States. Moreover, the counting of votes is still ongoing. So as soon as it became known that the growth rate of consumer prices in the United States slowed from 8.2% to 7.7%, a real rally began in almost all markets. The only exception was probably the oil market. But the pound jumped by more than three hundred points. After all, if inflation slows down much faster than forecasts, and the most desperate optimists expected it to fall to 8.0%, then the Fed has no reason to further tighten monetary policy. In other words, the US central bank may well start lowering interest rates next year. It was this change in expectations that caused the dollar to fall sharply.

Inflation (United States):

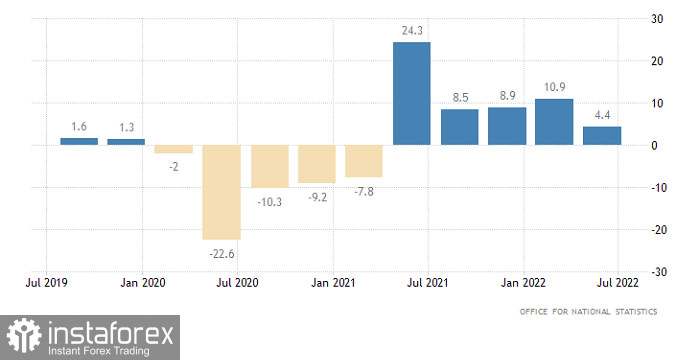

But the movement turned out to be so impressive that a rebound, or even a local correction, would only take a matter of time. And it is quite possible that today's preliminary data on UK GDP will just be an excellent reason for this. Indeed, according to forecasts, the economic growth rate of the United Kingdom should slow down from 4.4% to 2.3%.

GDP growth Rate (UK):

The pound has strengthened in value by more than 350 points against the US dollar. This strong inertial move led to a control tracking of the price with subsequent resistance levels of 1.1750.

The RSI H1 technical instrument entered the overbought zone during such an intense price move, which corresponds to a convergence with the resistance level. RSI D1 is moving confidently in the upper area of the 50/70 indicator, which indicates ongoing upward interest in the market.

The MA moving lines on Alligator H4 and D1 are directed upwards, this signal corresponds to the general mood of market participants.

Expectations and prospects

In this situation, the technical signal about the overbought pound still takes place on the market. For this reason, traders are considering the scenario of a price pullback from the resistance level of 1.1750.

As for the subsequent upward cycle, market participants will consider it in case the price stays stable above the 1.1750 level. With this development, the overbought signal will be ignored by traders.

Complex indicator analysis in the short, intraday and medium-term periods has a buy signal due to the upward cycle.