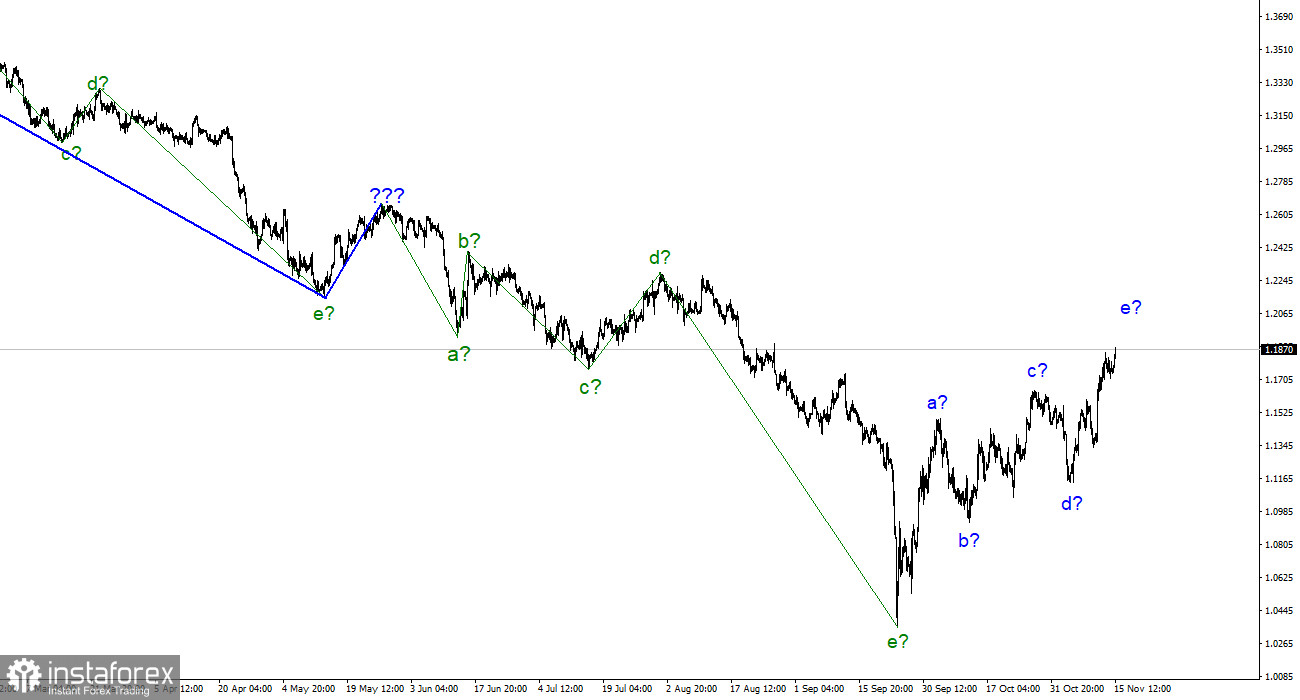

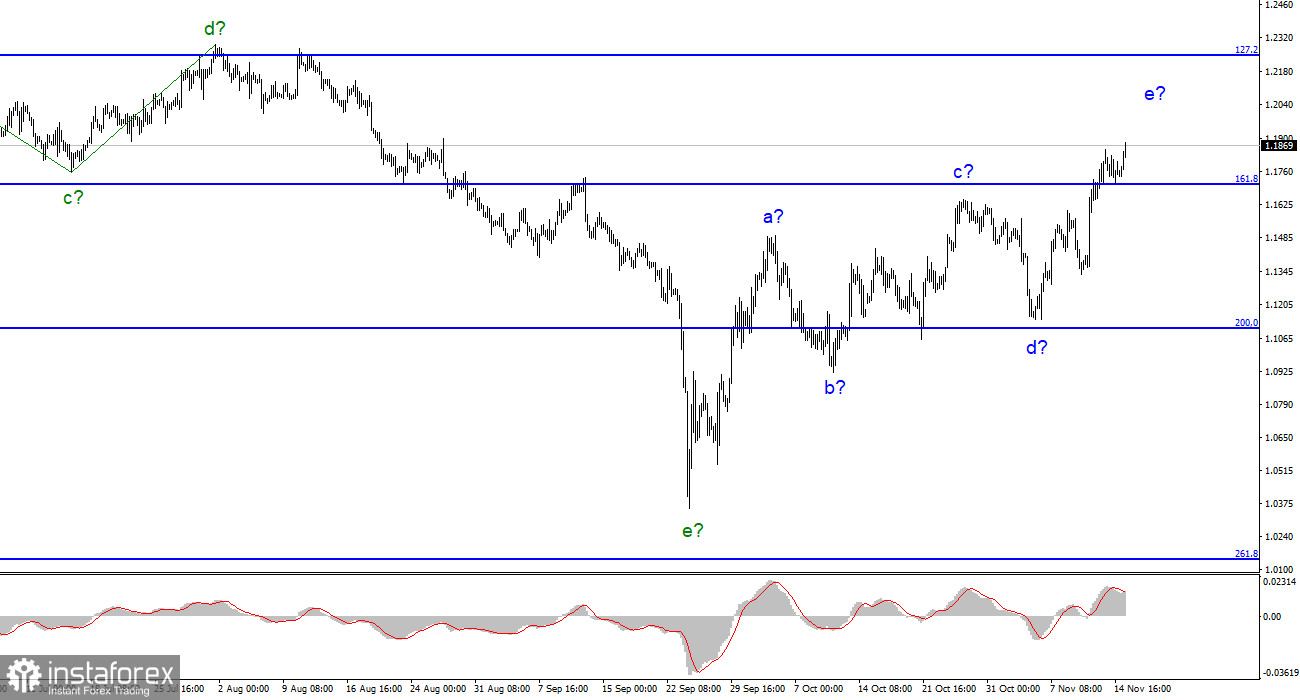

The wave count for the GBP/USD pair looks rather complicated but clear. We have a presumably completed downtrend section, which consists of five waves a-b-c-d-e. There is also a five-wave up-trend section, which has taken the form of a-b-c-d-e. Thus, I expect a further increase in the pair's quotes, but it is unlikely to last for long. The recent news background could be interpreted in any direction, as both central banks raised their interest rates, and two weeks before that, the US dollar fell despite the positive Non-farm Payrolls report. All this makes me think that the market is completing a full-fledged five-wave structure, after which a new downtrend segment is likely to be formed. A successful attempt to break 1.1704, which is 161.8% Fibonacci, indicates that the uptrend leg is incomplete, but the overall wave structure looks fully completed.

The pound rising and has every chance of forming a new downtrend segment

On November 15, GBP/USD increased by another 150 basis points. The tool grows almost every day with small breaks, and this actually surprises me. Of course, you can always find reasons why a particular instrument grows. However, from the point of view of forecasting, such a movement of the instrument looks unusual. Let's start with the fact that all the latest reports from the UK were, to put it mildly, pessimistic. For example, GDP in the third quarter decreased by 0.2%, while unemployment rose to 3.6%. We can recall last week, when several FOMC members announced their readiness to slow down the pace of monetary tightening in December, and the US inflation slowed down significantly for the first time in a long time. But how long will these two factors continue to reduce the demand for the US dollar? They are not that significant to cause a fall in the American currency every day.

According to the waves analysis, it is too early to panic. The upward section of the trend can continue developing up to 21 figures. Both pairs have built the same wave structures. Wave e does not look too long yet to draw conclusions about the need to make adjustments. The only thing is that the demand for the British pound is growing almost without any reason. The British economy now causes the greatest number of concerns among economists. It has already entered a recession, though Andrew Bailey sounded quite optimistic last week. The rate of the Bank of England cannot increase any further, it has already risen to 3%, and many analysts believe that the British regulator will also begin to slow down the pace of its increase from December. So, I am still waiting for the completion of the five-wave upward structure in the near future with further construction of a downtrend section, possibly a three-wave corrective one.

General conclusion

The wave count of the GBP/USD pair suggests the construction of a new downtrend section, but it will probably start a little later (if it starts at all). I can't advise buying the instrument, since the wave count imply the beginning of the downtrend segment right now. Demand for the pound is still growing, but I don't think that wave e will get any longer.

On the higher wave scale, the picture is very similar to the Euro/Dollar pair, which is good, since both pair are supposed to move in one direction. At this time, the upward corrective section of the trend is nearing completion. If this is true, then we will soon see the construction of a new bearish trend.