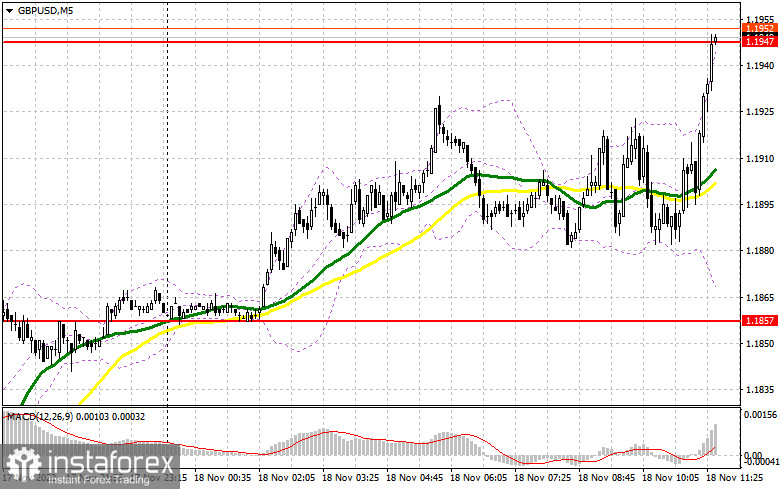

In my morning review, I mentioned the level of 1.1947 and recommended entering the market from there. Let's analyze the pair on the 5-minute chart. Amid low volatility in the first half of the day, the pound remained stable and was trading within the sideways channel even despite disappointing data on UK retail sales. The technical setup and the trading strategy haven't changed much in the first half of the day.

For long positions on GBP/USD:

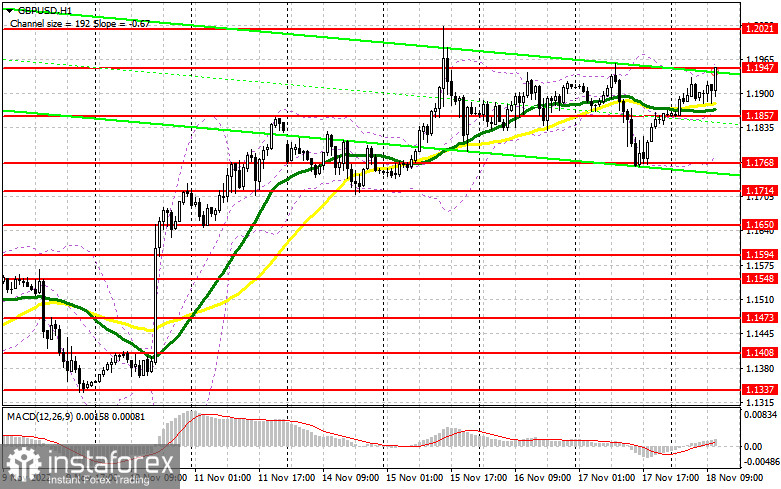

At the moment of writing, the pound bulls have closely approached the resistance level of 1.1947 where the main trading activity is observed. At this point, I expect bears to step in but we will talk about this scenario later. As for going long, the best moment to buy the pair would be a decline of the price towards 1.1857. A drop in the price may happen after the publication of the data on existing home sales in the US. To be honest, I doubt that this report can seriously affect the trajectory of the pair. Only a false breakout at 1.1857 will create a good point for going long, keeping in mind a possible strengthening of the bullish market and a break above the resistance of 1.1947. A breakout and a downward retest of this range will generate a buy signal that may bring the price up to the level of 1.2021. This will pave the way to new monthly highs found at 1.2078. The level of 1.2116 will serve as the highest monthly target where I recommend profit taking. If bulls fail to maintain control of the 1.1847 level where moving averages supporting the bullish trend are located, traders will actively start to take profit. This will bring the pair under pressure and will open the way to the 1.1768 target. In this case, I recommend buying the pair only after it makes a false breakout. It is possible to go long on GBP/USD right after a rebound from the level of 1.1714 or 1.1650, bearing in mind a possible correction of 30-35 pips within the day.

