Markets rallied on Monday ahead of the release of US consumer inflation data and the Fed's monetary policy decision for December. Analysts said CPI is likely to fall to 7.3% y/y, while rise 0.3% m/m. This will certainly affect the Fed's decision on rates and the future course of monetary policy.

But if the figures show values no higher or lower than expected, or at least show a simple decline compared to the previous ones, a rally will begin in equity markets, accompanied by a weakening dollar and lower treasury yields.

Nevertheless, the point is that inflation is the biggest problem in the US as far as macroeconomic indicators are concerned because everything else, for example GDP and unemployment, remains in pretty good shape for now. The prolonged cycle of interest rate hikes will definitely damage the economy, which the authorities do not want as next year is a pre-election year. This means that there is a high chance that with all the harsh rhetoric of Fed members regarding the need to push inflation to 2%, the central bank may make some adjustments, but only under the conditions of a gradual, albeit lower, inflation. The Fed may also give a forward-looking assessment of the national economy.

Forecasts for today:

EUR/USD

The pair is trading below the resistance level of 1.0585. If inflation eases in the US, market players could push the quote to 1.0685.

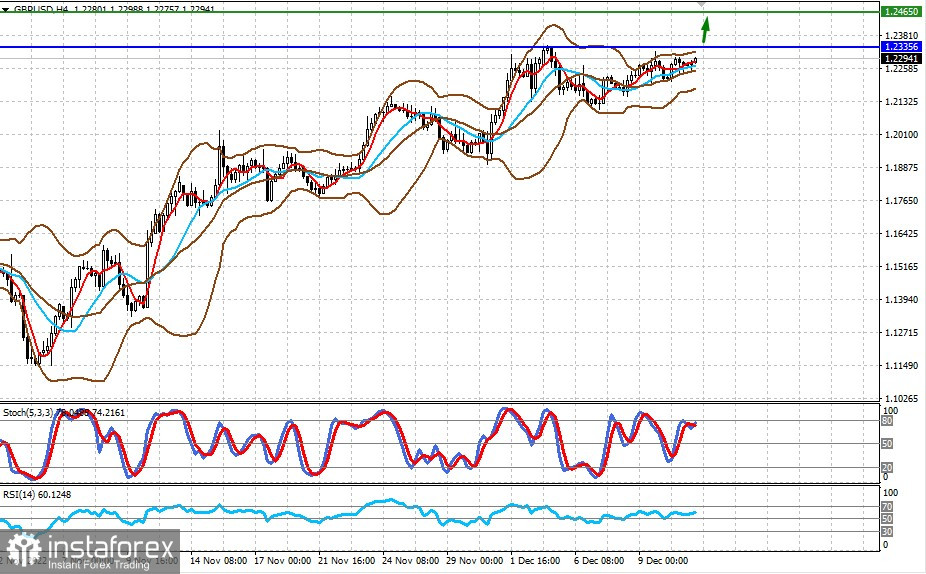

GBP/USD

The pair is trading below the resistance level of 1.0585. If inflation eases in the US, market players could push the quote to 1.0685.