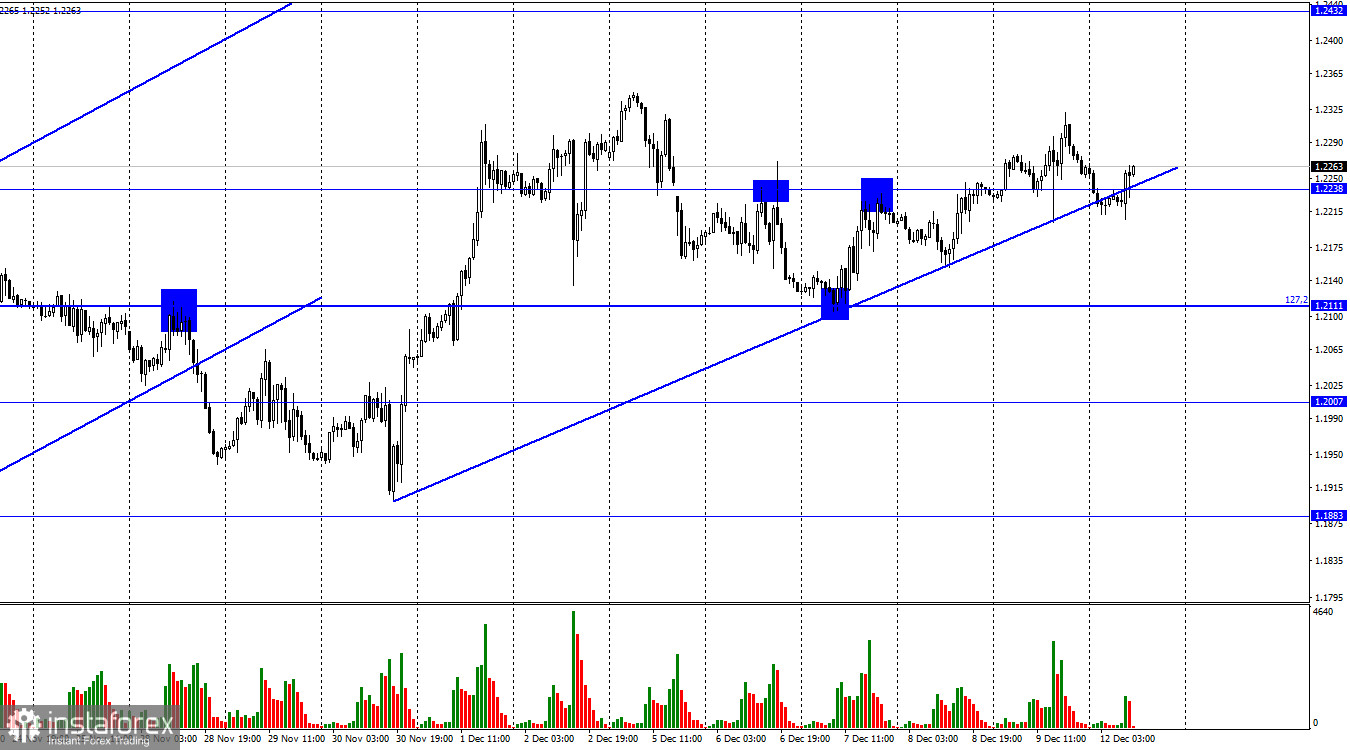

Hello, dear traders! On the 1-hour chart, GBP/USD consolidated above 1.2238, which allows traders to push the pair to 1.2342. Given that the new ascending line has already been broken, the pound may slide this week. Additional pressure on the pair comes from fundamental factors. Indeed, this is going to be quite a busy week. The Bank of England will announce its interest rate decision, and data on inflation and GDP in the UK will be delivered. Therefore, traders will have enough reasons for active trading, and the price trend remains to be seen.

Industrial production in the UK was unchanged in October (+0%), coming in line with market expectations. At the same time, a batch of GDP data revealed a 0.5% increase in the reading in October and a 0.3% fall in the three months, almost in line with the forecast.

On a yearly basis, the UK economy grew by 1.5%. All in all, GDP data came mixed. On the one hand, the results were in line with expectations. On the other hand, the reports were disappointing. Therefore, traders priced these figures just partially, and the sterling edged slightly higher.