For short positions on GBP/USD:

Now the main goal for the buyers is to protect the level of 1.1947. It would be great if the pair performed a false breakout at this level. This will form a good sell signal with room for a proper downside correction, at least to the middle of the sideways channel at 1.1857. A breakout and an upward retest of this range, as well as strong data on the US housing market confirming that the US economy is still robust, will create a nice entry point. After this, the price may return to 1.1768 which is a lower boundary of the sideways channel. At this point, bears may face some obstacles. The area of 1.1714 will act as the lowest target where I recommend profit taking. If the pair fails to develop a strong downward movement from 1.1947 after a false breakout in the afternoon, bulls may add more long positions which may send the pound higher to the level of 1.2021. Only a false breakout at this level will create a good entry point for going short, considering the continuation of the downtrend. If nothing happens there as well, I would recommend selling GBP/USD right from 1.2078, keeping in mind a possible pullback of 30-35 pips within the day.

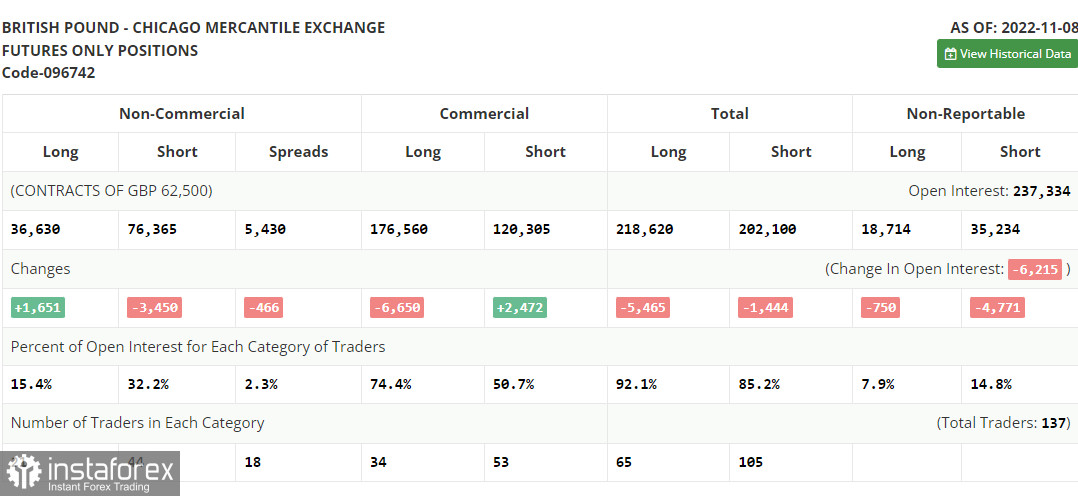

COT report

The Commitments of Traders report for November 8 showed a drop in the short positions and a rise in the long ones. The meeting of the BoE has changed the balance in the market. Although the regulator admitted it did not plan to pursue an aggressive monetary policy, the demand for a cheaper pound is still high. The British currency is supported by the news that inflation in the US turned out to be higher than expected. However, it is a big question whether bulls will manage to keep the price at the highs. The headwinds that the UK economy is facing continue to weigh on the government and the Bank of England. The recent GDP data confirmed a contraction, while more rate hikes from the central bank make the situation even worse. Labor market reports are coming out soon and if we see some major negative developments there, the British pound could react with a strong drop. The latest COT report showed that long positions of the non-commercial group of traders rose by 1,651 to 36,630, while short positions fell by 3,450 to 76,365. This resulted in the non-commercial net position declining to -39,735 from -44,836. The weekly closing price went up to 1.1549 from 1.1499.

Indicator signals:

Moving Averages

Trading above the 30- and 50-day moving averages indicates that the pound is set to rise further.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a downward movement, the lower band of the indicator at 1.1768 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.