The pound sterling advanced on the news that inflation exceeded forecasts and reached a 41-year high due to a sharp increase in energy prices. Higher inflation increased pressure on the government and the Bank of England, forcing them to continue their aggressive monetary policy. The Bank of England's task is to fight inflation by raising interest rates and increasing borrowing costs. However, the government's responsibility is limiting the impact of the cost-of-living crisih in the UK, which is exacerbated by higher interest rates. It is not an easy task for them.

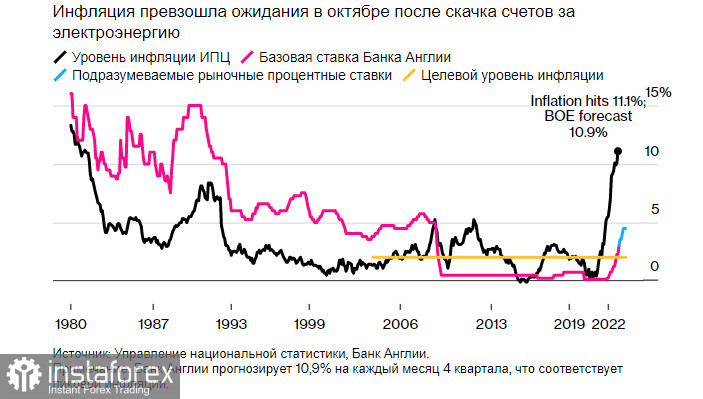

According to the Office for National Statistics, in October the consumer price index rose to 11.1% from a year ago, exceeding the forecasted increase to 10.9% by the Bank of England. The inflation rate is more than five times the target of 2%.

Obviously, this makes another interest rate hike by the BOE in Decebmer more likely. A couple of weeks ago the regulator claimed it would slow down the pace of rate moves due to the state of the country's economy. This is not a surprising development - the central bank led by Andrew Bailey have been known for their inconsistent promises that can change at any time.

Recently, Prime Minister Rishi Sunak said that controlling inflation is the main goal of his government. He confirmed that the Treasury is seriously determined to reduce its balance sheet in the near future, even as the economy heads into recession. During the G20 meeting in Bali, Sunak acknowledged that inflation and the cost-of-living crisis are the number one issue for Britons. He added Sunak said Wednesday at a G20 leaders meeting in Bali that the UK will have to make some tough decisions to protect themselves and start controlling inflation.

This is good news for the forex market and the pound sterling. The latest inflation print stands in contrast to the US, where rumors are growing that inflation may have peaked, which would allow the Federal Reserve to slow down rate hikes. The smaller the difference in rates, the better for the pound sterling.

BoE Governor Andrew Bailey will give a speech in Parliament today. He will most likely promise to sharply raise borrowing costs to prevent further price growth. The pound may rise on this statement, so it is advisable to take a closer look at the technical picture. At the moment, the markets are expecting interest rates to peak around 4.65% by August 2023, which is 10 bps higher than previously estimated.

Chancellor of the Exchequer Jeremy Hunt said he would help the Bank of England bring inflation back to its target by making "tough but necessary" decisions to reduce the Treasury's budget deficit.

Core inflation, excluding prices for energy, food, alcohol and tobacco products, remained unchanged at 6.5%. Food and beverage prices jumped by 2% over the month. Prices of milk, cheese, and eggs climbed significantly alongside chocolate, jam, tomato ketchup, cooking sauces and carbonated drinks. Prices of 10 out of 11 food categories rose, with the exception of tea and coffee.

Gasoline and diesel fell by 0.5% per month.

On the technical side, GBP/USD and the pound will continue to get stronger. The pair made notable gains yesterday, but has not managed to keep the initiative. Now bulls are focused on defending the support at 1.1870 and breaking through the resistance at 1.1940, which limits the pair's upside potential. Only a breakout above 1.1940 will make further recovery to the 1.2020 area more likely. Afterwards, the pair could surge strongly towards 1.2080. The pressure on the trading instrument will increase if bears take control of 1.1870. This will deal a blow to the positions of bullish traders and make short-term growth less likely. A breakout below 1.1870 will push the GBP/USD back towards 1.1790 and 1.1740.

As for the technical picture of EUR/USD, the bulls have come on top. So far the demand for the euro remains fairly high. To rise further, EUR will have to break above 1.0440, which will push the trading instrument towards 1.0480. From there, EUR/USD can easily climb to 1.0525 and 1.0570. If the pair slides down, only a failure of the support level of 1.0385 will push EUR/USD back to 1.0333 and increase pressure on the pair. Then it could potentially decline to a low of 1.0280.