European Central Bank Vice President Luis de Guindos said the central bank's semi-annual financial stability assessment this week will show just how much threats to the region have risen again.

"Risk repricing and liquidity pressures make financial markets and non-bank financial institutions vulnerable to risk-adjustment indiscriminately," Guindos said in a speech in Frankfurt on Monday. "Investment funds' liquid asset holdings remain low and thus could exacerbate a market correction in a forced selling scenario."

Guindos, who oversees financial stability analysis at the ECB, echoed officials' current mantra about the risks of inflation and the need to keep raising interest rates. In his speech, he focused on how market and liquidity threats have changed, noting that the price correction after the Russian invasion has already begun.

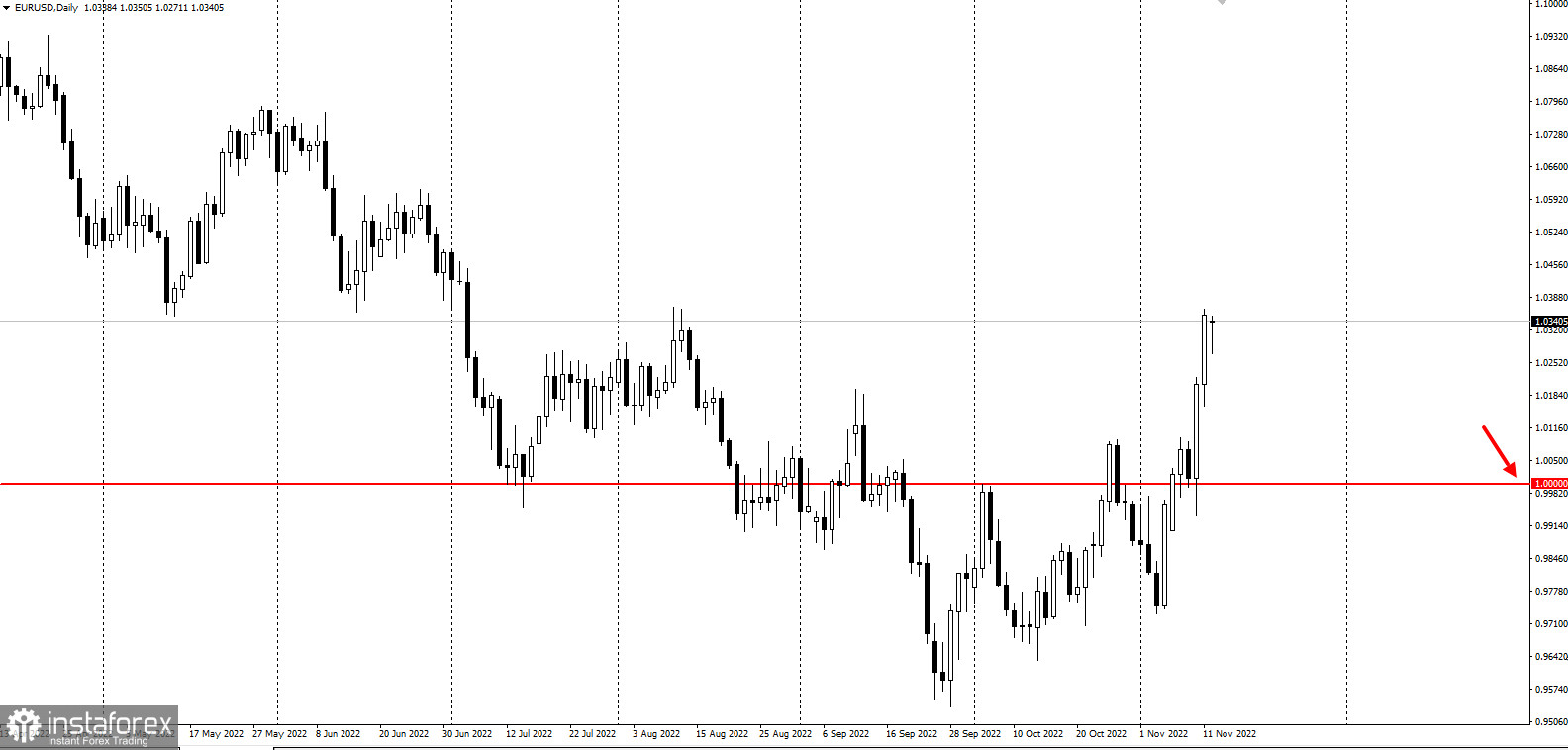

Meanwhile, the EURUSD pair is trading well above parity:

"So far, this repricing has generally been orderly, but market volatility has increased, leading to a domino effect on margins and liquidity," he said. "Asset valuation remains sensitive to the uncertain trajectory of inflation, monetary policy normalization and economic activity."

Meanwhile, banks, although more profitable than before, could face higher credit risk due to vulnerabilities in real estate markets, the vice president added.

Officials have made it clear that the ECB must continue to raise borrowing costs even after a 200 basis point hike since July. A growing number of people see the need to raise them to a level that limits the economy, which is supposed to start at about 2%.