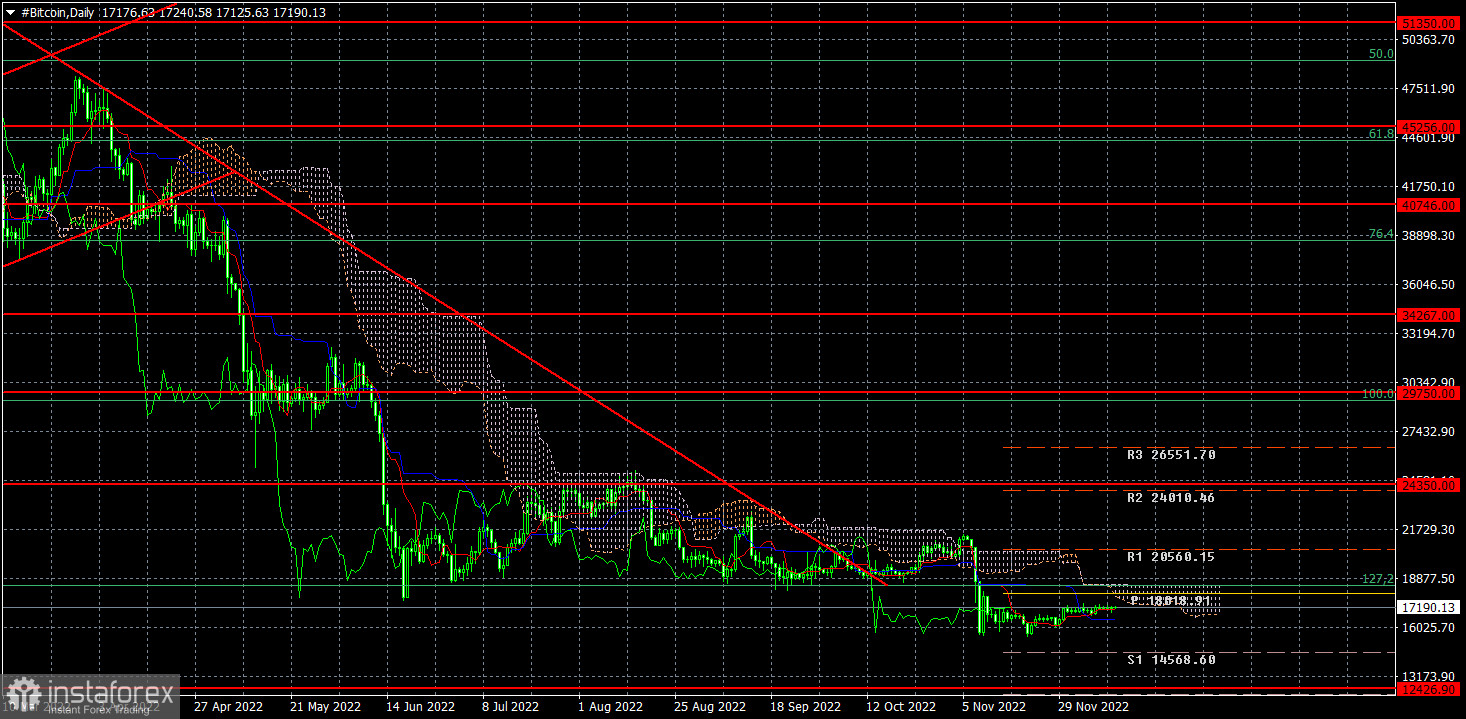

Bitcoin has consolidated below the Fibonacci level of 127.2% ($18,500) and has not yet made a single attempt to climb back above it after several weeks. Over the past few months it has been clear that the downtrend is not over yet. It can persist indefinitely until the cryptocurrency falls to its all-time lows at $1,000 – $5,000. Of course, theoretically, Bitcoin could fall even lower. It can decline to the level of $10,000 and then start to form a new bullish trend. But everything we have seen lately can be described in one word – exodus. Investors are fleeing all together, while the market is crashing down.

The entire crypto market is not just going through a crypto winter. It is experiencing perhaps the worst period in its history. Any cryptocurrency or digital asset is worth nothing by itself. It is just a piece of code that has no practical application. People could likewise declare some plant to be an investment, start drying its leaves and opening farms, and so on. By itself, Bitcoin is worth nothing, so it can fall as low as possible.

Furthermore, central banks around the world keep raising interest rates and reducing their balance sheets, which clearly does not benefit risky assets, such as equities. The US stock market has been in a downtrend for about a year, leaving few chances for BTC. Stocks represent specific companies that produce goods, provide services, generate earnings, and own very specific assets that may not be worth anything on their own. In addition, no central bank would ever want to have a form of money on its territory that is not under its control. Therefore, BTC is at best undesirable for central banks. From time to time, investors decide to invest in cryptocurrencies, driven only by the desire for making massive gains in a short period of time. However, no one wants to invest into BTC when it falls below its mining costs. Even at its current seemingly attractive levels, few investors are willing to return into the crypto market. Several bankruptcies of crypto exchanges have only increased distrust of the entire industry.

In the daily time frame, BTC finally made a successful attempt to overcome $18,500. Now, from our perspective, it can continue to slide down towards $12,426. As warned earlier, just because BTC surpassed the descending trendline does not mean the downtrend is over because the price was moving sideways at the same time. Now, Bitcoin has broken through the lower trend line of the price channel, so it may continue to decline.