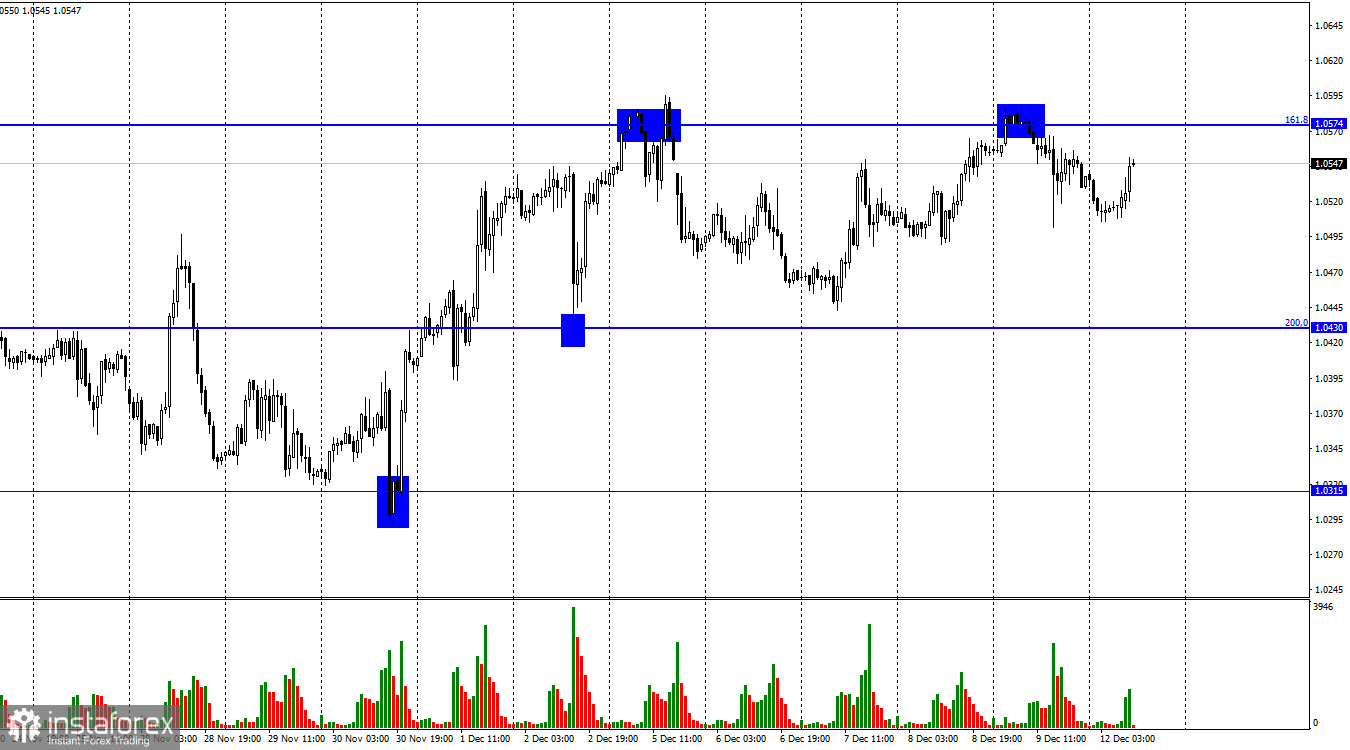

On Friday, EUR/USD advanced to the Fibonacci retracement level of 161.8% at 1.0574. Then it bounced off this level and reversed in favor of the US dollar. On Monday morning, the euro recovered and resumed its rise toward 1.0574. Another rebound will support the dollar and initiate a drop to the Fibonacci level of 200.0% at 1.0430. A close below 1.0574 will open the way to the higher target at 127.2% - 1.0705.

Last treading week ended without any changes. Trading activity was somehow subdued so the pair was moving slower than before. On the fundamental side, the producer price index declined to 7.4% on a yearly basis. I can't say that this data was surprising. Actually, the PPI is declining together with the headline inflation, which is quite natural. Nevertheless, this was the only report this day that caused a reaction in the market. In particular, traders began to buy USD but this trend did not last for long. Most likely, market participants are waiting for the ECB and the Fed meetings that are scheduled for this week.

