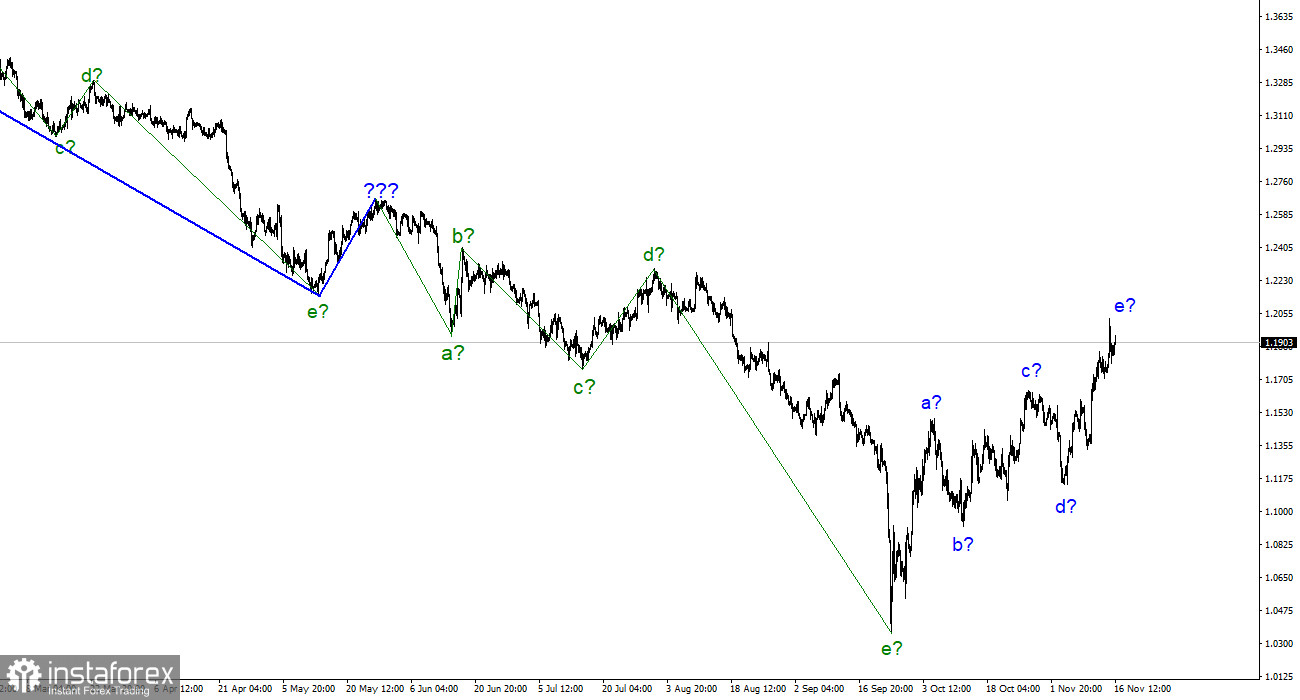

The wave pattern for the pound/dollar instrument currently appears quite confusing, but it still needs to be clarified. A downward trend segment with five waves (a, b, c, d, and e) has supposedly reached its conclusion. Additionally, we have a five-wave upward trend section with forms a, b, c, d, and e. As a result, although the instrument's quote growth may continue for a while, it won't likely last very long. Since both central banks recently increased interest rates, the news backdrop could have been interpreted differently. The previous Friday, we witnessed a decline in the dollar's value relative to the news backdrop, which may have contributed to its potential new growth. All of this makes me think that the market has decided to finish a full-fledged five-wave structure before starting a new downward trend section. The upward trend section isn't complete until a successful attempt to break through the 1.1704 level, which corresponds to Fibonacci's 161.8%, is made. However, the wave structure appears to be well-equipped overall.

The British pound is no longer able to increase.

Although the pound/dollar exchange rate fell by 75 basis points on November 21, today's movements had a very small range. Today's news background is nonexistent in the UK, and the same will be true for the USA. Therefore, the instrument's decline of 75 points is still very favorable for the US dollar, which has recently been having serious growth issues. As I have already stated, the wave marking is currently in favor of developing a new downward section of the trend. It needs to be constructed so that the wave pattern maintains its integrity, even if it is a three-wave section. Recall that wave marking can take almost any form and that any structure can be lengthened and made more complex numerous times. This is a drawback of waves because it is sometimes difficult to predict how the instrument will move. However, there is currently no reason to anticipate a picture's complexity. There are currently few reasons for the market to grow its demand for the dollar, but there are also none to grow its demand for the pound. Eventually, the waves will continue to prevail, and the instrument's performance will decline. This method is simple, obvious, and logical.

