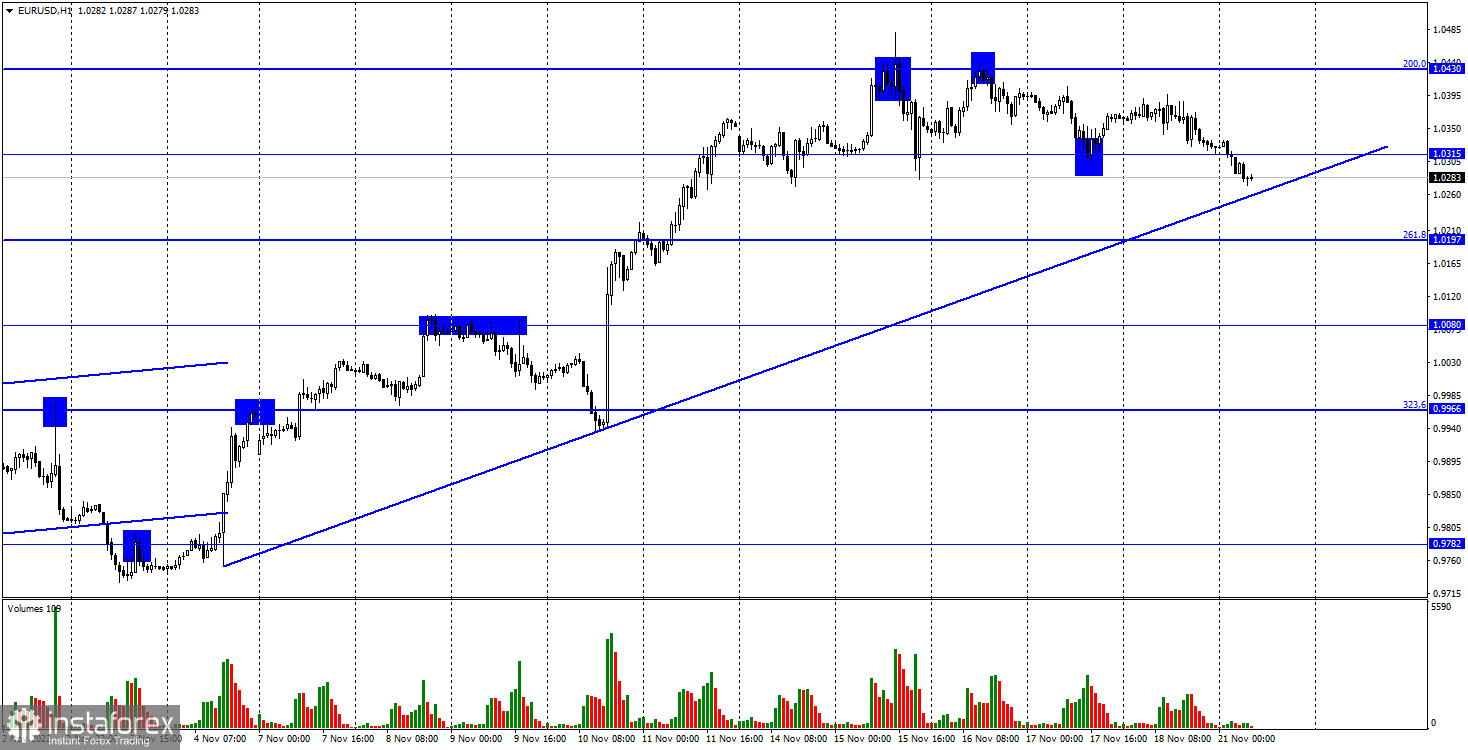

Hi everyone! Last Friday, the EUR/USD pair was gradually moving near the uptrend line. Today, it has finally approached it. It is likely to drop below it. If this scenario comes true, the quotes could decline to 1.0197, the Fibonacci correction level of 261.8%. After that, a decrease to 1.0080 may take place. If so, there could be a trend reversal. Bears may take control. Two failed attempts to pull back from the 1.0430 level last week indicate that the euro may resume a downward movement.

The impact of fundamental factors was rather weak last week. So, there was a moderate increase or drop in short and long positions following the release of economic reports. The euro/dollar pair had been trapped in the range between the levels of 1.0315 and 1.0430 for almost the whole week. However, today the situation may change dramatically even without any drivers. The economic calendar for today is rather uneventful. It makes no sense to talk about the results of the past week as there were no interesting events or sharp movements. The euro climbed to a new high. however, it needs new drivers for further growth. Currently, there are none. So, this is high time for correction.

As a reminder, the latest crucial reports were inflation ones from different countries. In the European Union, consumer prices advanced to 10.6% on a yearly basis. In the UK, inflation spiked to 11.1% in annual terms. In the US, the situation is slightly better but inflation is still very high at 7.7% on an annual basis. In my opinion, traders have already factored in all these reports as well as the possible consequences. By consequences, I mean the central banks' monetary policy decisions at the December meeting in 2022. I believe that the euro is lacking drivers for a further rise. On the 24H chart, there was a pullback. However, it is not enough for a trend reversal. I assume that the pair is likely to trade between 0.9500 and 1.0300 for several months.

