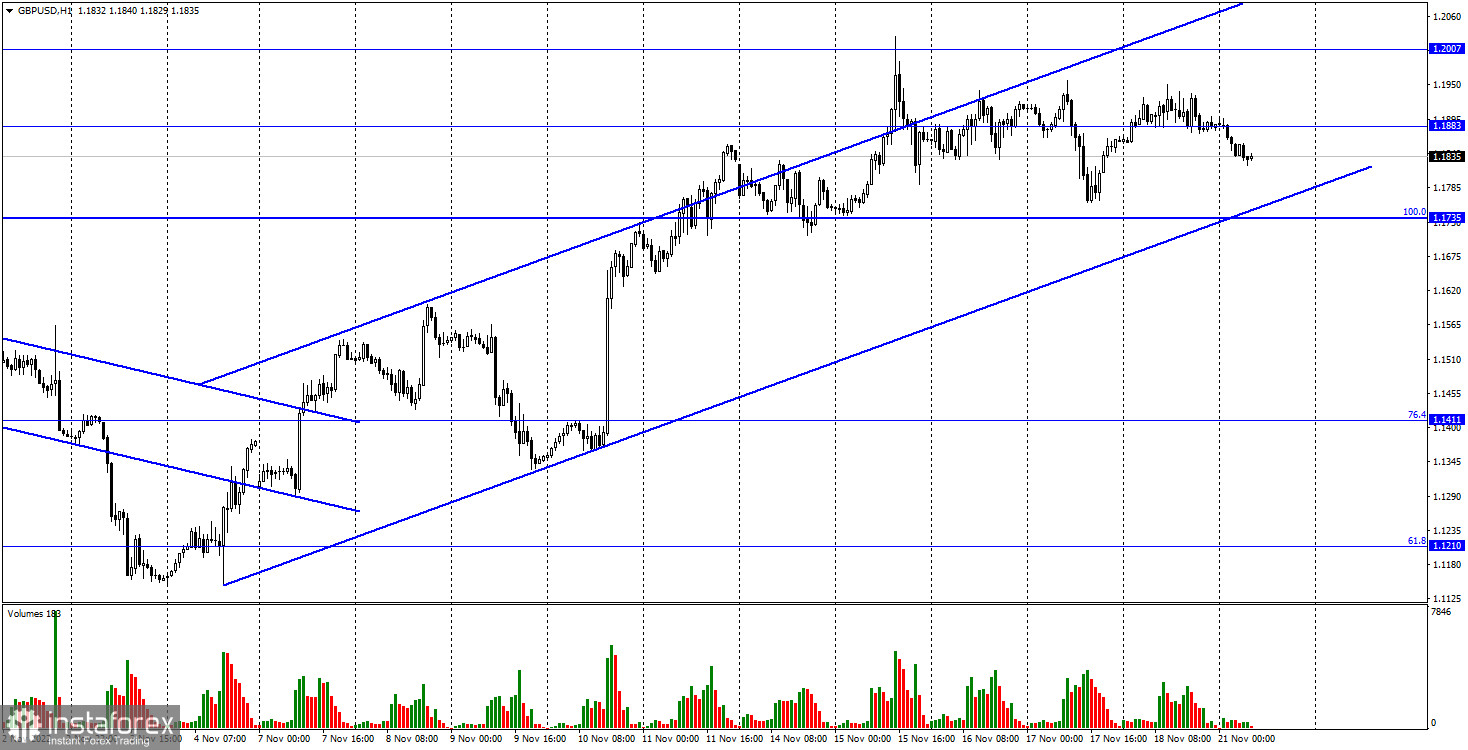

On Friday, the GBP/USD pair was moving sideways near 1.1883 on the hourly chart. On Monday, the British pound fixed below this level and started to decline toward the lower boundary of the bullish channel. The market maintains bullish sentiment. If the price consolidates below the boundary, the market sentiment is likely to change. Following this scenario, the price may drop lower to 1.1411.

The euro and the British pound have already used all the advantages the positive news background offered. However, some news hardly supported the British currency but traders have been buying it in recent weeks. Currently, the pound/dollar pair may form a downward pullback and the news have nothing to do with this. The economic calendar has a few important reports to be released this week. Thus, the market sentiment is unlikely to change. The sideways channel remains the key factor for the pound. Now it depends on whether it continues to trade within the channel or not.

