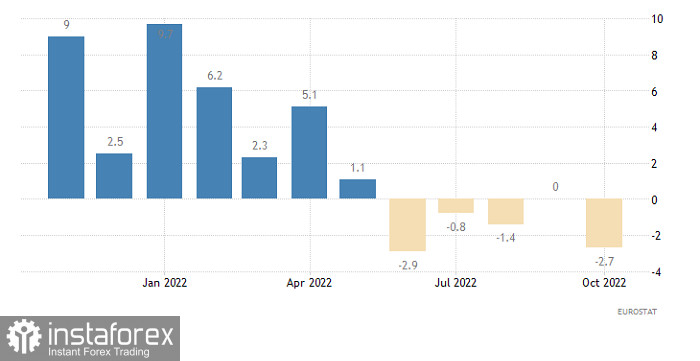

Retail sales in Europe continue to fall. It came down to -2.7% in October, which is far worse than the expected -2.2%. And even though previous data was revised from -0.6% to 0.0%, it did not change the situation.

Retail Sales (Europe):

The macroeconomic calendar is completely empty today, so market players do not have anything to look forward to. Thus, all eyes will be on other events, such as the long-discussed price cap in oil, which is still being worked out. The issue will become clear most likely at the end of this week.

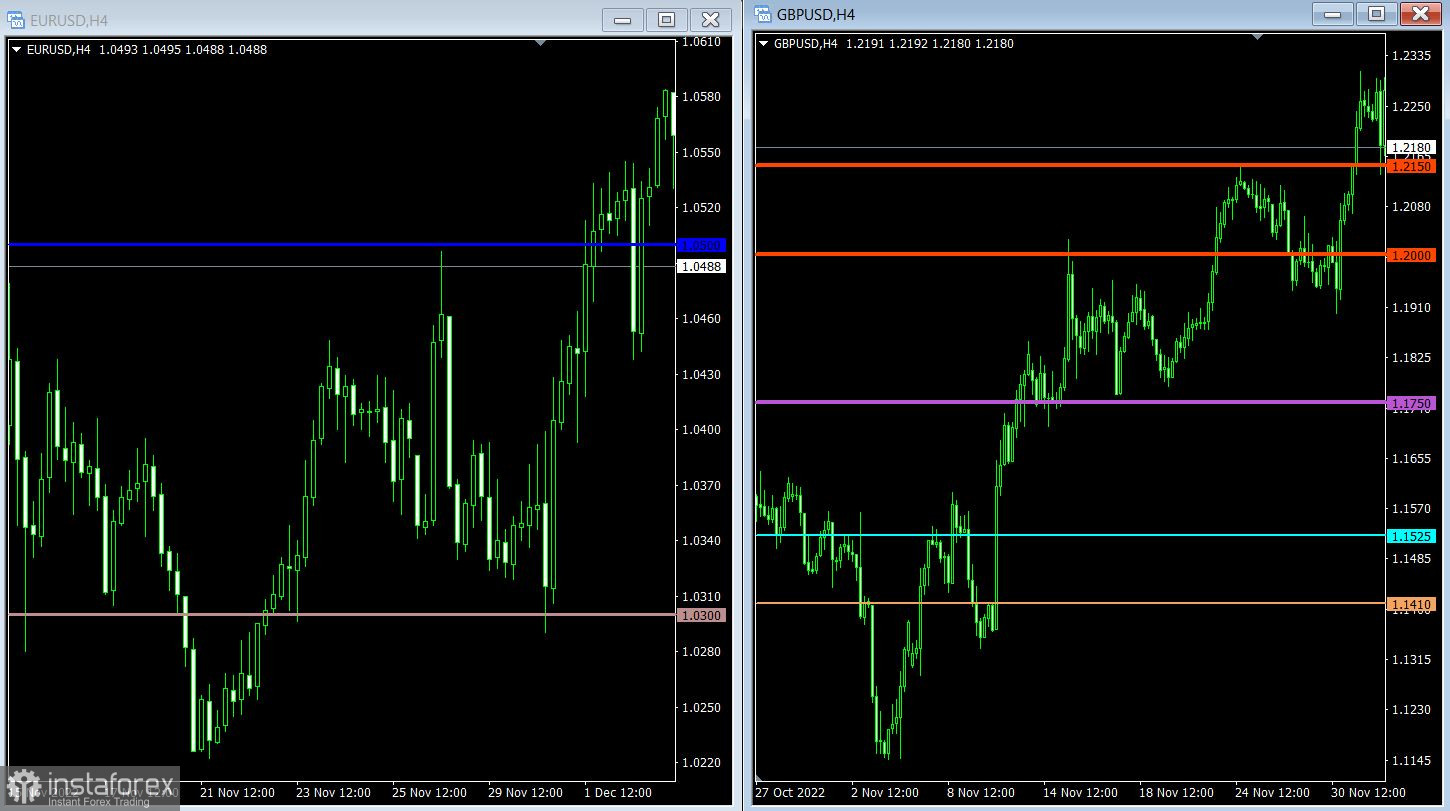

In terms of the forex market, the euro has bounced away from 1.0600, leading to a surge in the volume of short positions. It is now fluctuating near 1.0500, which could be a signal of a regrouping of trading forces. A prolonged stagnation below 1.0500 could lead to a full-blown correction.

There is a pullback in GBP/USD, in the direction of 1.2150. If the quote remains below 1.2150 in the four-hour TF, short positions will surge. Otherwise, the pair will see a rebound.