Details of economic calendar on December 12

US producer prices eased the annual rate to 5.9% from 6.8%. This is a good omen for a further decline in US consumer inflation. This fact indicates the odds that the Federal Reserve will be poised to moderate the pace of further rate hikes.

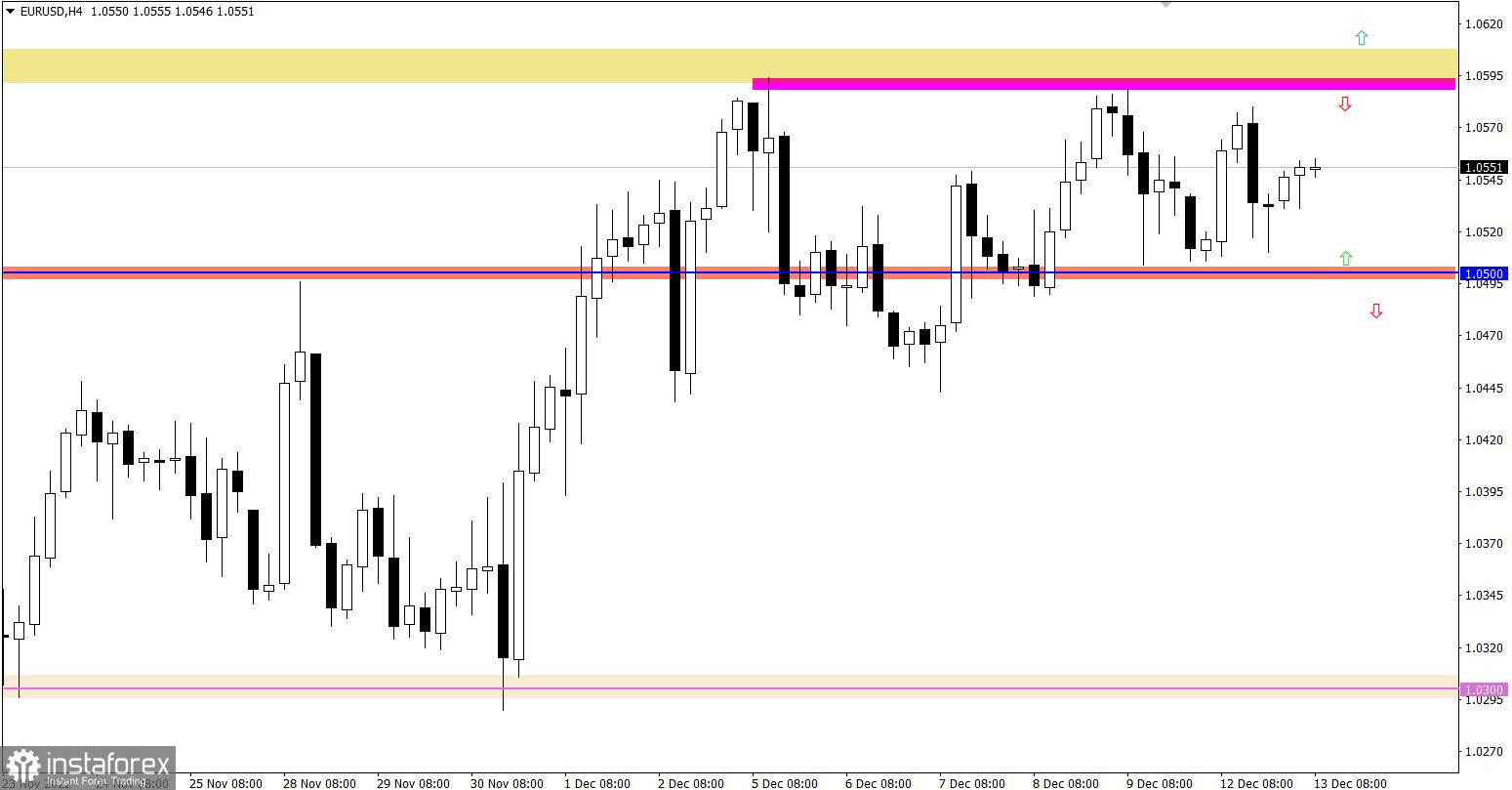

Overview of technical charts from December 12

EUR/USD has been oscillating within a trading range between 1.0500 and 1.0600 where the upper border has been shifted 15 pips up. The sideways market means that the instrument has been accumulating trading forces. In the end, the price may shoot up and gain bullish momentum.