Last week, the UK inflation report showed that inflation accelerated to 11.1%. The new British government published its financial plan for 2023. It was revealed that taxes would be increased and subsidies and spending would be reduced. From an economic point of view, this is good, as the economy may become more stable and less prone to a fall. However, this may happen due to an increase in the Bank of England's interest rate. The next fiscal year will start in a few months and this factor cannot support the pound now. Thus, it is more likely that the pair will fall this week as there is no reason to continue the growth without a pullback.

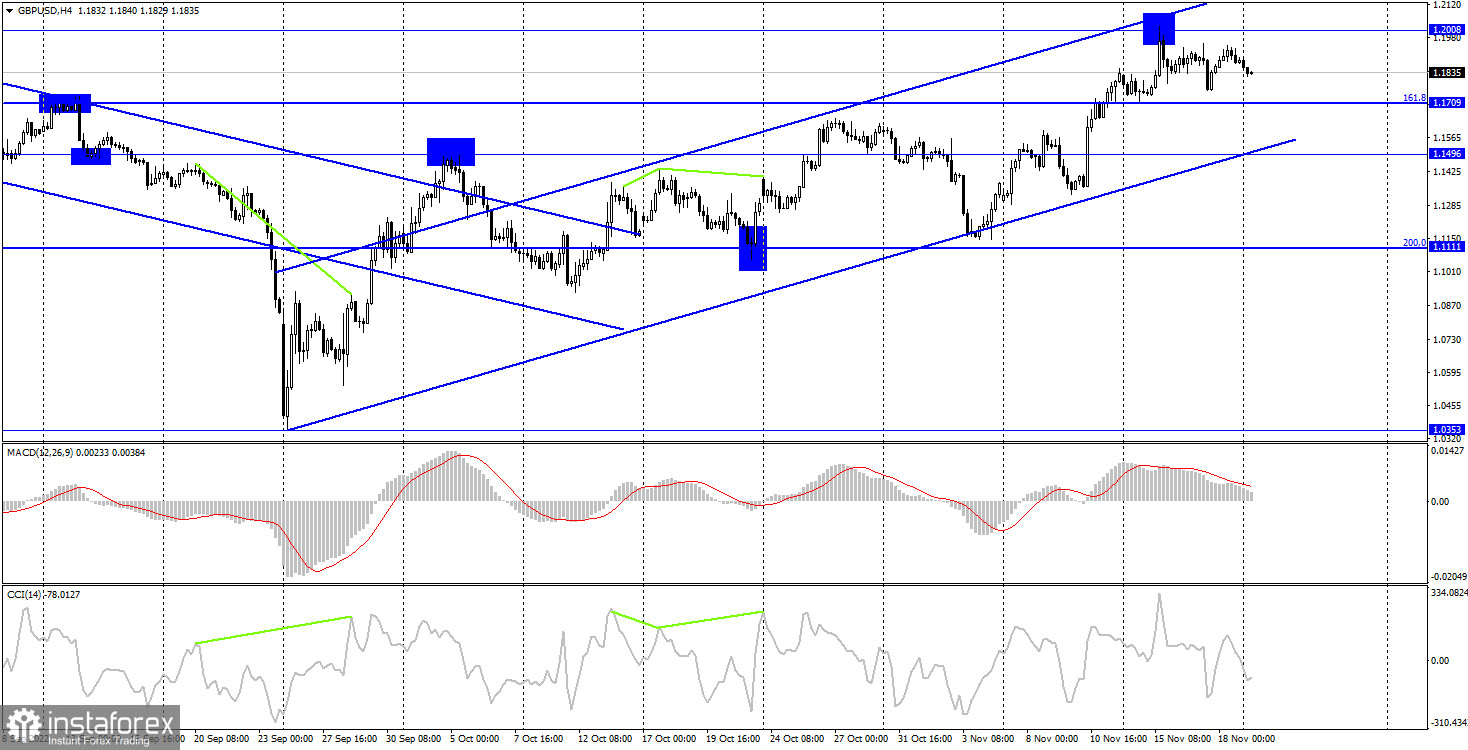

On the 4-hour chart, the pair rebounded from 1.2008 and reversed to the downside. The price started to decline toward the correctional level of 161.8% - 1.1709. If the price rebounds from this level, it may return to 1.2008. However, if it fixes below 1.1709, it is likely to continue to fall to the lower boundary of the ascending channel. Notably, this channel confirms that the bullish sentiment in the market persists.

