Tensions over what signals the Fed will show are rising due to a recent article that said officials are divided on how long rates should increase. According to the note, some expect a steady decline in inflation in the coming months, so the rate hike should be stopped as soon as possible. Others, however, fear that inflation will not fall adequately next year, so they call for rates to be raised further, or at least held high longer.

The US inflation report for November will be published today, but so far businesses are not yet seeing any threats of higher inflation. In fact, yields on 5-year TIPS bonds have been falling since March 2022.

Another increase in inflation will cause another uncertainty to the economy, which will ramp up demand for dollar, while reducing risk appetite.

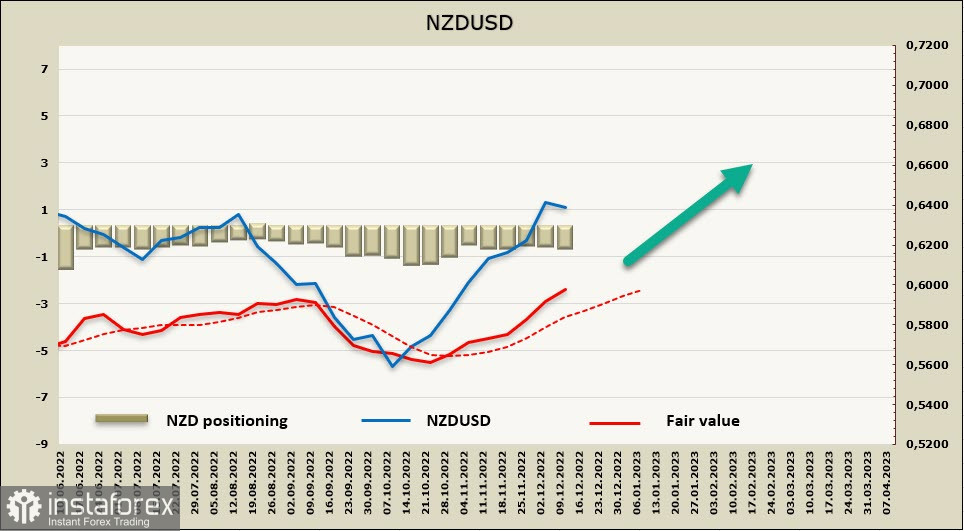

NZD/USD

A further rise in government spending is likely to increase the risk of tougher policy in New Zealand. This means that interest rates could be raised above forecast, which the RBNZ estimates is at 5.5%, while the ANZ bank sees 5.75%. If that happens, the country will fall into recession much faster than expected, but bond yields will be higher, which would strengthen expectations of a yield spread.

Positioning on NZD continues to be bearish, but the performance is still minimal and close to neutral. Net short positions increased by 97m to -411m during the week, however, the estimated price shows no intention to turn downwards yet, which means that the direction of capital flows is more inclined to a rise.

NZD/USD is trading in a narrow range, near the resistance level of 0.6460/80. Bulls do not have enough strength to trigger a breakout, but it could hit 0.6240/50 as long as the Fed shows a more hawkish view on its monetary policy.

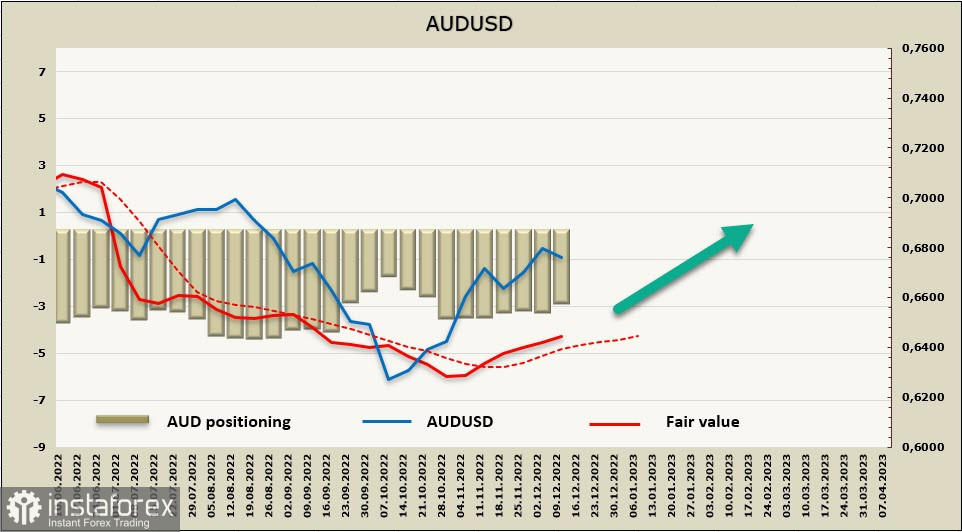

AUD/USD

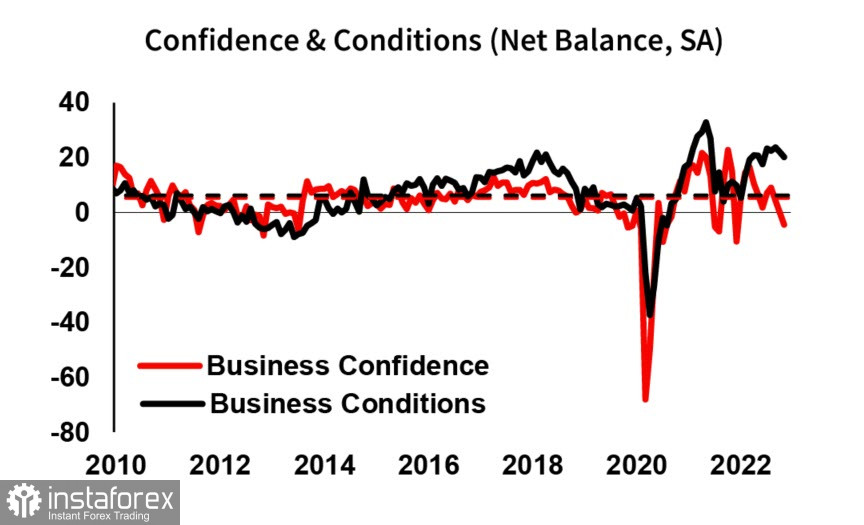

Business confidence turned negative in November, falling below zero for the first time since November 2021. Fortunately, conditions remained fairly high at +20p.

But with activity persisting, there is little sign of any reversal in inflation. Cost growth remained largely unchanged at elevated levels on both the labor and input costs, while retail prices continued to rise at a rapid pace. Overall, there is growing concern that the strength of the economy will converge in 2023.

This indicates that companies are becoming increasingly pessimistic due to the slowdown in global economy, weaker consumption, rising inflation and higher rates that are lowering real household incomes.

That is why it was not a surprise that net short positions in AUD declined by 272 million to -2.713 billion during the week. Bearish performance persists, but the medium-term trend is in AUD's favor. The settlement price is above the long-term average, pointing upwards, which suggests that attempts to go higher will continue.

Even so, AUD has shown the weakest momentum among the G10 currencies over the past week due to both volatility in the Fed's monetary policy outlook and growing worries over whether China is willing to cut their restrictions. Hitting 0.6880 and 0.6910/30 are possible, but only if the Fed gives hawkish signals on Wednesday evening. The strength of AUD is also not enough for a sustained rise.