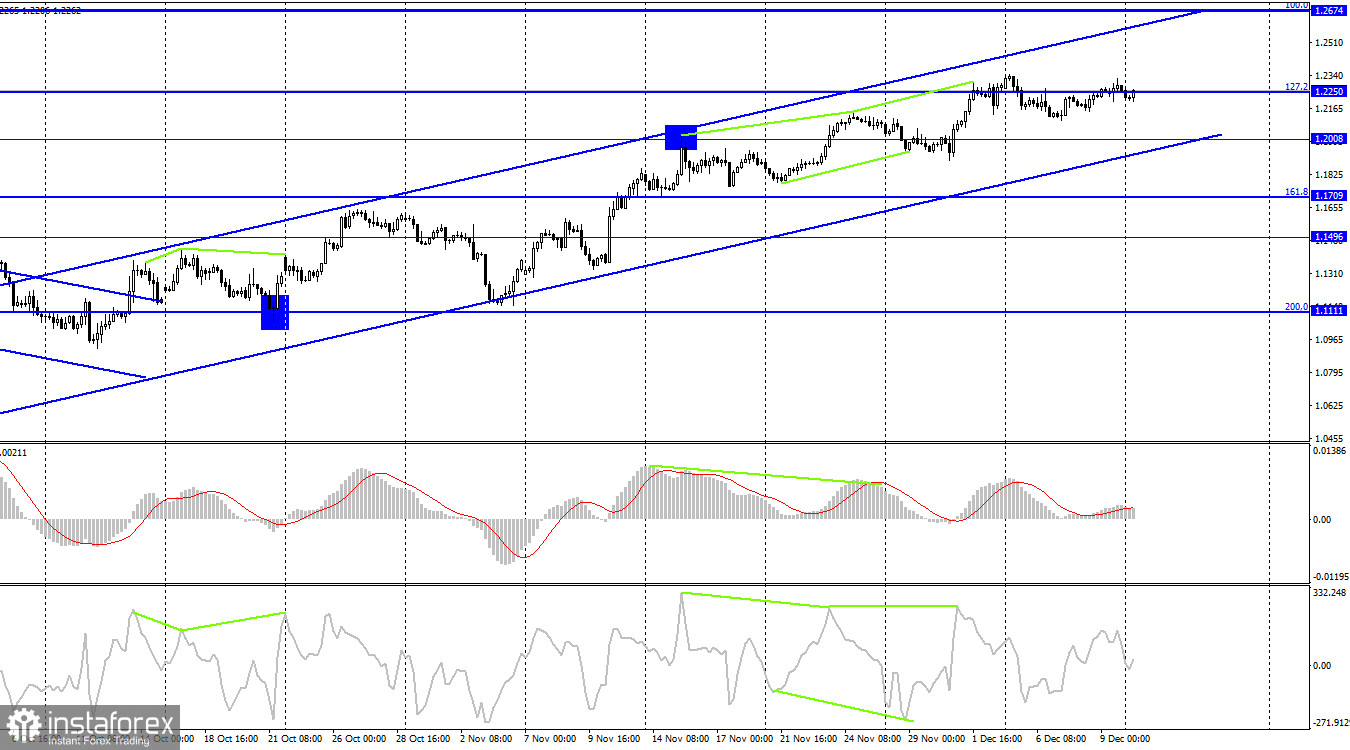

This week's events will have a significant influence on market sentiment. Therefore, the pound is more likely to fall this week than to rise. Nevertheless, the market used to show an unpredictable reaction to important events. Therefore, the pair is unlikely to fall steeply before it closes below the ascending corridor on the 4-hour chart.

On the 4-hour chart, the quote settled below the 127.2% retracement level of 1.2250, allowing traders to push the price down to 1.2008. The ascending corridor indicates a bullish bias. The pair may plunge once it closes below the corridor.

