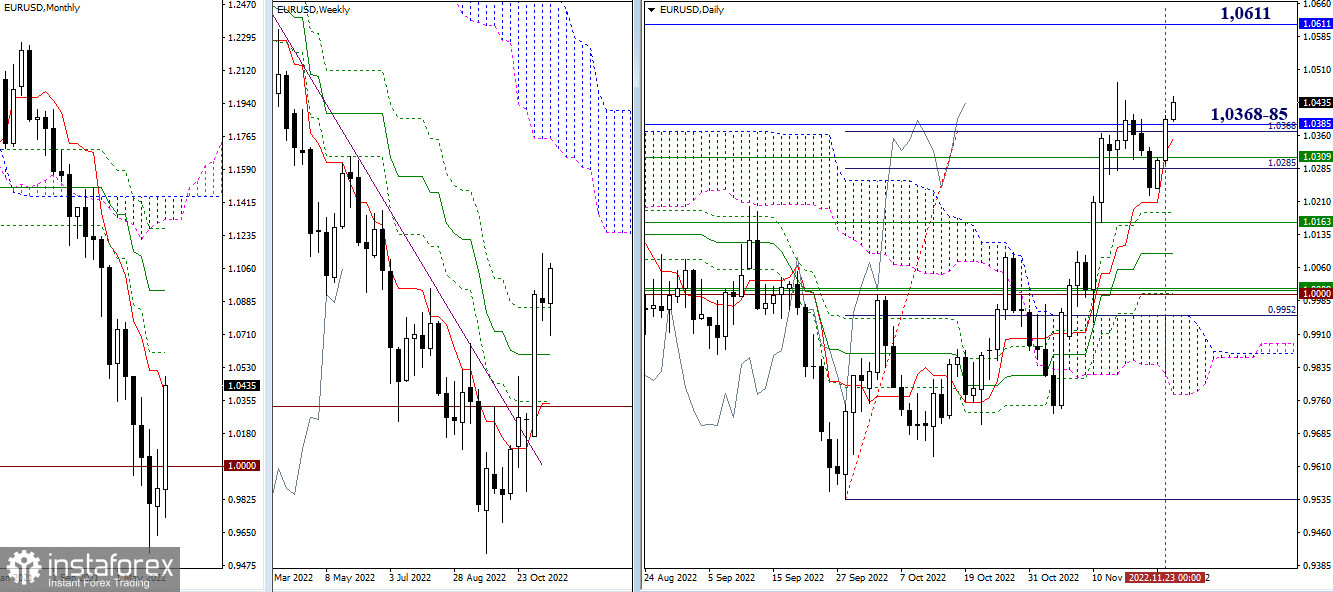

EUR/USD

Higher time frames

Yesterday, bulls were active and managed to close trading above the upper boundary of the resistance zone (1.0368-85). Therefore, potential development and further rise will allow traders to overcome attraction and focus on testing the next ascending target 1.0611 (monthly Fibo Kijun). If bulls fail to continue their move, they will have to return to the attraction zone 1.0285 - 1.0309 - 1.0369 - 1.0385 (final levels of weekly Ichimoku cross + monthly short-term trend + target for breakout of daily cloud).

