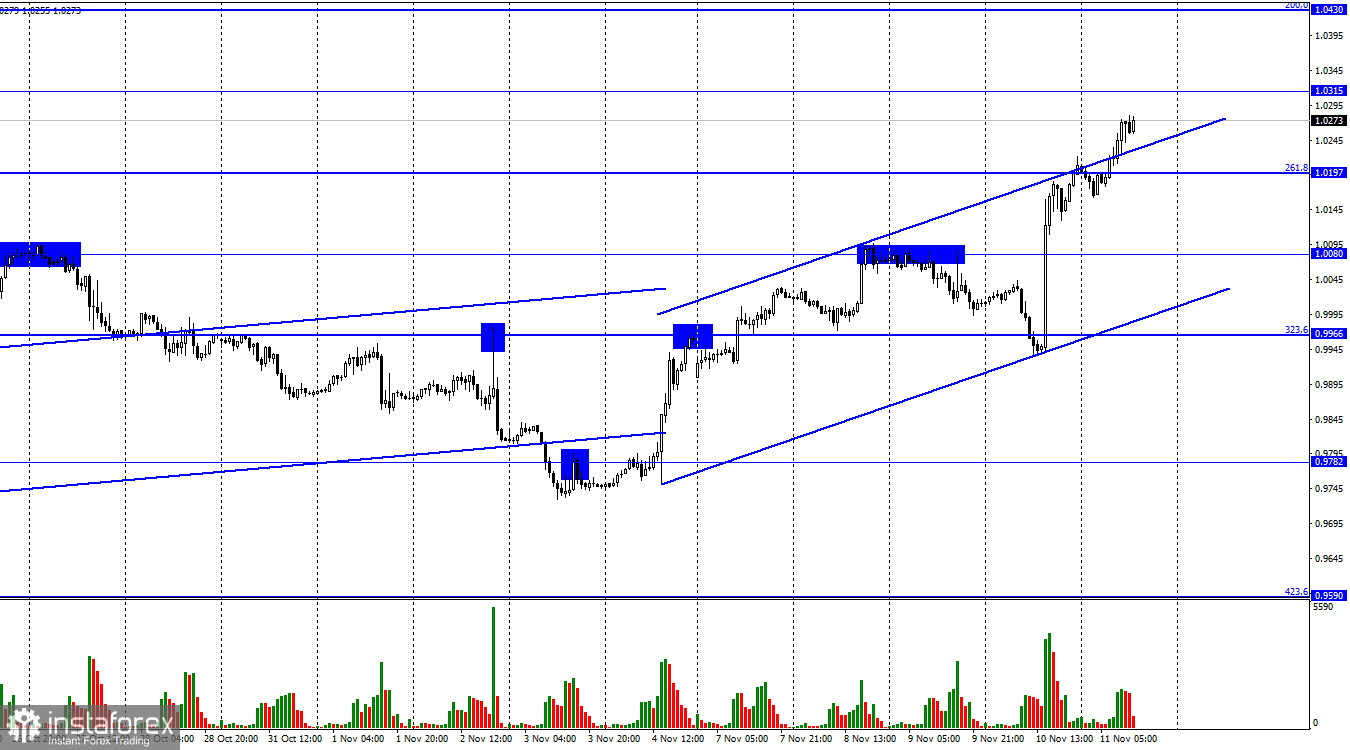

The EUR/USD pair performed a reversal in favor of the European currency on Thursday and rose to the corrective level of 261.8% (1.0197). Today, a close was made above this level, which allows us to count on continued growth towards the next level of 1.0315. Closing the pair's exchange rate above this level will increase the chances of the euro growing toward the Fibo level of 200.0% (1.0430).

Yesterday was as simple and easy as possible for traders. The information background, which was absent for most of the current week, was presented yesterday by one report on American inflation, which turned out to be so eloquent that traders had no choice but to sell the American currency. So, the consumer price index in the United States fell by the end of October to 7.7% y/y. Core inflation decreased to 6.3% y/y. It was important to understand not even how much inflation has decreased after all the Fed interest rate hikes but how much it meets traders' expectations. And traders expected a milder slowdown, so the fall from 8.2% to 7.7% was regarded as a signal to get rid of the US currency as soon as possible.

