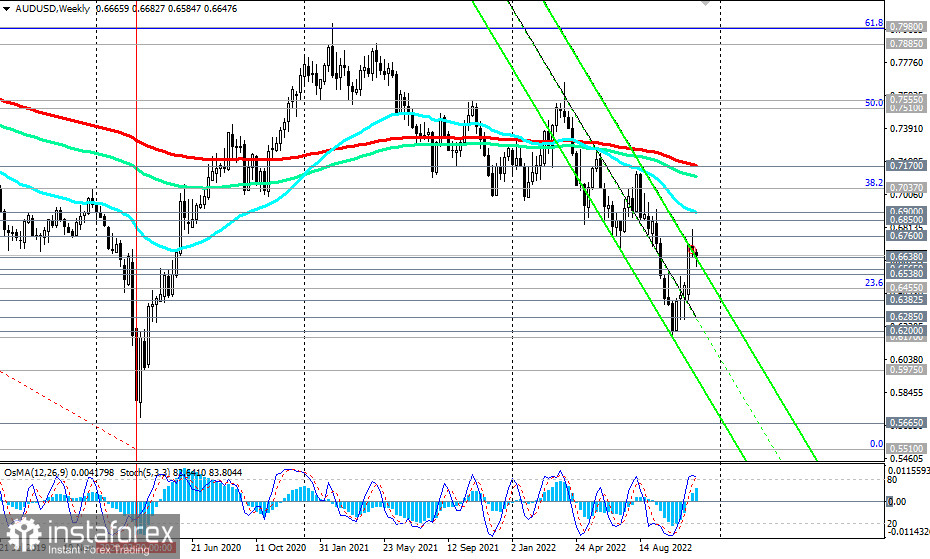

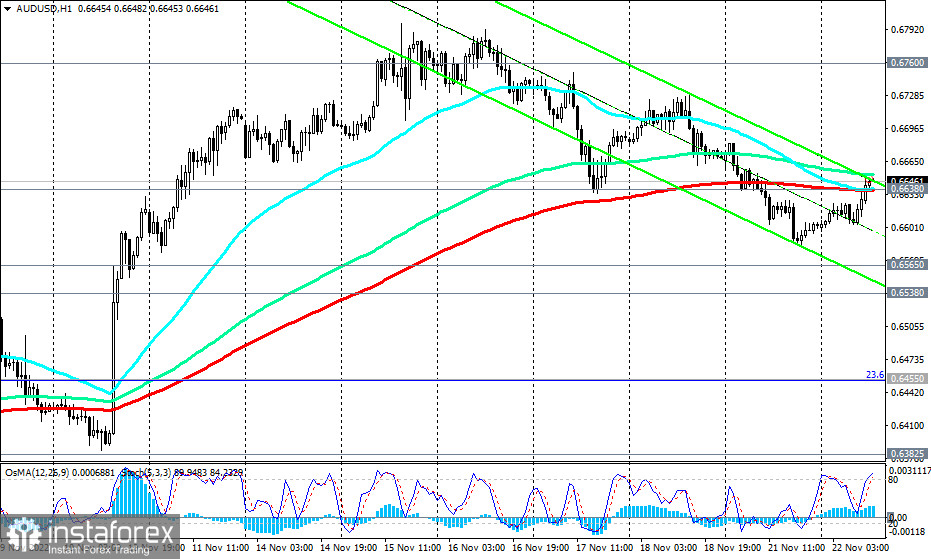

Against the backdrop of the US dollar weakening today and after the statements of RBA Governor Philip Lowe, the AUD/USD pair is growing, testing for a breakdown of the important short-term resistance level 0.6638 (200 EMA on the 1-hour chart). At the same time, despite the current upward dynamics, the pair remains in the zone of a long-term bear market, below the key resistance levels of 0.6760 (144 EMA on the daily chart), 0.6850 (200 EMA on the daily chart), 0.6900 (50 EMA on the weekly chart).

A breakdown of support levels 0.6565 (50 EMA on the daily chart), 0.6538 (200 EMA on the 4-hour chart) will mean a revival of the downward dynamics and a return of AUD/USD into the descending channel on the weekly chart.

In case of a breakdown of those support levels, short positions will become relevant and the first signal for their resumption will be a breakdown of the aforementioned support level at 0.6638 and the local support level at 0.6585.

Alternatively, after gaining support above 0.6638, AUD/USD will again attempt to break above the resistance level of 0.6760. But, most likely, there will be a rebound from this level or a little higher and closer to the key resistance level of 0.6850, and further movement will take place according to a negative scenario for AUD/USD.

Support levels: 0.6600, 0.6565, 0.6538, 0.6500, 6455, 0.6382, 0.6285, 0.6200, 0.6170, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6638, 0.6700, 0.6760, 0.6800, 0.6850, 0.6900

Trading Tips

Sell Stop 0.6620. Stop-Loss 0.6670. Take-Profit 0.6600, 0.6565, 0.6538, 0.6500, 6455, 0.6382, 0.6285, 0.6200, 0.6170, 0.5975, 0.5665, 0.5510

Buy Stop 0.6670. Stop-Loss 0.6620. Take-Profit 0.6700, 0.6760, 0.6800, 0.6850, 0.6900