On Tuesday, the publication of the US inflation figures is the main event of the day. Analysts suppose that the report may spur considerable fluctuations of the US dollar. A further direction of the greenback is the main question at the moment.

Early today, the US dollar is likely to remain stable against its main rivals since traders are waiting for the data on the US consumer prices for November.

A month ago, a report for October surprised traders by showing an unexpected drop in inflation. This caused a wave of speculations about a slower key interest rate hike by the Fed. This, in turn, led to a massive sell-off of the greenback.

A day before the publication of the data for November, bulls were trying to remain positive despite the fact that forecasts for inflation were updated.

Now, economists suppose that on a yearly basis, the consumer price index may decline to 7.3% amid a noticeable decrease in oil prices. The previous estimate unveiled a decline to 7.7%, whereas core inflation should have dropped to 6.1% from 6.3%.

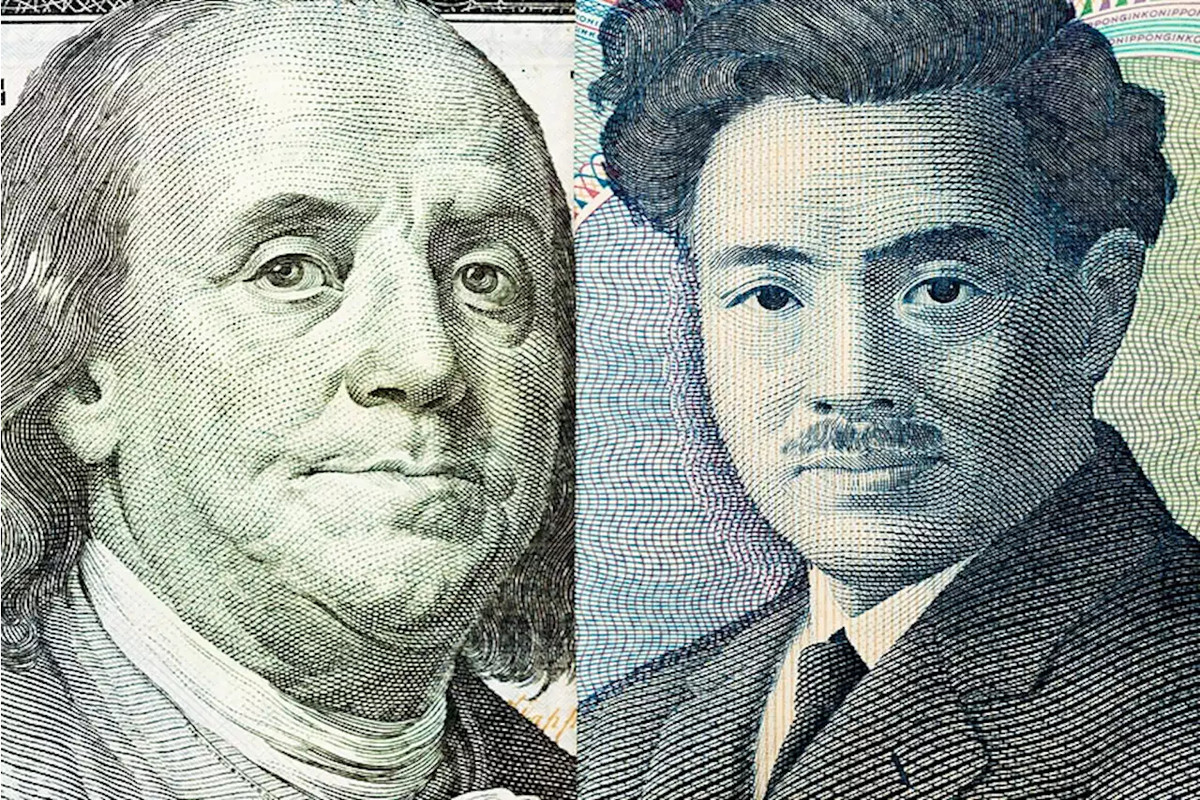

In fact, such a scenario should have had a negative effect on the US dollar. However, the greenback remains stable. It looks quite strong and is showing a better dynamic in the pair with the yen ahead of the inflation report.

On Tuesday, the dollar/yen pair increased by 0.8% to the 2-weekly high of 137.62. The rise could be explained by a breakout of the downward resistance line recorded 3 weeks ago.

At the moment, from the technical point of view, the market conditions are favoring buyers. The bullish sentiment is supported by signals from the MACD and RSI indicators, which did not enter the overbought area.

If today, bulls manage to surpass the resistance level of 138.70, the pair will jump to the levels of 139.90 and 142.25 recorded at the end of November.

Traders who are betting on the rise in the US dollar should get a confirmed fundamental impulse. Stronger data on the US inflation may act as a driver of the greenback.

If the CPI drops less than expected, remains unchanged, or increases, the US dollar may also jump.

Stably high inflation is the key reason for the Fed to continue its aggressive monetary policy tightening. Now, investors expect the US regulator to raise the benchmark rate by 50 basis points and announce a plan for its future actions.

If today's report turns out to be strong, the Fed may drop a hint about a higher target level of interest rates. This should boost the greenback even more, especially against the yen.

The fact that the difference between the interest rates of the US and Japan continues to rise will exert significant pressure on the yen.

However, some analysts foresee an alternative scenario, according to which the yen may jump, thus pushing the greenback significantly lower.

If today's report unveils a decline in US inflation, the US dollar is likely to fall against all other currencies.

From the technical point of view, sellers of the dollar/yen pair may get support from the convergence of the Fibonacci 61.8% correctional level and the 7-week downward resistance line of 1.138.70 formed at the end of October.

If the quote slides below 123.25, bears will strive to reach a new monthly low, which now is located at 133.60.