Macroeconomic calendar on December 5th

Yesterday, the United Kingdom, the eurozone, and the United States saw the release of business activity data.

In the eurozone, the services PMI dropped to 48.5 from 48.6.

In the United Kingdom, the services PMI remained at 48.8 in November.

In the United States, the services PMI fell to 47.8 versus 47.8 in November.

The results had no effect on the market as they came in line with preliminary forecasts.

In the eurozone, retail sales data came in at -2.7%, well below market estimates of -2.2%. Therefore, the previous revision of statistics to 0.0% from 0.6% had little influence on the euro.

Overview of technical charts of December 5th

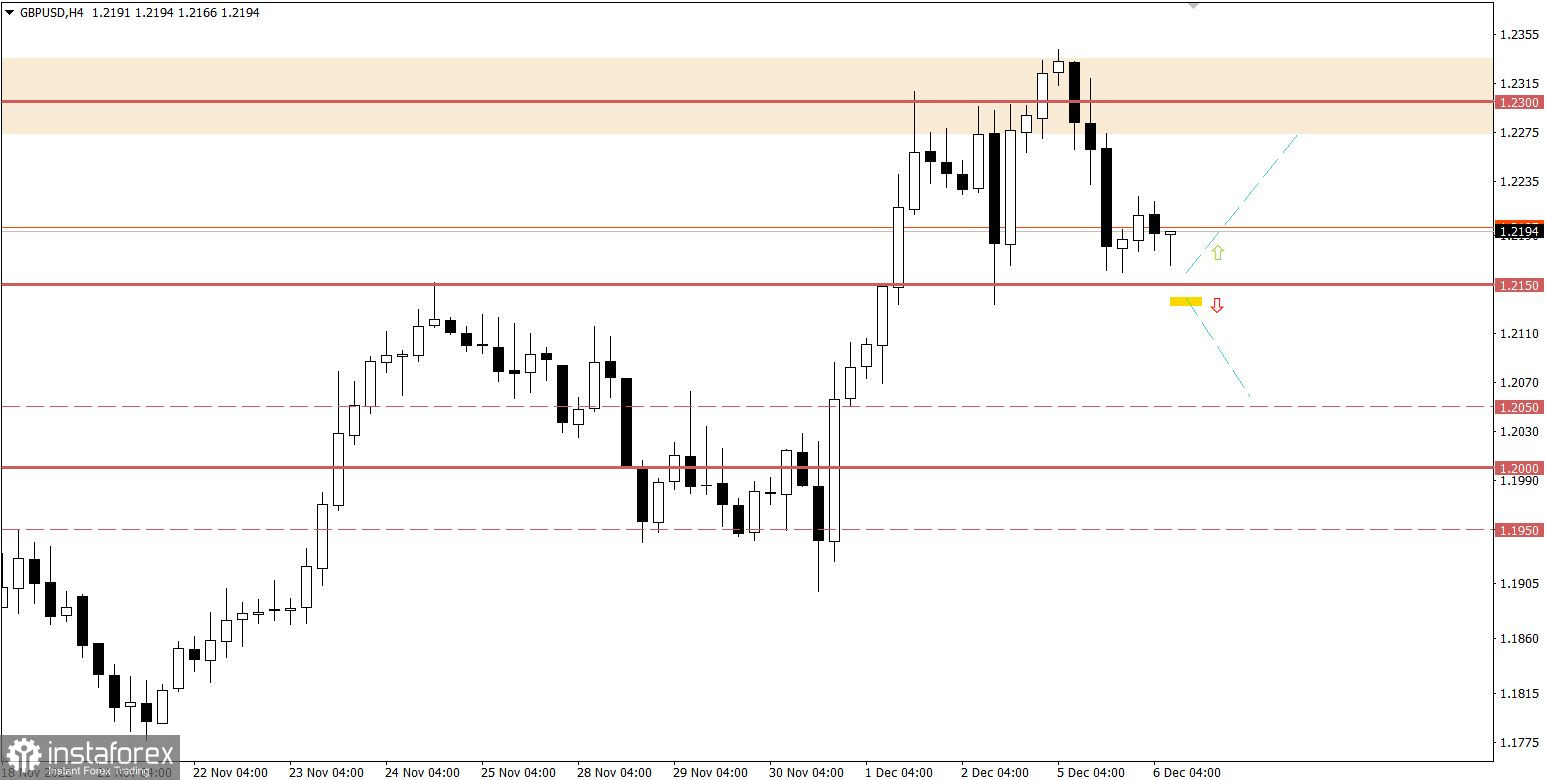

The GBP/USD pair failed to settle above 1.2300. Consequently, a reversal occurred, and the quote fell to 1.2150, in line with support. Notably, the analysis of the basket of major currencies shows that the greenback strengthened against all its counterparts during the North American session yesterday.

The GBP/USD pair resumed growth after a brief pause at 1.2300. As a result, a breakout through resistance took place, and the quote consolidated above the barrier.

Macroeconomic calendar on December 6th

The macroeconomic calendar is empty today, as no important releases are scheduled in the United Kingdom, the eurozone, and the United States.