The US dollar has been falling for some time already as traders avoid buying it. This week, the Fed is expected to announce a slowdown in its monetary tightening. Many analysts think that the ECB will do the same. Traders will especially focus on what Christine Lagarde and Jerome Powell will say at the press conference after the meetings. Against this backdrop, it could be hard to predict the trajectory of the pair on Thursday and Friday. The information background has a strong influence on the market this week so traders' reaction can be unpredictable. Today, nothing important is expected in the US or the EU but the pair may move actively anyway.

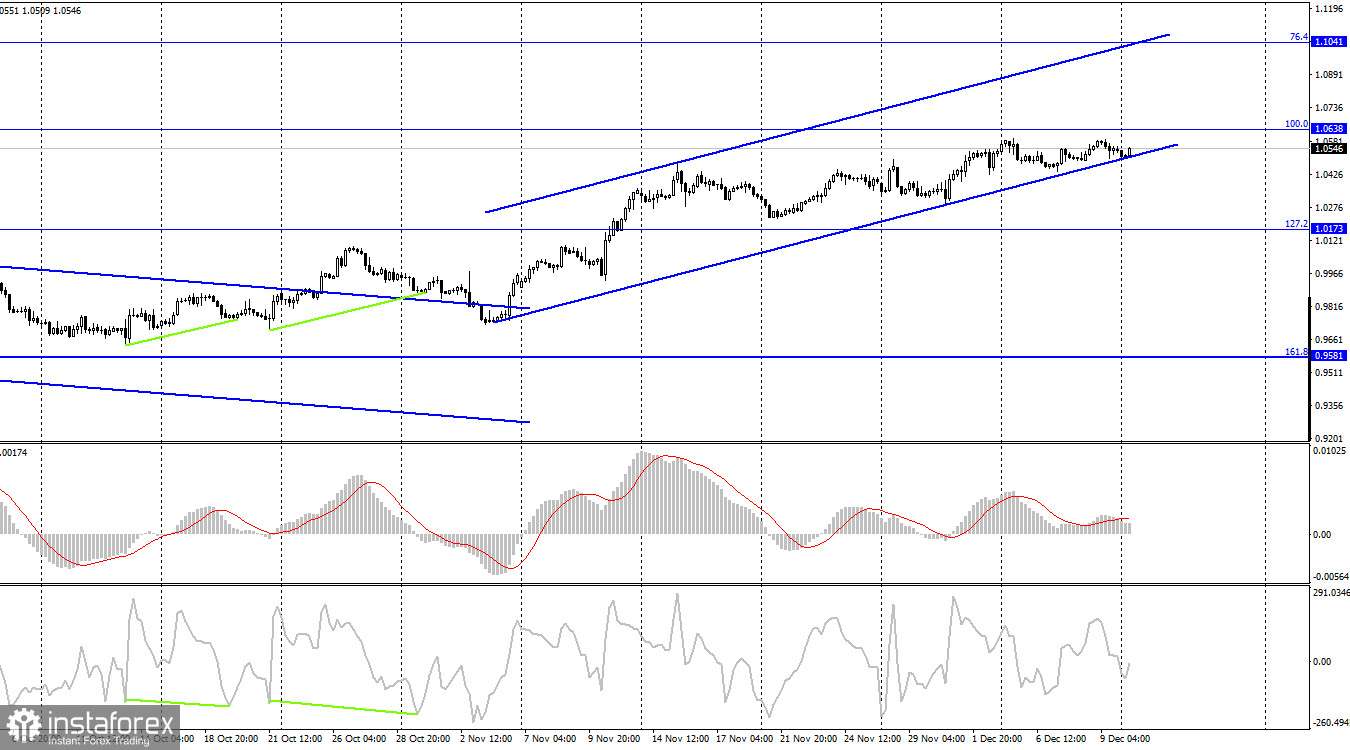

On the 4-hour chart, the pair continues to rise toward the Fibonacci retracement level of 100.0% at 1.0638. A rebound from this level will support the US dollar and send the pair lower to the Fibonacci level of 127.2% at 1.0173. Consolidation above 1.0638 will open the way to the next upward target at 1.1041. The ascending trend channel reflects the bullish sentiment of the market.

