Today's pre-Christmas period trading day began with the dollar on the offensive. It is rising against all major currencies, including commodity currencies such as the New Zealand dollar, the Australian dollar and the Canadian dollar.

More volatility may soon follow as the Statistics New Zealand will release its trade balance data today at 21:45 UTC, where trade deficit is expected to grow. RBA Governor Philip Lowe will give a speech at 7:00 on Tuesday, and at 13:30 UTC, Statistics Canada will release its retail sales data report. The retail sales index is a key measure of consumer spending, which accounts for the majority of overall economic activity.

It is considered as an indicator of consumer confidence and indicates the near-term health of the retail sector. The index is expected to decrease by -0.7% in September (the previous index values were +0.7%, -2.5%, 1.1%, 2.2%, 0.7%, 0.2%, 3.3%), and that is negative for the CAD. Taking into consideration the renewed positive dynamics of the American dollar, which we can see today, the negative report on retail sales may provoke further growth of the USD/CAD pair.

At 16:45, Bank of Canada Senior Deputy Governor Carolyn Rogers will give a speech. Her surprise announcements could also add to the volatility in the CAD quotes and the USD/CAD pair, respectively.

At 21:30, the American Petroleum Institute (API) will release its report on changes in U.S. oil inventories over the past week. Considering the fact that the Canadian economy still has the signs of a commodity economy and that oil is one of Canada's main export commodities, the oil price trend has a direct impact on the CAD.

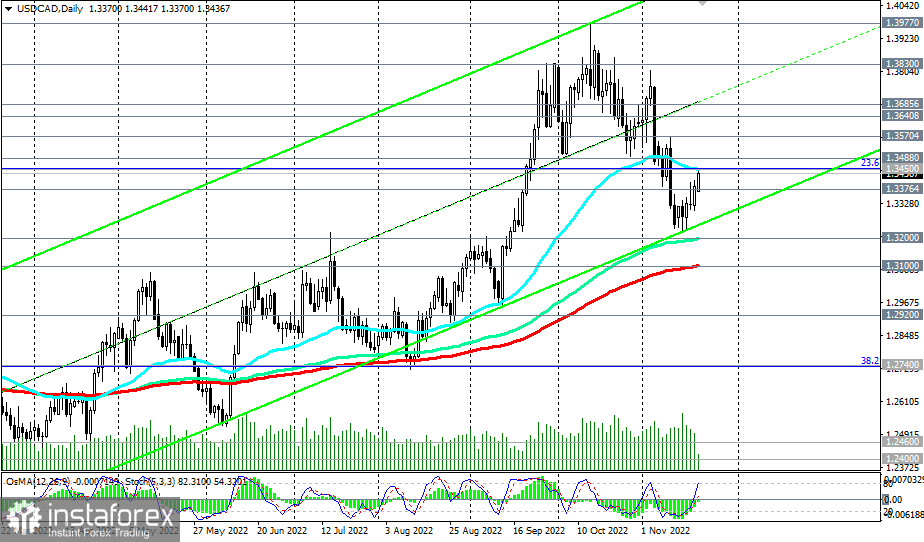

From a technical point of view, for calmer purchases, it is better to wait for USD/CAD to rise to the zone above the resistance levels of 1.3450 (23.6% Fibonacci level of the downward correction in the USD/CAD growth wave from 0.9700 to 1.4600), 1.3488 (200 EMA at 4- hour chart).

Selling can be resumed after the breakdown of the important short-term support level 1.3376 (200 EMA on the 1-hour chart) with the targets at the support levels 1.3200 (144 EMA on the daily chart), 1.3100 (200 EMA on the daily chart).

Support levels: 1.3376, 1.3300, 1.3200, 1.3100

Resistance levels: 1.3450, 1.3488, 1.3500, 1.3570, 1.3600, 1.3640, 1.3685

TradingTips

Sell Stop 1.3370. Stop-Loss 1.3460. Take-Profit 1.3300, 1.3200, 1.3100

Buy Stop 1.3460. Stop-Loss 1.3370. Take-Profit 1.3488, 1.3500, 1.3570, 1.3600, 1.3640, 1.3685, 1.3800, 1.3830, 1.3900, 1.3977, 1.4000