EUR/USD

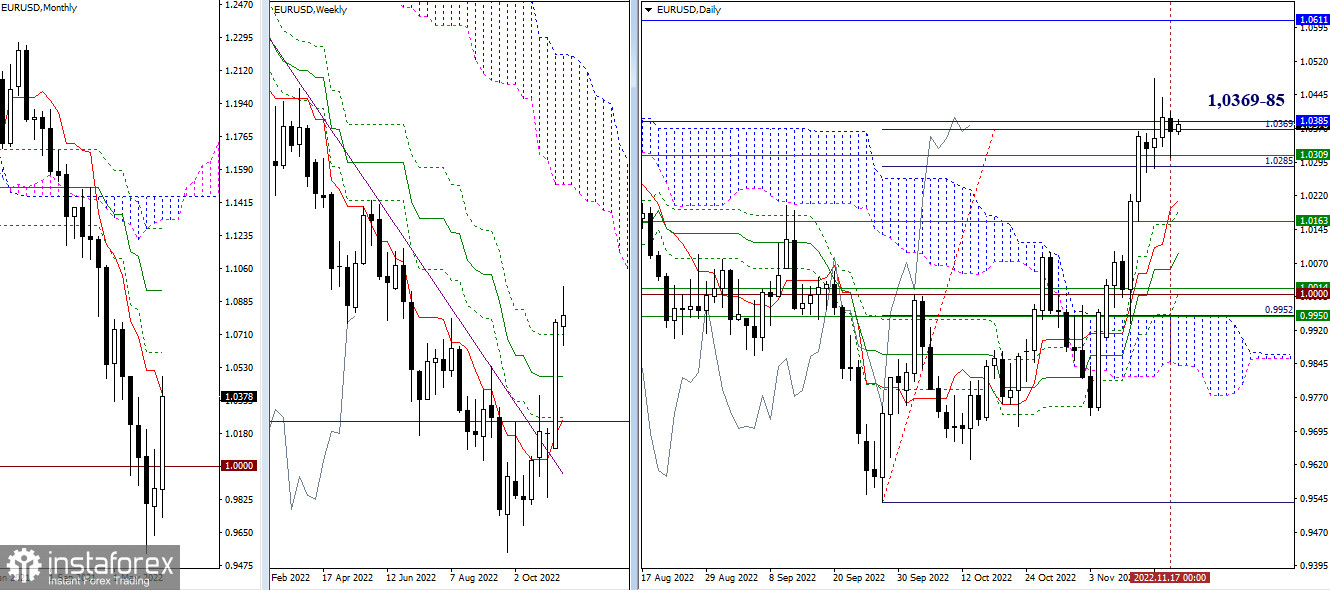

Higher timeframes

The situation still hasn't gone significant changes. The pair remains in the 1.0369–85 attraction zone (monthly short-term trend + 100% daily target). Thanks to this, the conclusions and expectations remain the same. Going beyond the designated levels and securing a consolidation above is still the main task for bulls. For bears, it is no less important now to get rid of the influence of the met levels 1.0285 – 1.0309 – 1.0369 – 1.0385 and securely consolidate below.

