Following the release of preliminary data on inflation in the eurozone, the dollar should have been strengthened significantly. Yet, those were its main competitors, the euro and the pound, that went up. The decrease came after the Fed boss' speech. In fact, the greenback started to go down when Jerome Powell was actually speaking. The chairman hinted that the regulator may hike rates by 50 basis points in December. This was enough to cause a fall in the US dollar.

Today, the greenback will remain under pressure, pushed by the data on the US labor market. Thus, initial jobless claims may rise by 18,000 and continuing ones to increase by 9,000. Ahead of the release of the US Department of Labor report, such disappointing results contributed to the weakening of the dollar.

United States Continuing Jobless Claims:

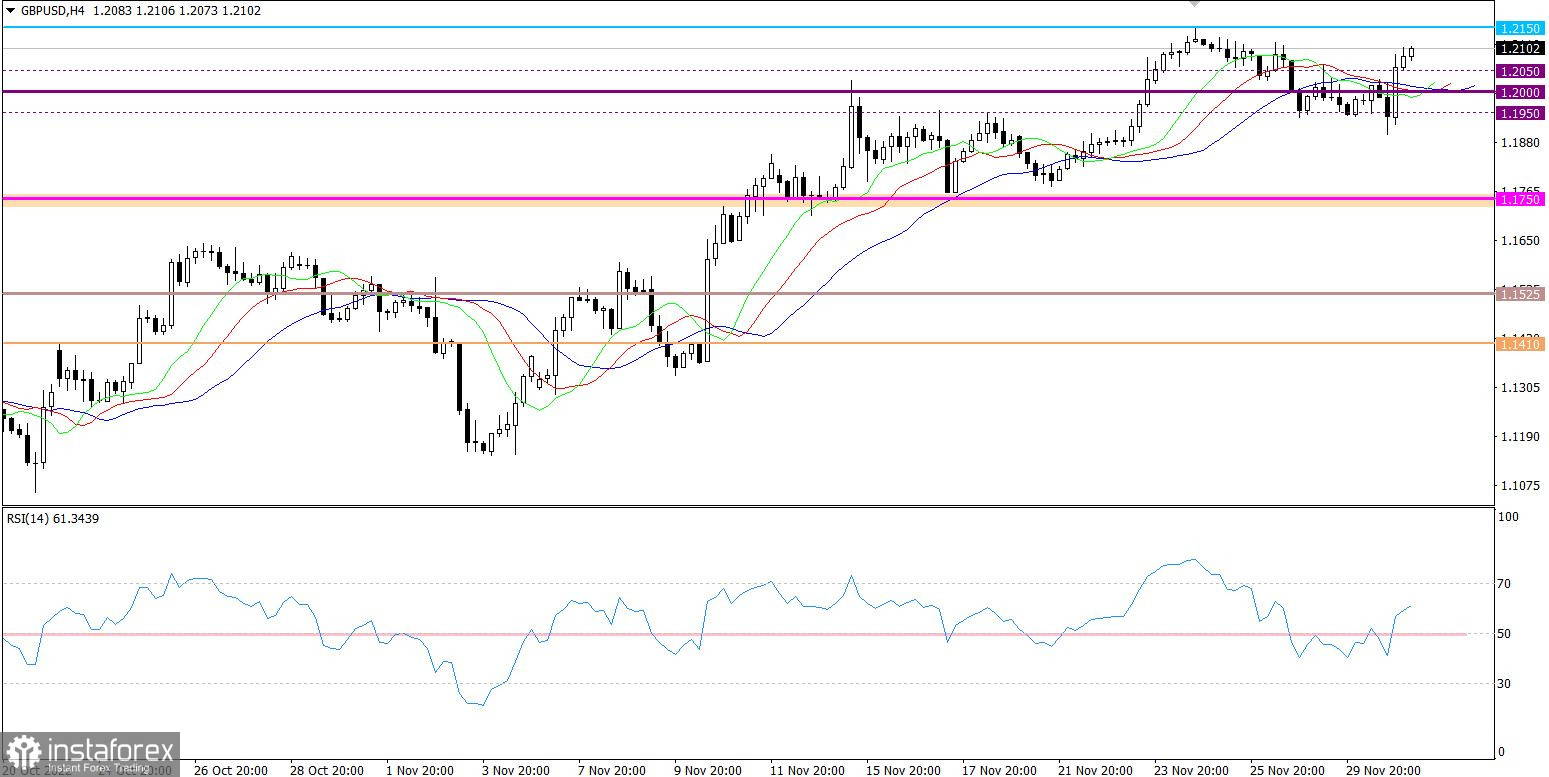

After hovering below the psychological level of 1.1950/1.2000 for several days, GBP/USD failed to consolidate. This area eventually became support where the price rebounded.

The RSI crossed line 50 to the upside on the 4-hour chart, signaling an increase in buying volumes. On the daily chart, the indicator is still moving up in the range of 50 to 70, indicating an upward movement from the low of the downtrend.

On The 4-hour chart, the Alligator produces no clear signal as its MAs are intertwined. On the daily chart, the Alligator illustrates an uptrend cycle, ignoring intraday price movements.

Outlook

If the price breaks through the 1.2150 resistance, the uptrend cycle from the low of the downtrend will extend. Notably, a breakout through 1.2150 will take place if the quote settles above it in the daily time frame.

Alternatively, the price may bounce off 1.2150.

As for complex indicator analysis, there is a buy signal for short-term and intraday trading due to the uptrend cycle from 1.1950/1.2000. In the medium term, indicators are also headed upward.