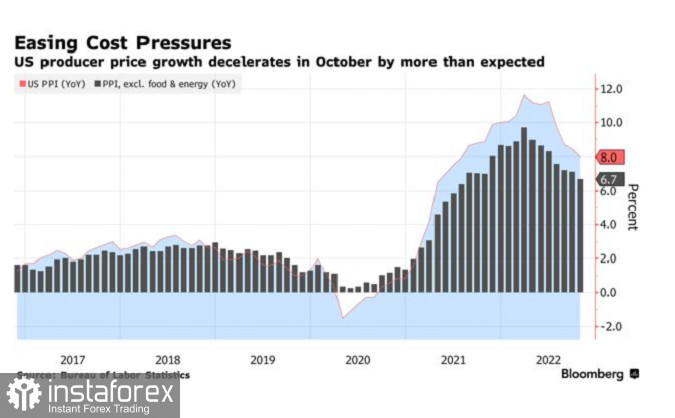

U.S. producer price growth slowed more-than-expected in October, the latest sign inflationary pressures are starting to ease.

The producer price index for final demand rose 8% from a year ago, the smallest annual increase in more than a year and 0.2% from the previous month, Labor Department data showed on Tuesday. Average estimates in a poll of economists by Bloomberg called for an 8.3% annual increase and a 0.4% increase from the previous month.

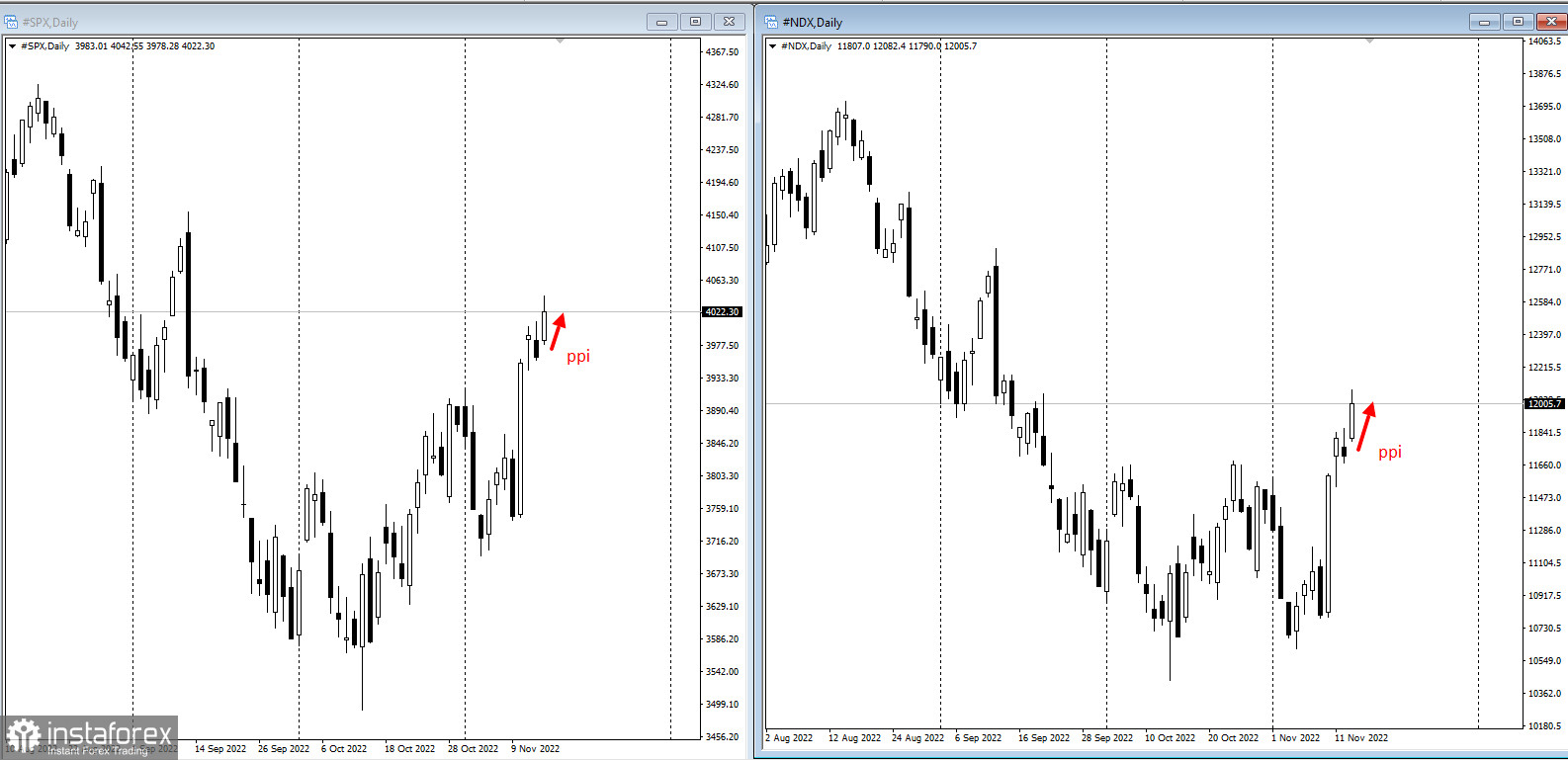

The S&P 500 opened higher, while Treasury yields declined.

After peaking at 11.7% y/y in March, producer price growth has slowed amid improved supply chains, lower demand and lower prices for many commodities. Excluding food and energy, the cost of goods fell during the month, and prices for services fell for the first time since 2020.

The dollar index fell after the release of the report:

The Federal Reserve, which closely monitors all inflation data, is expected to slow its pace of interest rate hikes soon, though officials stress they remain firmly committed to curbing inflation.

Many companies have successfully passed on most, if not all, of the increase in costs and labor costs to consumers, but some companies have recently expressed hesitation about further aggressive price increases in the face of an uncertain economic environment.