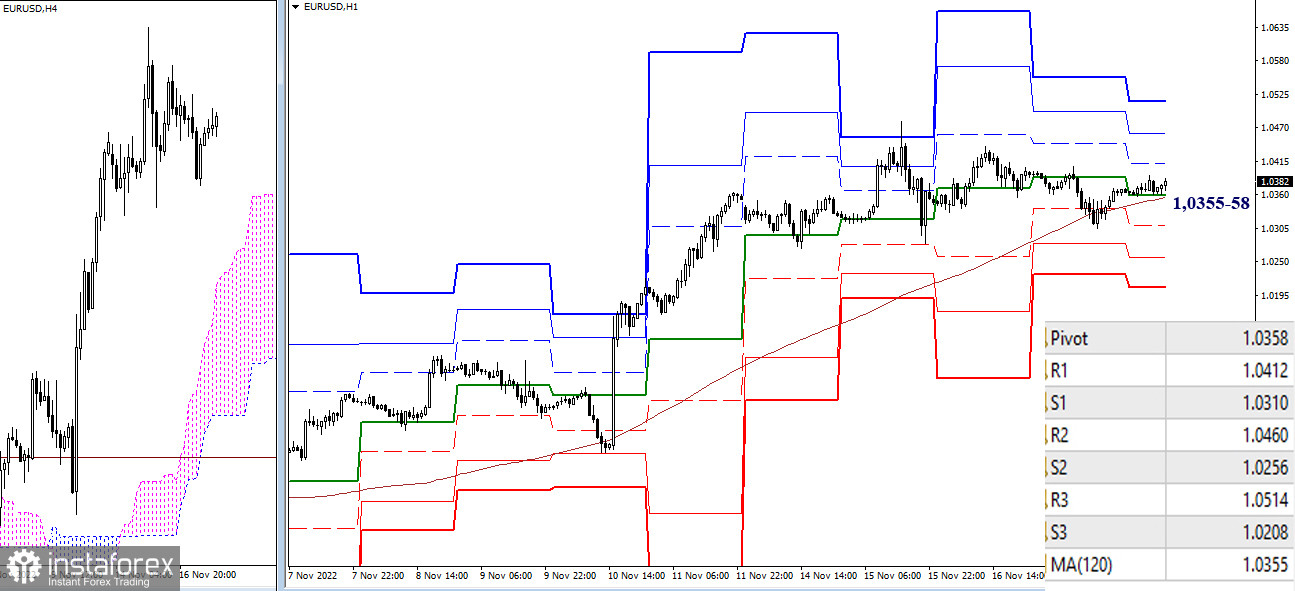

H4 – H1

On the lower timeframes, the pair remains in the correction zone, while the support of key levels 1.0355–58 (central pivot point + weekly long-term trend) has been tested recently. The location of the pair relative to these levels determines the current balance of power. Working above the levels strengthens the bullish sentiment, while working below will help the bears. The classic pivot points, which today are at the boundaries of 1.0412 - 1.0460 - 1.0514 (resistance) and 1.0310 - 1.0256 - 1.0208 (support), will serve as additional benchmarks within the day in case of movement development.