In this light, investors and traders will be analyzing the news stream.

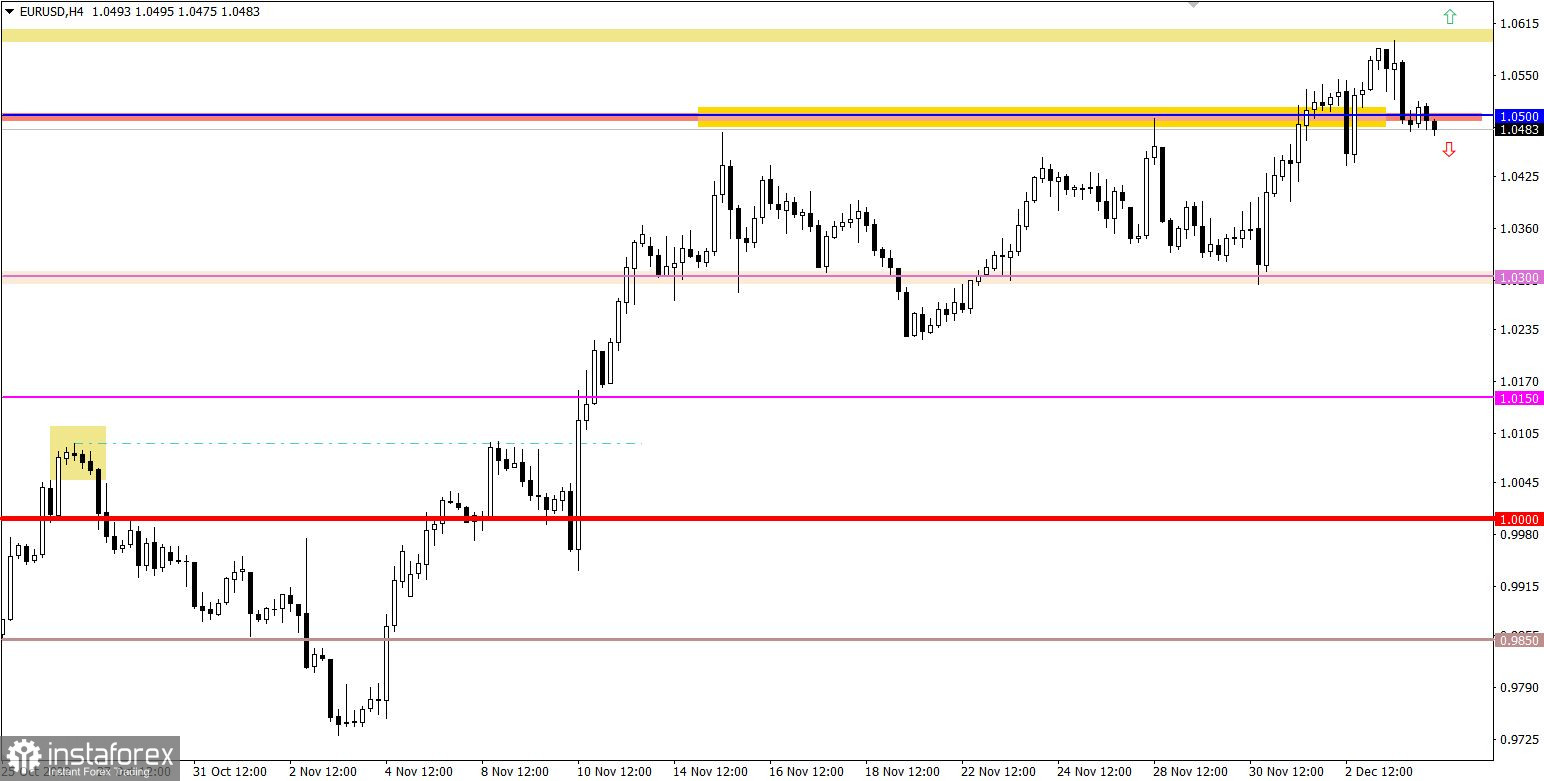

Trading plan for EUR/USD on December 6th

Prolonged consolidation below 1.0500 may trigger a full-fledged correction with the target at 1.0300.

If the pair goes up, the price should return at least above 1.0500. Consolidation above 1.0600 on the H4 chart will generate a buy signal.

Trading plan for GBP/USD on December 6th

A correction will be confirmed once the price settles below 1.2150 on the H4 chart. In this case, the pair may drop to 1.2000.

Alternatively, the price may increase after a rebound at 1.2150.

What's on technical charts

The candlestick chart shows graphical white and black rectangles with upward and downward lines. While conducting a detailed analysis of each individual candlestick, it is possible to notice its features intrinsic to a particular time frame: the opening price, the closing price, and the highest and lowest price.

Horizontal levels are price levels, in relation to which a stop or reversal of the price may occur. They are called support and resistance levels.

Circles and rectangles are highlighted examples where the price reversed in the course of its history. This color highlighting indicates horizontal lines which can exert pressure on prices in the future.

Upward/downward arrows signal a possible future price direction.