The 1.3% increase of US retail sales in October dampened the talks of a rapid slowdown in inflation. Fed officials actively commented on the data earlier, mentioning possible changes in monetary policy, which cooled the ardor of optimists. San Francisco Fed chief Mary Daly said a "suspension is not on the table right now, it's not even part of the discussion, but instead it's about slowing the pace". As for where rates should go, Daly called "somewhere between 4.75 and 5.25" and said the unemployment rate might have to be raised to 4.5-5.0%.

Kansas Fed chief Esther George also said the real challenge for the Fed is to not stop too soon, citing the experience of the 70s and 80s. She said the flow has changed in supply chains, but the main driving force now is the labor market. She also warned that inflation could not be brought down without a real slowdown, so the economy may have to experience a downturn in order to achieve it.

As for other Fed members, New York chief John Williams drew attention to the risks to the economy and the need to stabilize the economy, while Christopher Waller expressed his personal opinion that the pace of rate hikes can be slowed down, but everything will depend on the incoming data.

Since the next inflation report will be published only a month later, it is unlikely that dollar will see another collapse, especially if the Fed does not give signals for a rate reversal. Instead, it could stabilize at current levels, them attempt to resume growth.

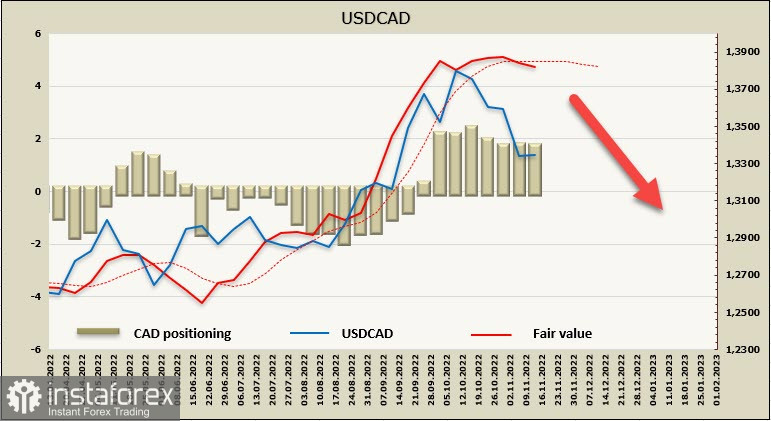

USD/CAD

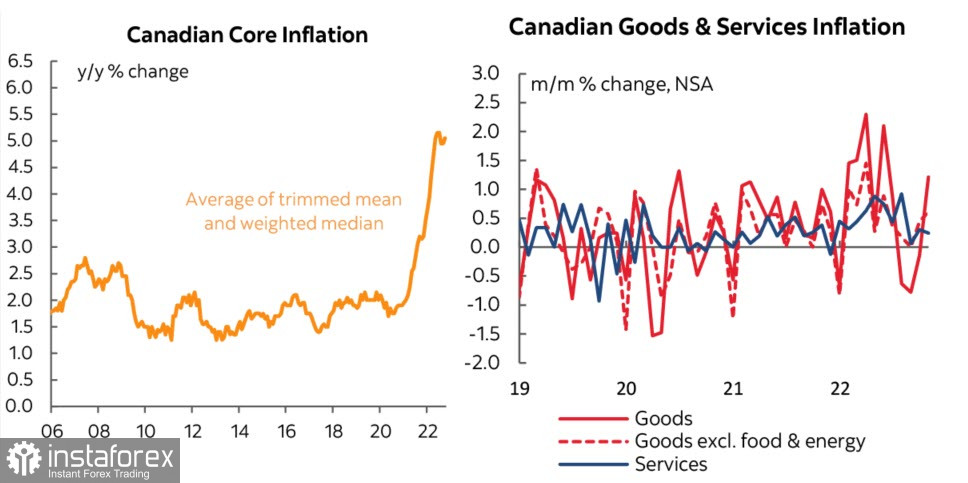

CPI in Canada remained stable in October, at 6.9% y/y, with a monthly increase of 0.7%, which was in line with expectations. The average of the Bank of Canada's three core inflation indicators rose to 5.4% y/y, still well above the target. The service sector's contribution to inflation has slowed, and if commodity prices remain stable, inflation could begin to reverse.

Housing prices and airfare are also rapidly declining, and there are fewer reasons for tightening monetary policy. This is why the net short position in CAD increased during the reporting week, by 80 million to -1.38 billion. Bearish pressure remains, but there is no active dynamics. The settlement price is also trying to shaft downwards, giving reason to expect a deeper correction.

Since inflation in Canada is slowing almost in sync with the US, it is unlikely that USD/CAD will reverse. The advantage is currently with dollar, in which a decline to 1.3000/70 is possible. But if the economy shows signs of approaching recession, the situation could reverse, and the pair will form a local bottom above 1.3232, then resume growth to 1.3976.

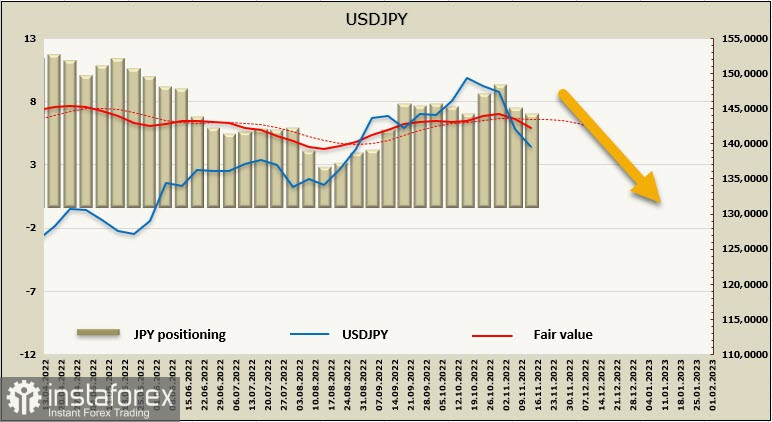

USD/JPY

The first preliminary estimate of GDP for the 3rd quarter was released. However, it was much lower compared to the previous one. Trade deficit also continues to grow, primarily due to high commodity prices and weak yen.

The head of the Bank of Japan, Haruhiko Kuroda, held a press conference earlier, during which he emphasized the stability of the yen exchange rate. This is the first sign of recovery, but so far no real steps have been announced to change the policy of yield targeting. In any case, the active weakening of yen is unlikely to resume.

As for positioning, net short positions on JPY remained practically unchanged at -6.46 billion. The bearish pressure is obvious, and the estimated price continues to go lower. A correction is unlikely to be protracted.

Although the slowdown in inflation in the US and another intervention from the Bank of Japan allowed yen to correct to 139.40/90, a deeper decline, especially in the current environment, is unlikely. Such a scenario will happen only when there is another intervention by the Bank of Japan and a strong signal from the Fed that rate growth will slow down.

This means that yen may have hit its bottom, and will start trading sideways around 137.65. Going above 151.92 is unlikely as it will be limited by 144.80/145/50.