The euro-dollar pair is storming the 4th figure for the first time since July of this year. On Monday, the EUR/USD bears tried to seize the initiative, but the general optimistic mood of the market did not allow them to do so. The hawkish comments of the Federal Reserve representatives did not help the bears amid the "peaceful" results of the G20 summit, gas news from Germany and a relatively good report from the ZEW institute. The scales tipped in favor of risky assets, while the safe dollar temporarily ceased to be in high demand. Among all the currency pairs of the "major group", these trends were especially pronounced in the EUR/USD pair. But first things first.

Let's start with the preliminary results of the G20. The central event of the summit is the meeting between US President Joe Biden and Chinese President Xi Jinping. Their talks behind closed doors lasted more than three hours, following which the parties exchanged very complementary statements. In particular, Xi Jinping said that the US and China "need to find the right direction" and "improve relations." Biden, in turn, agreed with the colleague and noted that their countries can "handle differences, prevent competition from conflict and find ways for better cooperation." The heads of state agreed to "define the economic nature of the relationship", while trying to find "common ground" in other areas.

It is obvious that all these are very generalized formulations that are inherent in such events. But if we recall the presidency of Donald Trump (and his rhetoric against China), then the contrast is clearly visible. Therefore, the market's reaction is appropriate - the interest in risk has increased, the demand for safe harbor instruments has decreased. Plus, the Covid news from China also played a role. It became known that Beijing has eased quarantine measures, despite the increase in the incidence of coronavirus in the country. First, China has reduced the quarantine period for travelers arriving in the country. Secondly, the so-called switch mechanism on arriving flights has been canceled (in which flight routes were instantly closed if some passengers tested positive for coronavirus). Third, the National Health Commission has lifted identification and isolation requirements due to "secondary close contacts."

In other words, China seems to be gradually moving away from the "zero tolerance" policy for Covid, and this fact has been positively received by the market.

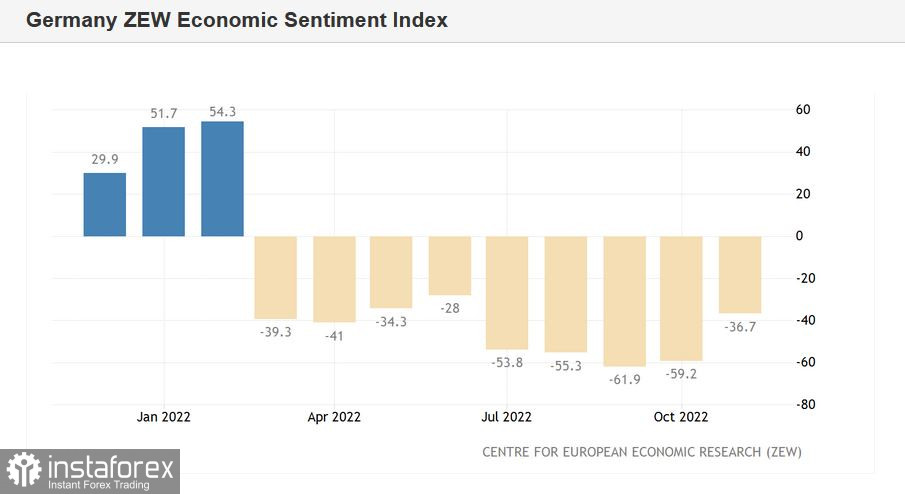

EUR/USD bulls were also supported by the reports that were just published by the ZEW Institute. In particular, the German business sentiment index, although it remained deep in the negative area, still moved away from multi-year lows reached in September. Plus, the indicator came out in the green zone: with a forecast of a decline to -51 points, it came out at -36 points. The current situation index in Germany also exceeded the forecast values (although it remained in the negative zone), showing positive dynamics: if in October this indicator came out at -72 points, then this month it rose to -64 (against the forecast of a decline to -76 points). The pan-European business sentiment index showed a similar trend: -38 points in November after falling to -59 in October.

The so-called gas issue also supported the single currency. In Germany it was reported that the filling level of gas storage facilities has reached 100%, despite the cessation of supplies via Nord Stream in early September. According to the German Federal Network Agency, gas consumption in the country this year (at the moment) is below the average for the last four years, primarily due to warm weather. The average air temperature in Germany is almost two degrees higher than in previous years.

All these fundamental factors allowed EUR/USD bulls to renew their multi-month high at 1.0480.

But despite such a rapid rise in prices, it is still too early to talk about a trend reversal. The factors listed above have a "limited shelf life", especially with regard to the outcome of the G20 summit. By the second half of this week, EUR/USD traders will switch to classical fundamental factors, focusing, in particular, on the rhetoric of the Fed representatives. While this rhetoric is very hawkish in nature. For example, Christopher Waller said the other day that markets should now pay attention to the "end point" of a rate hike, and not to the pace of its achievement. At the same time, he noted that the end point is probably "still very far away." I believe other representatives of the hawkish wing of the Fed will sound similar signals. The essence of this position is that the speed of achieving the goal is not so important, provided that this goal is located higher relative to earlier benchmarks (that is, above the five% target).

Thus, the further development of the upward movement is a big question. Therefore, long positions still look risky despite such a strong rise in price. Taking into account the rather unsteady fundamental background for the euro, there are rather high risks that the pair will soon fall just as rapidly – at least to the level of 1.0150 (the lower line of the Bollinger Bands on the H4 timeframe). Therefore, at the moment it is advisable to take a wait-and-see attitude.