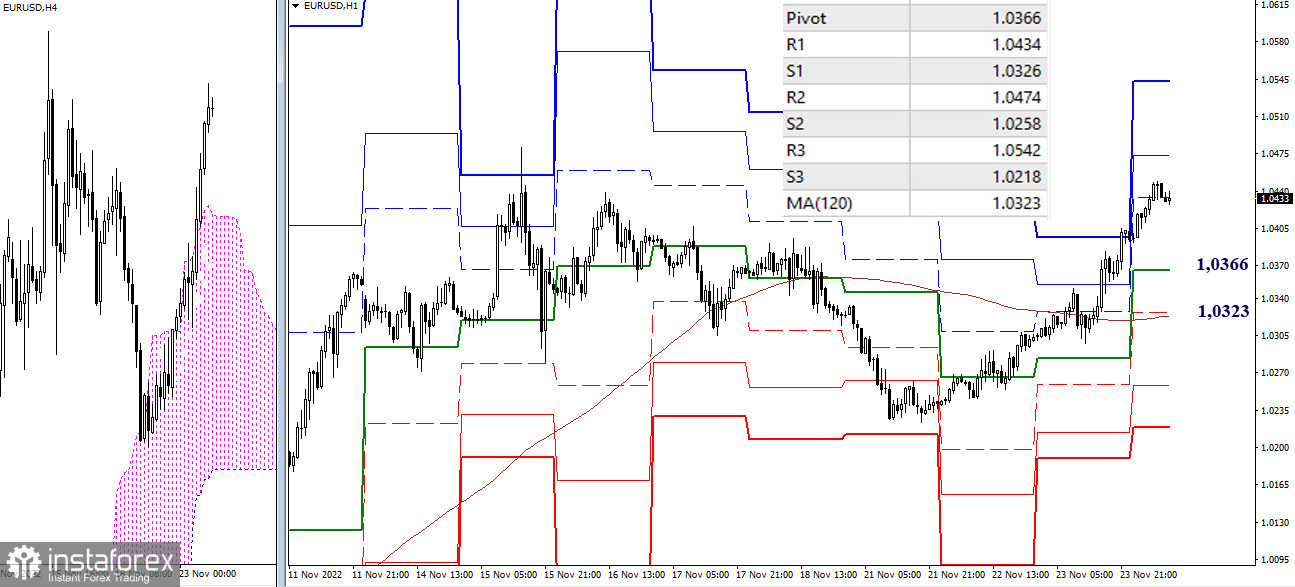

H4 – H1

Earlier, bulls consolidated above the key levels, gaining the major advantage. Currently, they are testing the resistance of the first classic Pivot point (1.0434). Later, marks for the further intraday rally are 1.0474 (R2) and 1.0542 (R3). The key levels in the current situation are the nearest supports. They can be seen at 1.0366 (central Pivot point) and 1.0323 (weekly long-term trend). A fixation below may change the current balance of power of the lower time frames.