***

GBP/USD

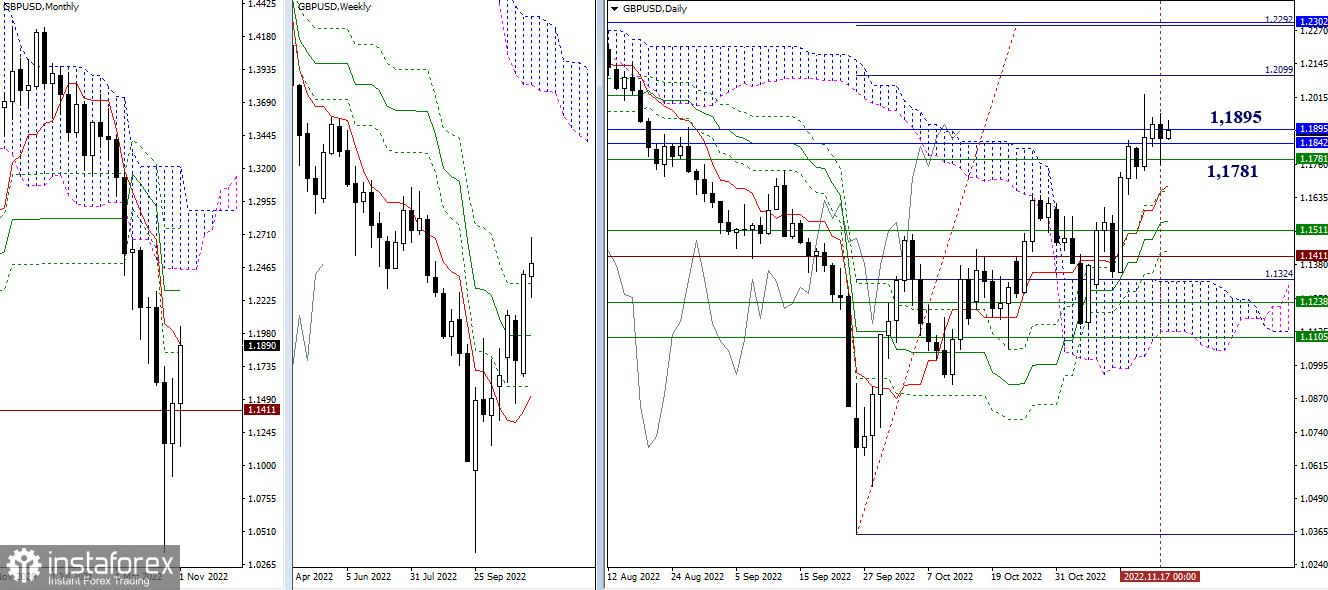

Higher timeframes

The attraction and influence of weekly and monthly levels 1.1781 - 1.1842 - 1.1895 continues to hold back the development of the situation. The pair prefers to consolidate and stay within this levels. Nevertheless, further upside benchmarks can be noted at 1.2099 – 1.2292 – 1.2302 (daily target for cloud breakdown + monthly medium-term trend). After exiting the zone of attraction, bears' task will be to test the supports of the daily Ichimoku cross, the nearest of which are now located at 1.1681 - 1.1544.

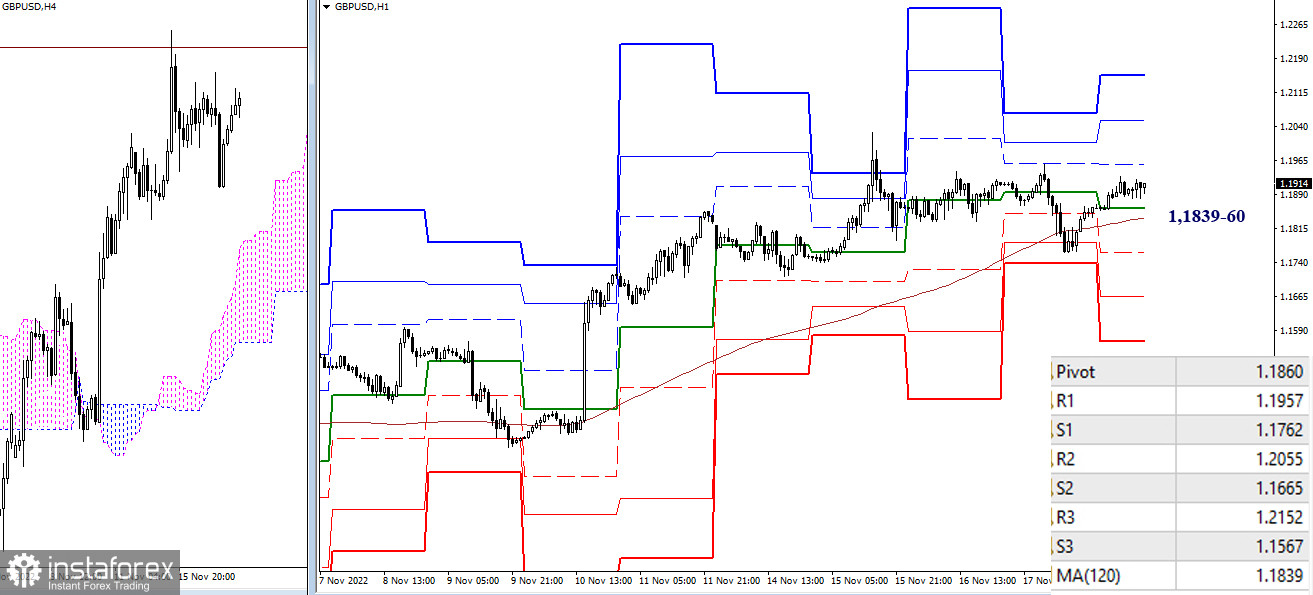

H4 – H1

Despite being in the correction zone, the main advantage is now on the side of the bulls. Further upward benchmarks are 1.1957 - 1.2055 - 1.2152 (resistance of the classic pivot points). The key levels of the lower timeframes today play the role of supports, located at the boundaries of 1.1839–60 (central pivot point + weekly long-term trend). In case of bearish activity, the tasks of bears will be to overcome the supports of the classic pivot points (1.1762 – 1.1665 – 1.1567).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)