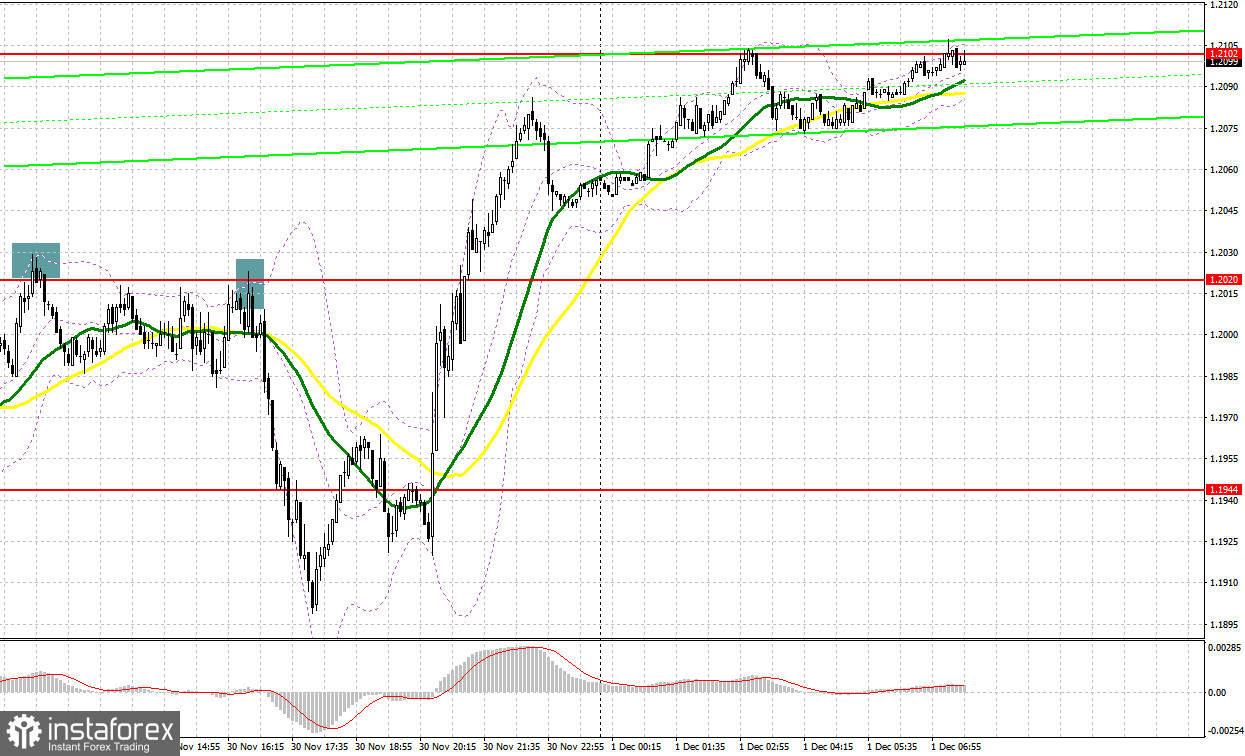

Yesterday, a few nice entry signals were made. Let's take a look at the M5 chart to get a picture of what happened. In the previous review, we focused on 1.2020 and considered entering the market there. Growth and a false breakout through 1.2020 produced a sell signal, and the price fell by 35 pips. In the second half of the day, another false breakout through 1.2020 generated one more sell signal, bringing a profit of over 100 pips.

When to go long on GBP/USD:

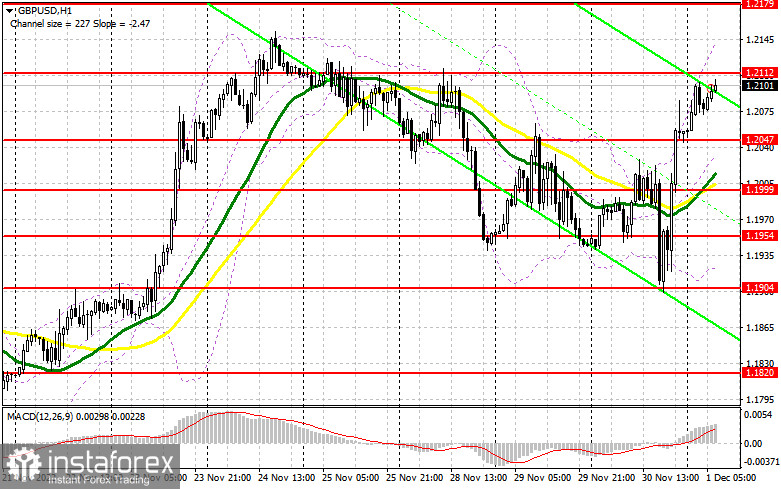

The Fed boss' dovish statements confirmed a change in the regulator's monetary policy stance. As a result, the greenback dropped against the pound. So, the pair may update the November high. The UK will see the release of the Nationwide house price index and the manufacturing PMI. These reports may limit the pair's growth potential because a decrease in the figures is anticipated. If the pound reacts with a fall, bullish activity may increase only near the 1.2047 support. A false breakout through the barrier will make a buy signal with the target at 1.2112. It is important that the bulls break through the mark today as it will allow them to extend the uptrend. After a downside test at 1.2112, the quote may head toward 1.2179. If the price goes above this range, the trend with the target at 1.2224, a new semi-annual high, will get stronger. The most distant target is seen in the area of 1.2256 where a profit-taking stage may begin. If the buyers fail and lose control over 1.2047, the pair will feel stronger pressure at the beginning of the month, and a correction will occur. In such a case, it would be wiser to go long after a false breakout through 1.1999. Also, it will be possible to buy GBP/USD on a bounce off 1.1954, allowing a correction of 30-35 pips intraday.

When to go short on GBP/USD:

The bears may trap the price in a sideways channel. To do this, they should do everything possible to prevent a breakout through the nearest resistance of 1.2112. A false breakout there following the release of pessimistic PMI data will produce a nice sell signal with the target at the nearest support of 1.2047. A breakout and a retest of the level to the upside will make a sell signal, and the pair will fall to 1.1999 which will make trading difficult for the buyers who expect a continuation of the uptrend. In addition, the bullish MAs are located in this range. The most distant target is seen at 1.1954 where a profit-taking stage may begin. After a test of this level, the pair will be stuck in the sideways channel and its short-term upside potential will be limited. If GBP/USD goes up when there is no bearish activity at 1.2112, the bulls will regain control over the market. A false breakout through the 1.2179 resistance will generate a sell signal. If there is no activity there, GBP/USD could be sold from the high and at 1.2224, allowing a bearish correction of 30-35 pips intraday.

Commitments of Traders:

Commitments of Traders for November 22 reflect a decrease in both long and short positions. A decline in economic activity in the UK signals a recession. Meanwhile, the Bank of England is focusing on inflation, which remains stubbornly high. In this light, traders prefer staying away from the market, neither selling nor buying the pound. This week, the US Fed will real its monetary policy plans for next year. In case hawkish statements will come in line with market expectations, the pound will feel strong selling pressure which will cause a mass sell-off in early December. According to the latest COT report, long non-commercial positions dropped by 3,782 to 30,917 and short non-commercial positions decreased by 674 to 66,859, which led to a further increase in the negative non-commercial net position to -35,942 from -32,834 a week earlier. The weekly closing price of GBP/USD grew to 1.1892 against 1.1885.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages, signaling increased bullish activity.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

Support is seen at 1.2160, in line with the lower band.

Indicator description:

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.