The challenging aspect is that there will be an increased demand for the British pound. So far, this increase will be consistent with the anticipated wave e. After this wave is finished, which will happen sooner or later, a descending section of at least three waves should still be built. This wave may take a much longer form than it is now. And the dollar should be in greater demand so that the wave marking is different from the previous downward trend, in which we at most saw one correction wave after each five-wave downward trend.

Conclusions in general

The construction of a new downward trend segment is predicted by the wave pattern of the pound/dollar instrument, though it may begin later than expected. I can no longer recommend purchasing the instrument because the wave marking already permits the development of a downward trend section. Although I don't believe the wave e will take on a particularly extended form, demand for the pound is still high for the time being.

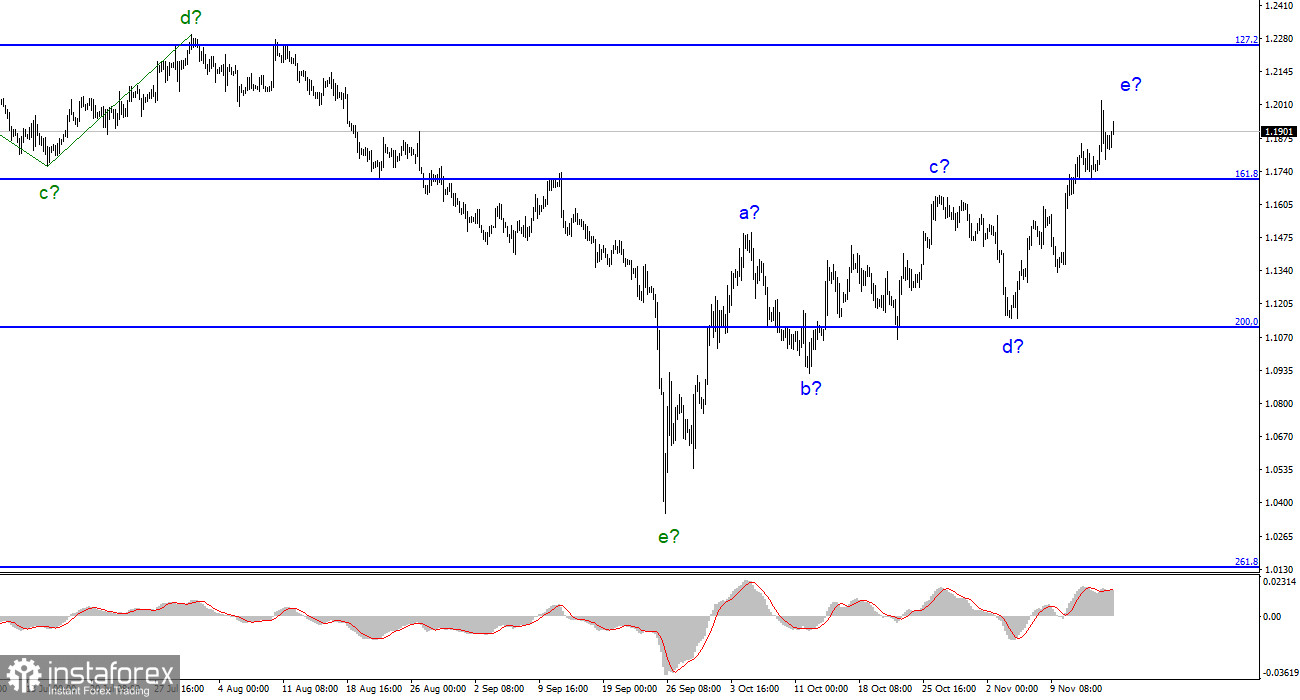

The euro/dollar instrument and the picture look similar on the larger wave scale, which is good because both instruments should move similarly. The upward correction portion of the trend is currently almost finished. If this is the case, a new downward trend will soon develop.