What does a decrease in inflation to 7.7% mean? It only means that the Fed will no longer need to raise the forecasted rate level. The regulator should not abandon plans to raise the rate to 5% by March next year. The Fed will not raise the rate by only 0.25% in December or will do so without tightening the PEPP. A faster decline in inflation than traders expected is just a nice bonus that does not change anything. At the same time, this bonus no longer allows traders to buy the US dollar, actively growing in 2022 just because the Fed constantly raised the rate. Now the day is visible on the horizon when it will stop growing, and the US dollar will lose one of the most significant support factors. Traders understand this and get rid of the US currency in advance, anticipating it will not grow anymore.

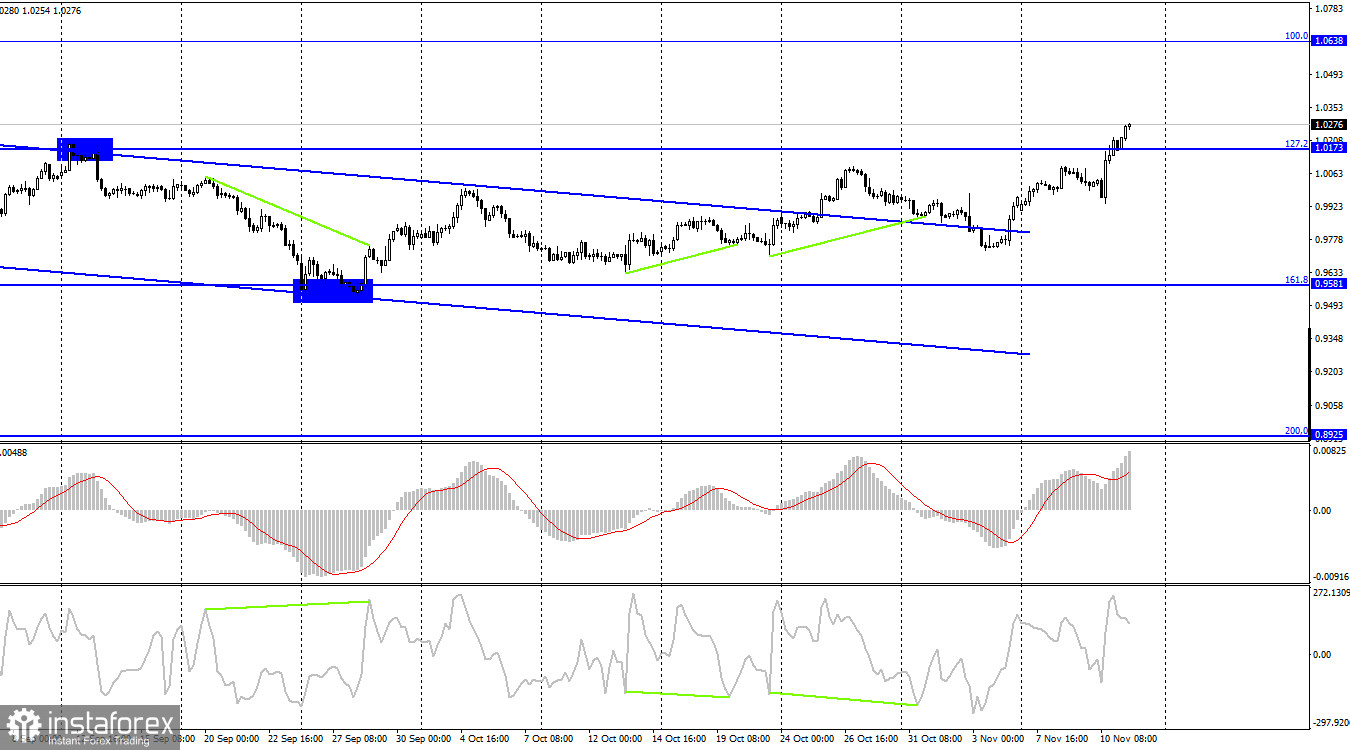

On the 4-hour chart, the pair secured above the corrective level of 127.2% (1.0173). Thus, the growth process can be continued toward the next Fibo level of 100.0% (1.0638). Emerging divergences are not observed in any indicator today. Closing the pair's quotes at 1.0173 will work in favor of the US currency and some fall.