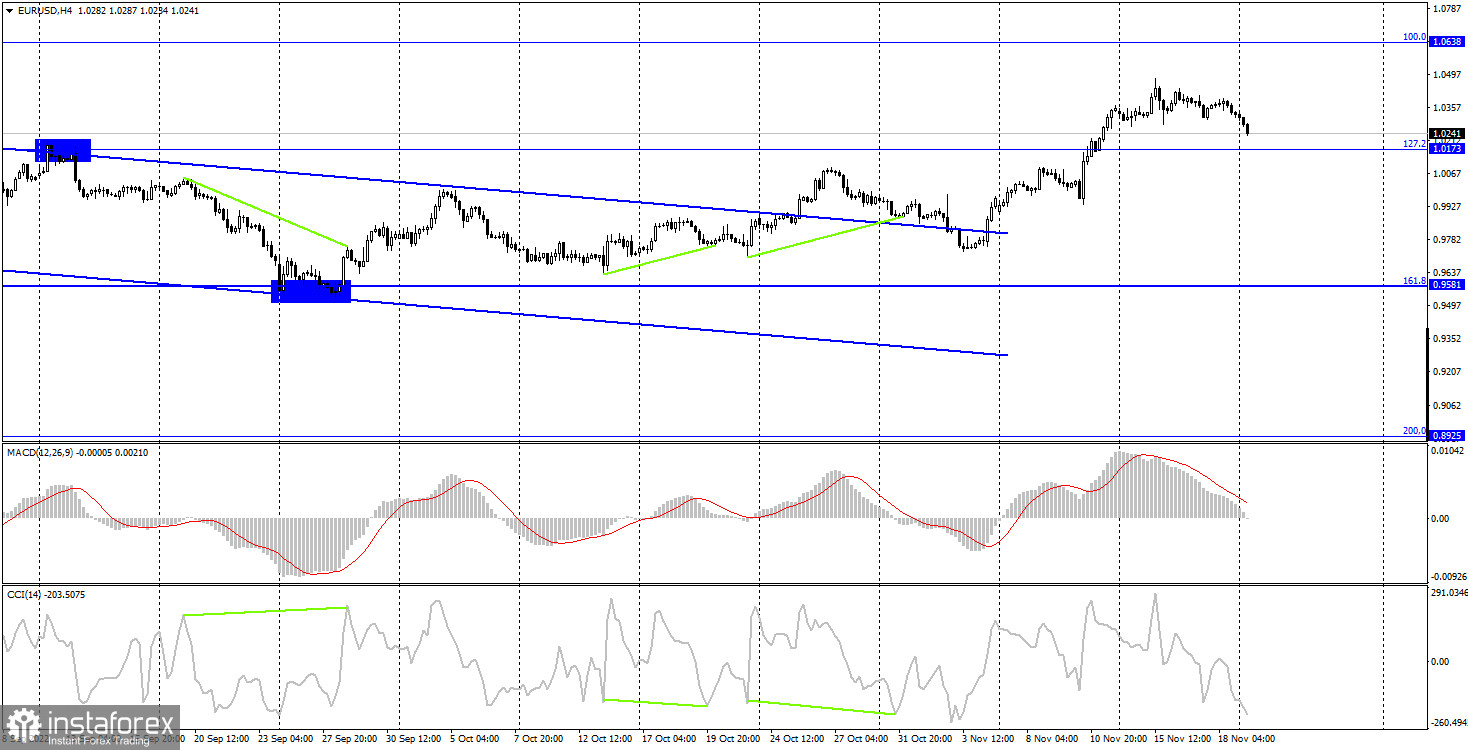

On the 4H chart, the pair settled above 1.0173, the Fibonacci correction level of 127.2%. At the moment, the pair is moving back to this level. If the pair rebounds from this level, it may hit 1.0638, the Fibonacci correction level of 100.0%. If it consolidates above 1.0173, the euro is sure to grow to 0.9581, the Fibonacci level of 161.8%.

Commitments of Traders (COT):

Last week, speculators opened 7,052 long positions and 1,985 short ones. It means that the marker sentiment has become more bullish. The total number of long positions amounts to 239,000, while the number of short positions stands at 126,000. For the first time in a long time, I can say that the euro is growing as it is stated in the COT reports. In the last few weeks, the chance of an uptrend has increased. However, traders were not ready to completely abandon purchases of the US dollar. Now the sentiment on the euro is getting more bullish. Yet, it may be a lengthy process. The euro also managed to close above the downtrend corridor on the 4-hour chart. Therefore, the euro is likely to start a steady upward movement, which somewhat contradicts the current fundamental background.

Economic calendar for US and EU:

On November 21, the economic calendar for the European Union and the United States is empty. The impact of fundamental factors on market sentiment will be weak today.

Outlook for EUR/USD and trading recommendations:

It is recommended to open short positions if the pair drops below the trend line on the 1H chart. The target levels are located at 1.0197 and 1.0080. It is better to open long positions if the price rises from the trend line on the 1H chart or 1.0173 on the 4H chart. The target level is seen at 1.0430.