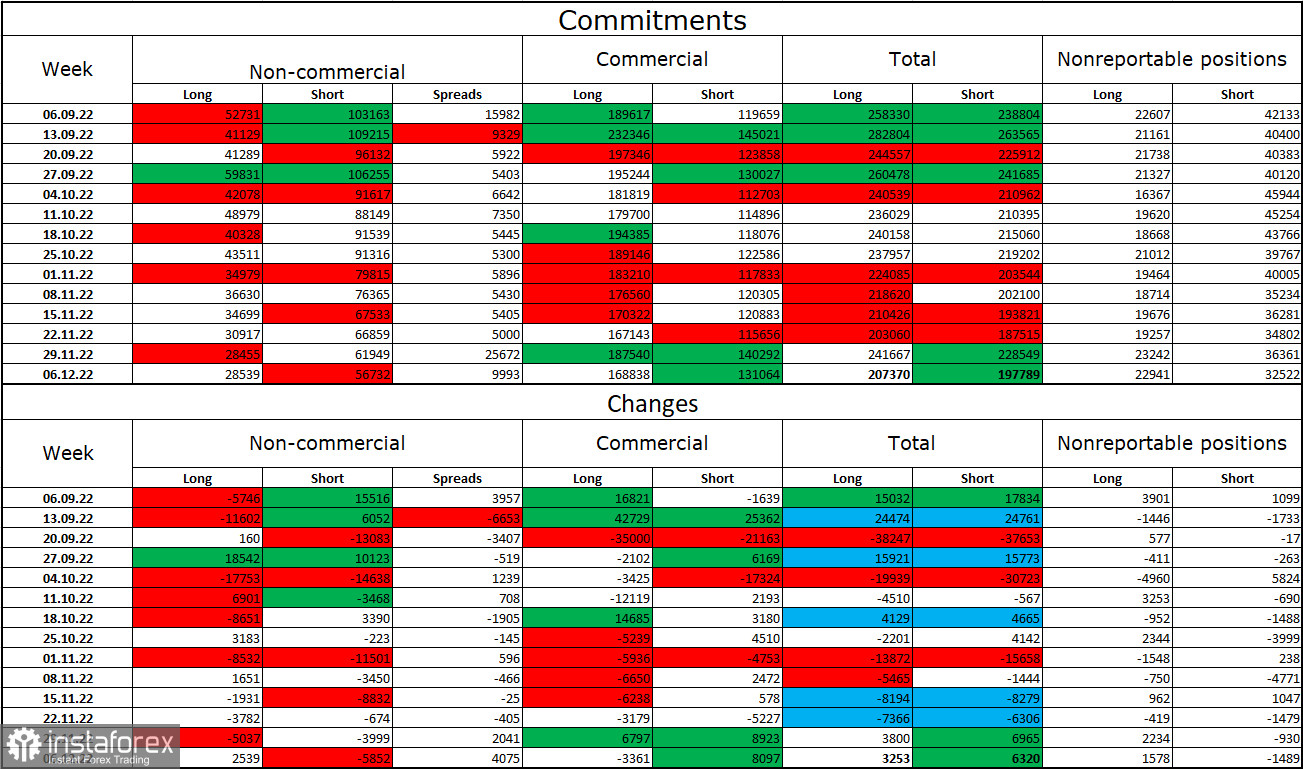

Commitments of Traders:

Bearish sentiment grew last week. Speculators opened 2,539 new long positions and closed 5,852 short positions. Overall, sentiment is still bearish with a wide gap between shorts and longs. Traders continue selling the pair although bullish sentiment has started to grow in recent months. Nevertheless, it is a long and slow process. It has lasted for several months now, but the number of shorts still twice exceeds that of longs. Growth may extend as technical analysis of the ascending corridor on the H4 chart shows. Still, there may arise factors that may shape the greenback's value. Anyway, we now see the long-awaited growth but it is hard to define with the help of COT reports. On the other hand, the net position is rising along with the pound.

Macroeconomic calendar:

United Kingdom: GDP data (07-00 UTC); Industrial Production (07-00 UTC).

No macro events are set to be released in the US today. Fundamental factors are unlikely to influence the market on Monday.

Outlook for GBP/USD:

It will become possible to open short positions at 1.2238 after a rebound on the H1 chart. The targets are seen at 1.2111 and 1.2007. These short positions could be held for now. Meanwhile, buying the pair currently seems risky.