Overview of trades and tips on trading GBP/USD

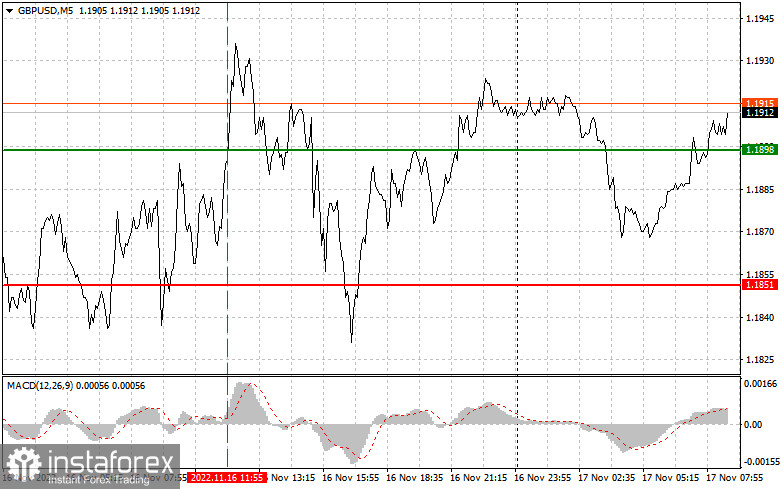

The level of 1.1898 was tested at the moment when MACD had passed a long way up from the zero mark. This capped the upward potential of the currency pair. For this reason, I didn't buy GBP/USD. No other signals were generated.

Inflation in the UK skyrocketed to the strongest level in the last 41 years. As a result, the sterling kept afloat because traders resumed speculations that the Bank of England will have to go ahead with aggressive rate hikes. The economic calendar suggests an interesting day loaded with important events. In the first half of the day, the British Exchequer will present its autumn economic forecast which might trigger high volatility in GBP/USD and a change in market sentiment. A speech by Huw Pill, a member of the Monetary Policy Committee, could also make an impact on GBP/USD, albeit to a lesser degree. In the second half of the day on Thursdays, market participants monitor weekly updates on initial unemployment claims in the US. However, traders will shift focus towards the US real estate sector. They are anticipating reports on building permits and housing starts. Lower readings will put pressure on the US dollar. Besides, Fed's policymaker Loretta Mester is due to speak tonight. Recently, she has softened her extremely hawkish rhetoric. So, her remarks will also clear up market sentiment.

Buy signal

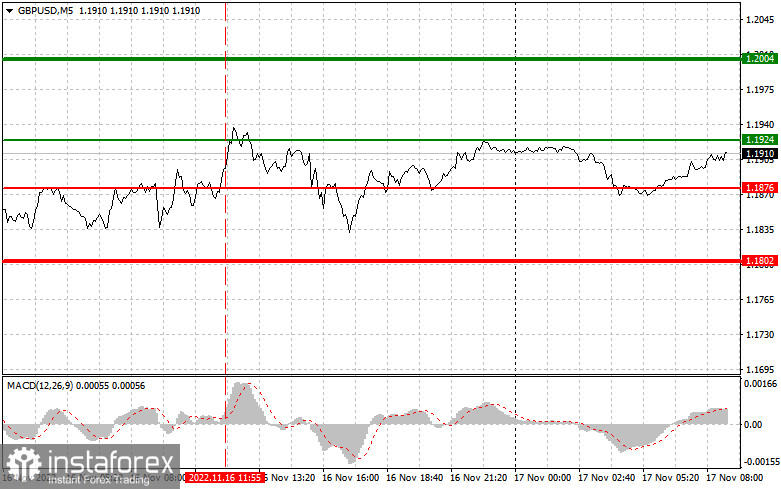

Scenario 1. We could buy GBP today after the pair reaches the market entry point at about 1.1924 plotted by the green line on the chart. The price aims to grow to 1.2004 plotted by the thick green line on the chart. I would recommend exiting long positions at 1 2004 and opening short positions in the opposite direction, bearing in mind a 30-35-pips downward move from the above-said level. We could bet on GBP's strength only on the condition of the positive market response to the UK budget plan. Importantly, before buying GBP/USD, make sure that MACD is located above the zero mark and it is going to begin its growth from it.

Scenario 2. Another option is to buy GBP after the price reaches 1.1876, but at that moment MACD should enter the oversold area which will limit the downward potential of the currency pair and will lead the market to reverse upward. We could expect the price to climb to the levels of 1.1924 and 1.2004.

Sell signal

Scenario 1. We could sell GBP today only after the instrument updates the level of 1.1876 plotted by the red line on the chart. This will rapidly push the price down. The sellers' key level will be 1.1802 where I recommend exiting short positions and opening long positions in the opposite direction, bearing in mind a 20-25-pips downward move from the above-said level. The sterling could come under strong selling pressure in case the Exchequer suggests lame solutions to the budget deficit problem. Importantly, before selling the pair, make sure that MACD is below the zero mark and is going to begin its decline from it.

Scenario 2. Sell positions could be also opened today in case the price reaches 1.1924, but MACD should be in the overbought zone. This will limit the upward potential of GBP/USD and will cause the downward reversal of the trajectory. We could expect the price to decline to 1.1876 and 1.1802.

What's on the chart

The thin green line is the key level at which you can place long positions in the GBP/USD pair.

The thick green line is the target price, since the price is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the GBP/USD pair.

The thick red line is the target price, since the price is unlikely to move below this level.

MACD line. When entering the market, it is important to adjust trading decisions to the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid trading during sharp fluctuations in market quotes. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation will inevitably lead to losses for an intraday trader.