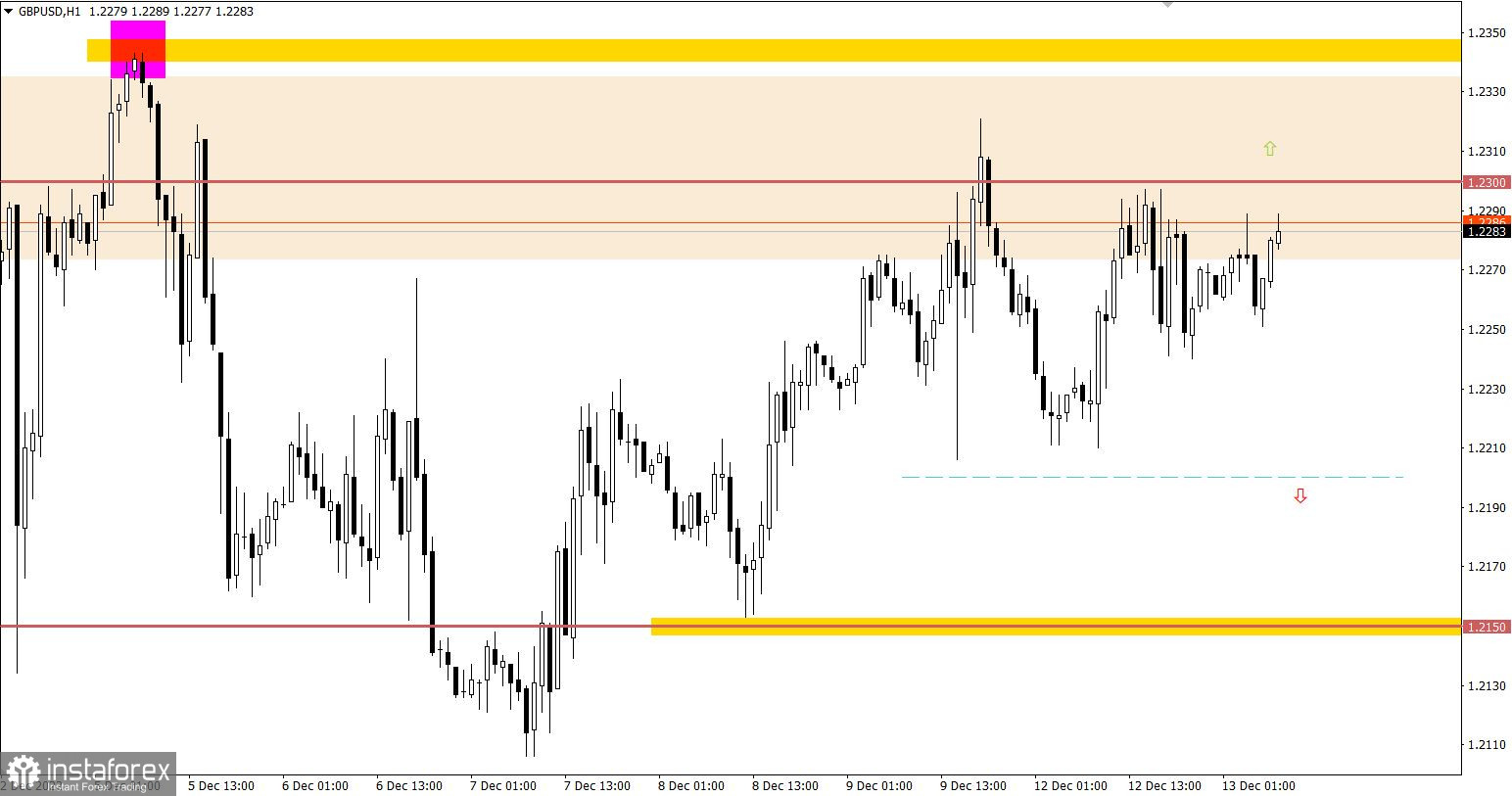

GBP/USD has been also trading in a range between 1.2200 and 1.2300 with moderate activity. In fact, such fluctuations prove the sideways market which eventually could trigger robust price swings and provide speculative opportunities.

Economic calendar on December 13

During the European session, market participants got to know the data on the US labor market. The unemployment rate showed an uptick to 3.7% from 3.6%. However, the number of employed Britons increased by 27,000 in October, contrary to expectations for a decline of 17,000.

All in all, the metrics on the labor market are not as dismal as in the consensus. Thus, the pound sterling perked up.

During the North American session, US inflation data will be on investors' radars. The US CPI could have logged a downtick to 7.6% from 7.7% on year. This data will certainly provide a clue to the Fed's further policy moves in terms of rate hikes.

The evidence of easing inflationary pressure in the US might trigger a sell-off of the US dollar.

The US CPI is on tap at 13:30 GMT

Trading plan for EUR/USD on December 13

Under such market conditions, traders still stick to the same strategies: sideways trading strategy and breakthrough strategy.

In the case of the breakthrough strategy, the upward scenario may come into play if the price settles above 1.0600 on the 4-hour chart. The downward scenario will be relevant in case the price settles below 1.0480 on the 4-hour chart.

Trading plan for GBP/USD on December 13

As the currency pair has been locked in the range-bound market, neither buyers nor sellers are able to hold the upper hand. From the point of technical analysis, traders should wait until the price goes beyond any of the borders and settles there on the 4-hour timeframe. This price action will indicate a further direction.

To sum everything up, the upward scenario will be considered by traders in case the price settles above 1.2300 on the 4-hour chart. This move will assure traders to increase long positions which, in turn, will reinforce the buyers' odds to update a local high of the upward cycle.

The downward scenario will be valid in case the price settles below 1.2200 on the 4-hour timeframe. This will open the door for a fall of at least to 1.2150.

What's on the charts

The candlestick chart type is white and black graphic rectangles with lines above and below. With a detailed analysis of each individual candle, you can see its characteristics relative to a particular time frame: the opening price, closing price, intraday high and low.

Horizontal levels are price coordinates, relative to which a price may stop or reverse its trajectory. In the market, these levels are called support and resistance.

Circles and rectangles are highlighted examples where the price reversed in history. This color highlighting indicates horizontal lines that may put pressure on the asset's price in the future.

The up/down arrows are landmarks of the possible price direction in the future.