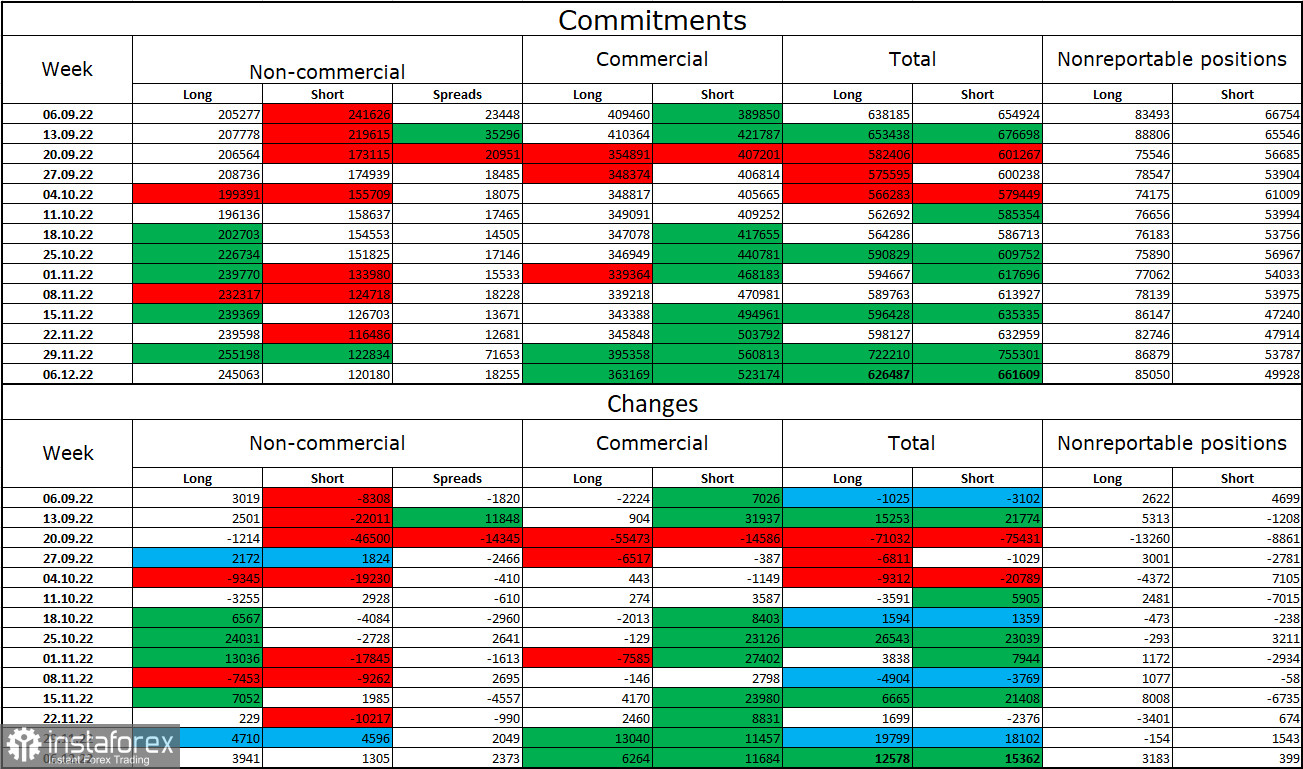

Commitments of Traders (COT) report:

Last week, traders opened 3,941 long contracts and 1,305 short contracts which is not that much. Large market players are getting more bullish on the pair. The number of opened long positions stands at 245,000 while the number of short positions is 120,000. The European currency is gaining ground according to the COT report. The number of long positions is twice as high as the short ones. In recent weeks, chances were getting higher for the euro to develop a proper uptrend. Now there is a risk that EUR has been overbought. After a prolonged decline, the euro has finally seen some improvement, and its prospects remain positive. The quote managed to break above the descending channel on the 4-hour chart. Therefore, the euro may continue to advance against the dollar in the long term.

Economic calendar for US and EU:

On December 12, economic calendars in both countries are empty. Therefore, the influence of the information background on the market will be zero today.

EUR/USD forecast and trading tips

I recommended selling the pair after a rebound from 1.0574 on the H1 chart with the target at 1.0430. This level has been tested. You can add more short positions when the price bounces off the 1.0638 level on the 4-chart. It is advisable to buy the euro when the price rebounds from the level of 1.0430 on the 1-hour chart with the target at 1.0574.