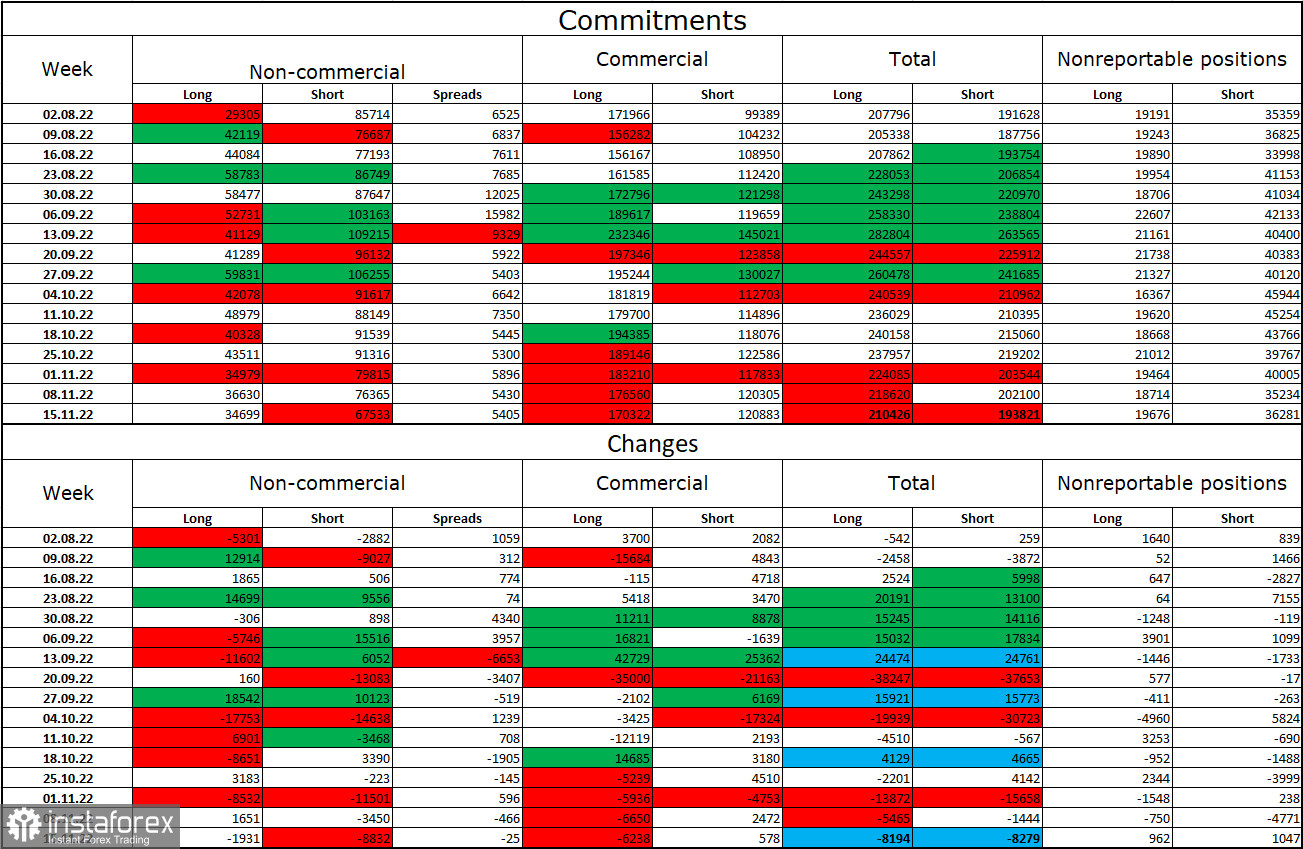

COT report:

Last week, the sentiment of non-commercial traders became less bearish than it was the week before. The number of speculators' long positions decreased by 1,931, and the number of short positions shrank by 8,832. The sentiment of the big players remains bearish, and the number of short positions is still much higher than the number of long ones. Thus, the big traders continue to hold short positions on the pound for the most part but their sentiment has gradually been changing to bullish in recent months but this may take a lot of time. It has already been going on for several months. The British pound might continue rising because the graphical analysis and the trend channel support the growth. As for the news background, everything is quite ambiguous because the reports do not support the British currency. Nevertheless, the pair is rising. The market was expecting it for many months but this growth has no solid grounds.

US and UK economic calendar:

On Monday, there are no economic reports in the US and the UK. The news background is unlikely to change the market sentiment.

GBP/USD forecast and recommendations for traders:

You may sell the pound if it fixes below the lower boundary of the current trading channel with the target at 1.1411. You may buy the currency with the target at 1.2007 if it rebounds from the lower boundary on the hourly chart.