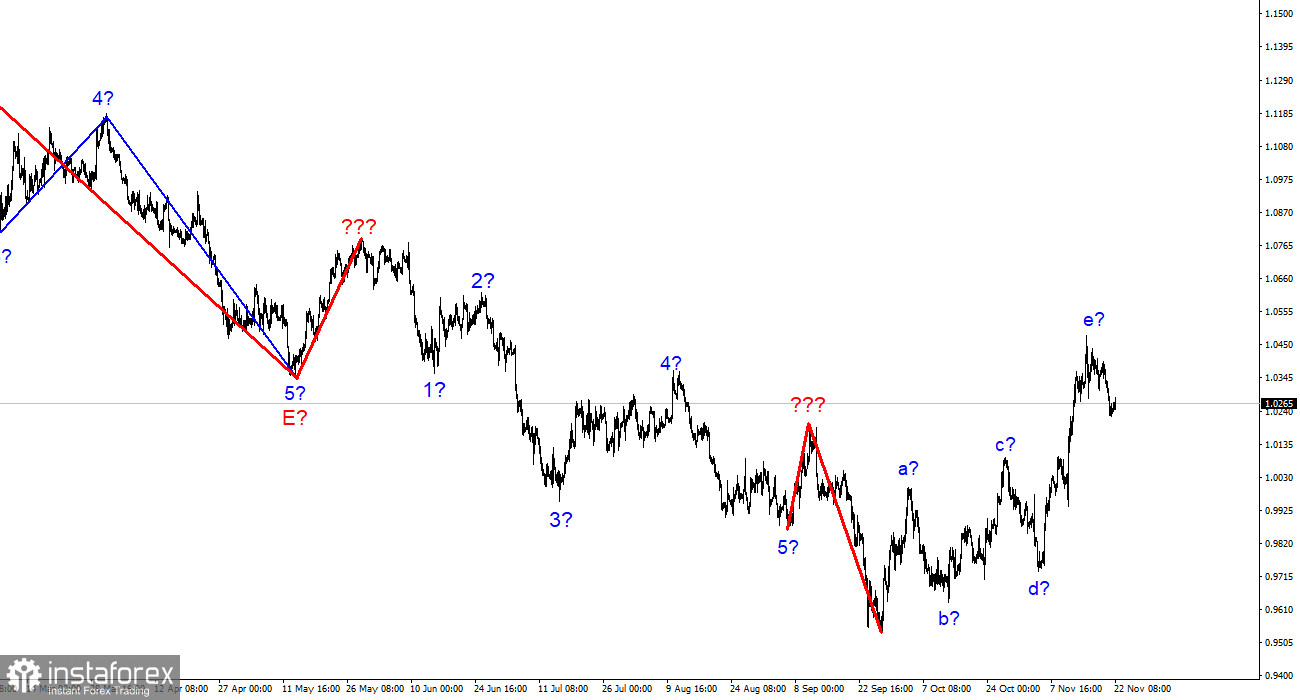

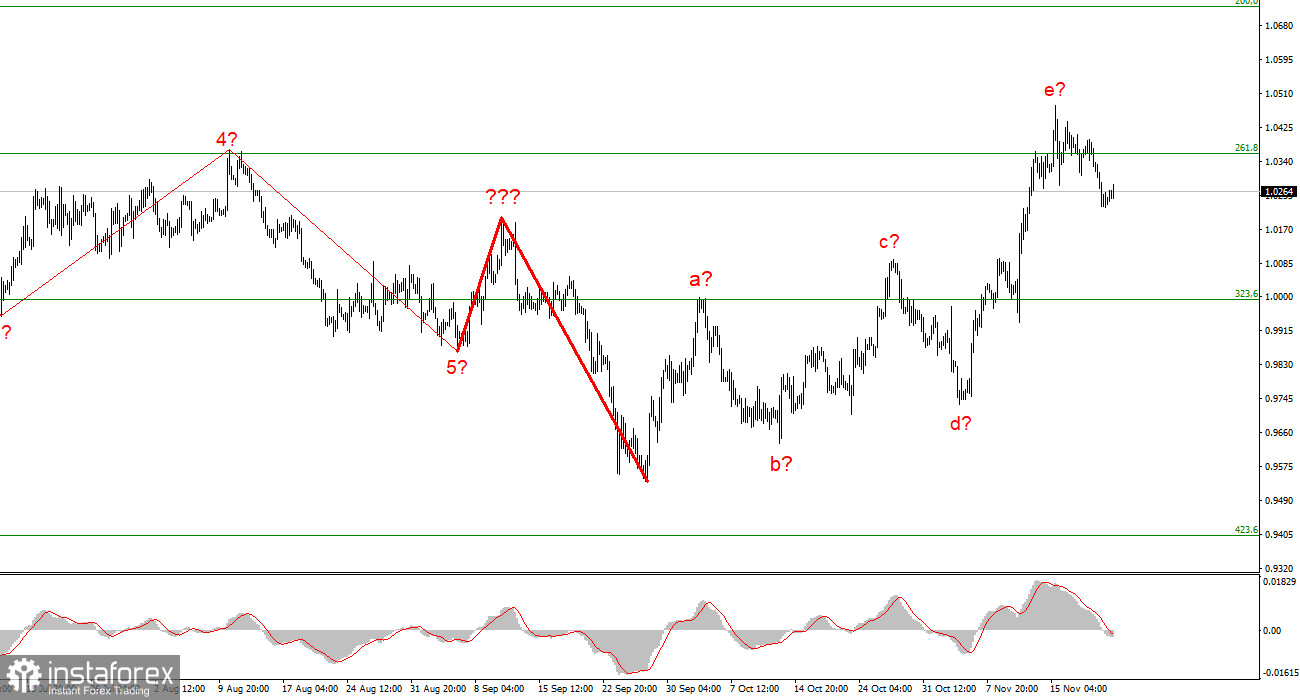

The euro/dollar pair's wave pattern on the 4-hour chart appears quite accurate. The upward portion of the trend has corrected itself. Initially, I believed three waves would develop, but it is now abundantly clear that there are five waves. As a result, the waves a, b, c, d, and e have a complex correction structure. If this supposition is accurate, the building of this structure may have already been finished since the peak of wave e is higher than the peak of wave C. In this instance, it is anticipated that we will construct at least three waves downward, but if the most recent phase of the trend is corrective, the subsequent phase will probably be impulsive. Therefore, I am preparing for a new, significant decline in the instrument. The market is prepared to sell when an attempt to break through the 1.0359 level, which corresponds to the Fibonacci 261.8%, is successful.

Right now, the euro and the pound's wave markings must match. You may recall that I frequently cautioned you against expecting the euro and the pound to trade in opposition. Although theoretically feasible, this happens incredibly infrequently in reality. Both instruments are currently getting ready to finish the trend correction sections. Thus, the British pound may also start to fall as part of a new segment of a downward trend.

On an empty calendar, demand for dollars is rising.

On Tuesday, the euro/dollar instrument increased by 30 basis points. Today, as well as yesterday, there is no news background, so it is quite reasonable for movements to have a low amplitude. This week won't have much news, so I'll concentrate on wave markup. Since it doesn't allow for multiple scenarios, it is now very straightforward. If the five-wave structure is finished, there are only so many options here; the downward trend section is already under construction. It no longer makes sense to speculate on the eventual appearance of the trend if the entire upward section of it becomes more complex.

The demand for US currency will increase this week. It will likely grow, albeit probably not quickly. Given that there is currently nothing else to start with, I am beginning with the wave pattern. There is nothing more to gain in this situation because the market has already absorbed all of the speculation, conjecture, and forecasts relating to the interest rates of the ECB and the Fed. If the instrument previously increased due to a weak report on US inflation and concern about a potential slowdown in the pace of tightening the PEPP, it makes sense to expect an increase in demand for US currency. That's what I hope will happen.

More specifically, there are absolutely no events this week that could influence the demand for the dollar. The "minutes" of the Fed, orders for long-term goods in the US, and several speeches by FOMC and ECB members, the main points of which are already quite obvious. What on this list has the potential to influence the market's mood? Nothing.

Conclusions in general

The analysis led me to conclude that the upward trend section's construction, which began as a five-wave structure but has since become more complex, is now complete. As a result, I suggest making sales with targets close to the estimated 0.9994 level, or 323.6% Fibonacci. The upward trend section could be made more complex by taking on a longer form, but this possibility has only increased by 10%.

The wave marking of the descending trend segment becomes more intricate and lengthens at the higher wave scale. The a-b-c-d-e structure is most likely represented by the five upward waves we observed. After the construction of this section is finished, work on a downward trend section may resume.