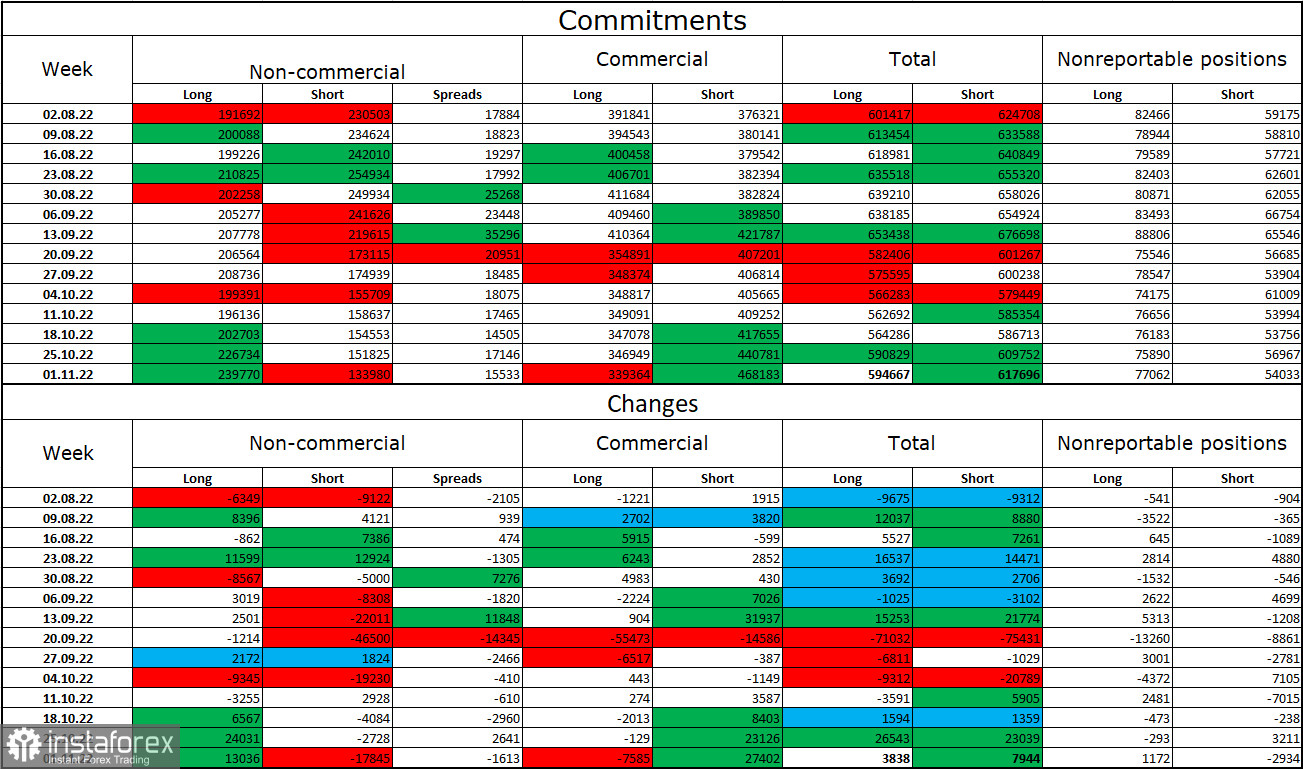

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 13,036 long contracts and closed 17,845 short contracts. This means that the mood of large traders has become much more "bullish" than before. The total number of long contracts concentrated in the hands of speculators now amounts to 239 thousand, and short contracts – 133 thousand. However, the euro is still experiencing serious problems with growth. In the last few weeks, the chances of the growth of the euro currency have been increasing, but traders are not ready to completely abandon purchases of the US dollar. Therefore, I would now bet on a descending corridor on a 4-hour chart, over which it was still possible to close. Accordingly, we can see the continuation of the growth of the euro currency. However, even the bullish mood of major players does not allow the euro currency to show strong growth.

News calendar for the USA and the European Union:

US - consumer sentiment index from the University of Michigan (15:00 UTC).

On November 11, the calendar of economic events of the European Union was empty. In America today, there is only one entry in the calendar. The influence of the information background on the mood of traders for the rest of the day may be absent.

EUR/USD forecast and recommendations to traders:

I recommend selling the pair when fixing quotes under an upward trend corridor on an hourly chart with a target of 0.9782. I recommended buying the euro currency when rebounding from the 0.9966 level on the hourly chart with a target of 1.0080. The plan has been exceeded twice, and now it is possible to hold these positions with the goals of 1.0315 and 1.0430.