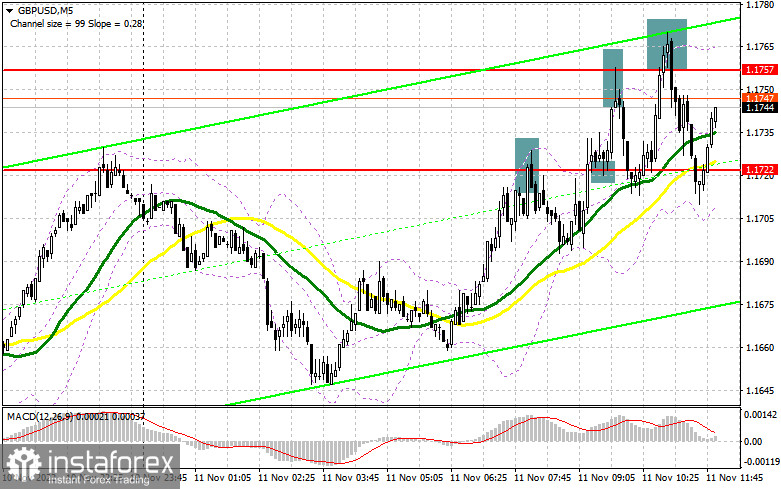

In my morning forecast, I paid attention to the level of 1.1722 and 1.1757 and recommended making decisions on entering the market there. Let's look at the 5-minute chart and figure out what happened. The unsuccessful first attempt to rise above 1.1722 led to a sell signal, which resulted in the pound moving down by 30 points. However, the fairly balanced data on UK GDP returned demand for the pound, leading to a breakdown and consolidation above 1.1722 and a buy signal. The upward movement amounted to more than 30 points, after which the bears began to sell actively in 1.1757, allowing two false breakouts to form at once. The downward movement also amounted to about 30 points, but it was impossible to gain a foothold below 1.1722. In the afternoon, the technical picture was revised.

To open long positions on GBP/USD, you need the following:

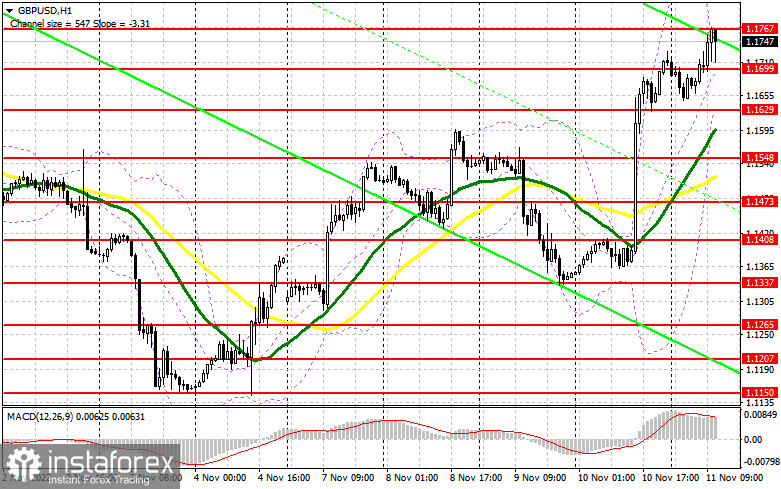

The UK's GDP turned out to be better than economists' forecasts, and the annual decline in economic growth did not become as critical as many believed. The volume of industrial production in the UK has grown at all, contrary to negative forecasts, which prompted new purchases of the pound. The pair's further direction will be determined by American statistics and data on the US consumer sentiment index. Weak reports will lead to a breakthrough of 1.1767 and an exit to the next monthly highs. In the case of a decline in the pair after strong statistics, only a false breakdown in the nearest support area of 1.1699, formed by today's results, will give a buy signal to restore and update the resistance of 1.1767. A breakout and a top-down test of this range will keep the situation on the bulls' side, allowing to build a more powerful trend with the prospect of updating 1.1838. The furthest goal will be 1.1899, where I recommend fixing the profits. If the bulls fail to meet their objectives in the afternoon and miss 1.1699, a larger profit-taking will begin. This will return the pressure on the pair and open the way to 1.1629. In this case, you should buy there only on a false breakdown. I recommend immediately opening long positions on GBP/USD for a rebound from 1.1548 or even lower – around 1.1473- to correct 30-35 points during the day.

To open short positions on GBP/USD, you need the following:

Sellers are trying to repel the attacks of buyers, but it turns out badly. Only strong data on the US economy, as well as hawkish statements by representatives of the Federal Reserve System, which are scheduled for today, will help to protect 1.1767. While trading will be conducted below this range, sellers will have every chance of correcting the pound, but only the formation of a false breakdown at 1.1767 will be a good signal to open short positions. This will push the pound to 1.1699 – the support formed in the first half of the day. A breakout and a reverse test from the bottom up of 1.1699 will give an entry point in the expectation of a return to 1.1629. The furthest goal will be the 1.1548 area, where I recommend fixing the profits. A test of this area will negate all bullish prospects for the pound. With the option of GBP/USD growth and the absence of bears at 1.1767, bulls will continue to return to the market with the expectation of a new wave of growth and the continuation of the upward trend. This will push GBP/USD to the 1.1838 area. Only a false breakout on this level will give an entry point into short positions to move down. In case of a lack of activity, I advise you to sell GBP/USD immediately from 1.1899, counting on the pair's rebound down by 30-35 points within a day.

Signals of indicators:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, which indicates further growth of the pound.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the upper limit of the indicator around 1.1767 will act as resistance.

Description of indicators

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 50. It is marked in yellow on the chart.

• Moving average (moving average determines the current trend by smoothing volatility and noise). Period 30. It is marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

• Bollinger Bands (Bollinger Bands). Period 20

• Non-profit speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.