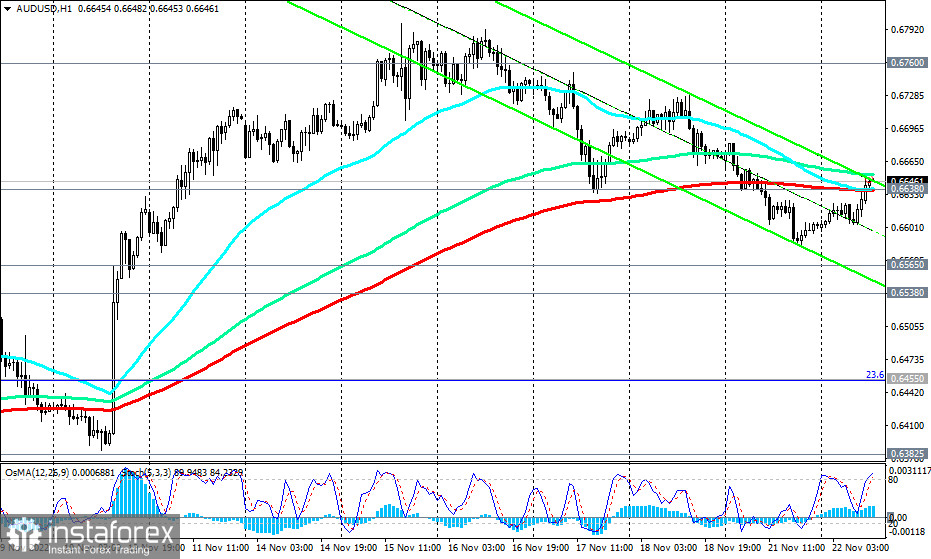

Against the backdrop of the US dollar weakening today and after the statements made by RBA Governor Philip Lowe this morning, the AUD/USD pair is growing, testing the important short-term resistance level of 0.6638 for a breakdown.

"The board expects to increase interest rates further over the period ahead. We are not on a pre-set path though it is possible that the Council will return to 50 bps or leave rates unchanged for some time," Lowe said.

It should be noted that in comparison with the actions of the ECB, the Fed, the Bank of England, the Bank of Canada and the Reserve Bank of New Zealand, the Reserve Bank of Australia is acting rather restrained in relation to changes in its monetary policy parameters, moderately raising its interest rates.

As you know, at the beginning of this month, when the meeting of the RBA was held, the bank's management decided to raise the interest rate by 25 basis points, to 2.85%. This is the highest level in the last nine years. However, "the board of the Central Bank saw fit to raise rates at a slower pace," said Lowe during his speech following the meeting.

The RBA is still forced to tighten monetary policy in the face of rising inflation. However, "rising interest rates and rising inflation are putting pressure on the budgets of many households," although "the Central Bank remains determined to bring inflation back to its target," the RBA said in a statement following its November meeting.

In other words, the RBA seems set to raise interest rates further, but "the size and timing of future rate hikes will be determined by incoming data, inflation outlook and labor market assessments."

Today (22:00 GMT), a block of macroeconomic statistics from Australia will be released. Economists' forecasts suggest that the Commonwealth Bank and S&P Global PMI for service sector may decline in November from 49.3 to 49.1 and the manufacturing sector from 52.7 to 52.4 points.

Also, the deteriorating epidemiological situation in China is putting pressure on the Australian dollar quotes. The worsening of the situation may cause tougher quarantine measures and a decrease in purchases of Australian raw materials and goods (China, as you know, is Australia's largest trade and economic partner and buyer of its raw materials).

As we noted at the beginning of our review, today, the AUD/USD is growing, being in the stage of an upward correction, but remaining in the zone of the global downward trend, below the key resistance levels of 0.6760, 0.6850, 0.6900, which still makes short positions on the pair preferable.

Tomorrow, the focus of market participants will be the publication (at 19:00 GMT) of the minutes of the Fed's November meeting, which may contain additional information regarding the prospects for monetary policy. Sellers of the dollar expect that already at the December meeting, the Fed may increase not by 0.75% but by 0.50%, and will soften the rhetoric of its statements regarding future interest rate hikes.

Buyers of the dollar are counting on the Fed's continued super-tight monetary policy cycle: U.S. inflation is still well above the Fed's target of 2.0%.