***

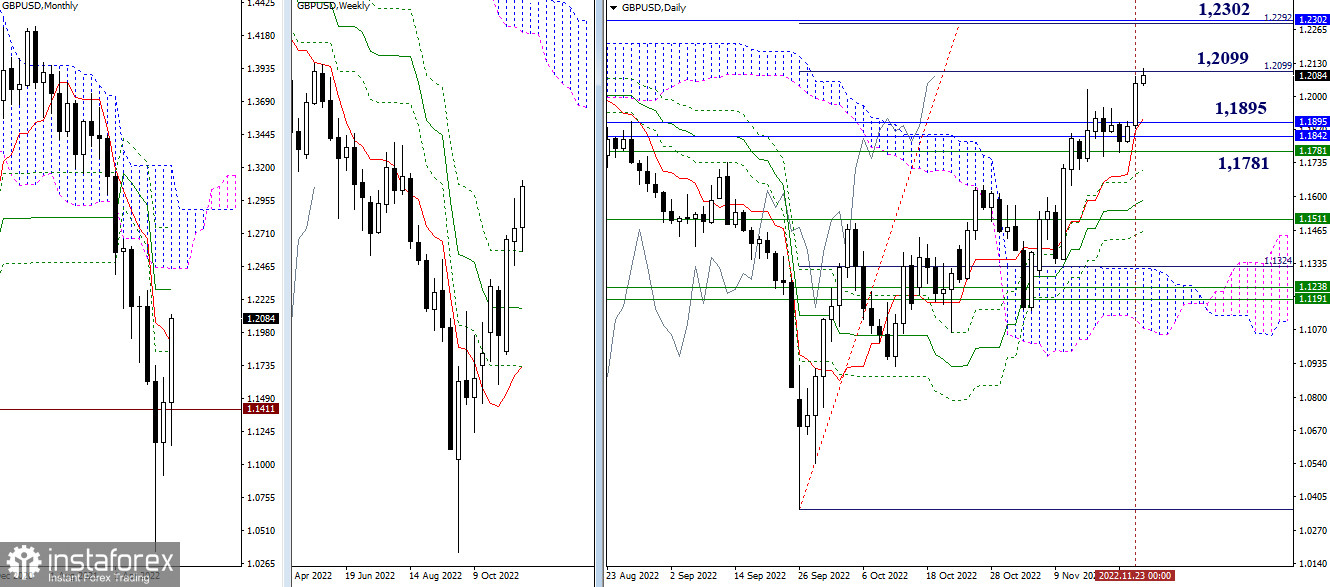

GBP/USD

Higher time frames

Yesterday, bulls were active. They managed to renew the previous week high. At the same time, bulls reached the resistance of the first mark of the daily target for the breakout of the Ichimoku cloud (1.2099). The interaction may result in a deceleration or formation of a pullback. The next upward target is 1.2292 - 1.2302 (100% target fulfillment + monthly medium-term trend). If bears return to the market, they first will rush to the recent consolidation zone, formed by the influence of weekly and monthly levels 1.1781 - 1.1842 - 1.1895.

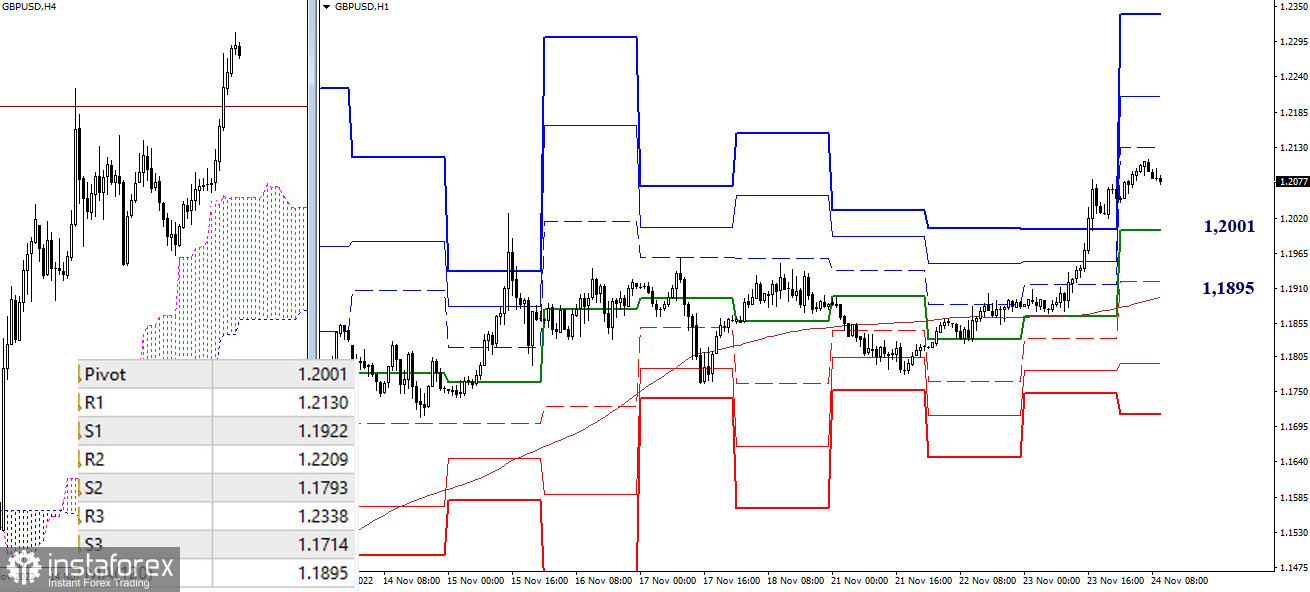

H4 – H1

Bulls have the current advantage of the lower time frames despite some decline in the last hours. Ascending intraday targets may be registered at the boundaries of 1.2130 - 1.2209 - 1.2338 (classic Pivot points). Key levels serve as support, located at 1.2001 (central daily Pivot point) and 1.1895 (weekly long-term trend). Testing and further breakout of the key levels may change the balance of power of lower time frames. Moreover, a return to the attraction zone of higher time frames will occur and an effective rebound from the current resistance of higher time frames (1.2099) will be formed.

***

The technical analysis of the situation uses:

Higher time frames - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)