Futures for US stock indices increased amid expectations that the world's largest economy will experience its lowest level of inflation this year, allowing the Federal Reserve to adopt a less hawkish stance.

Following a fairly rapid increase in stock prices during Monday's regular session, futures contracts for the S&P 500 and Nasdaq 100 increased by at least 0.3%. Shares of energy and technology companies also contributed to the European Stoxx 600 index's growth. US bonds are dynamically weak.

US stock indices increased on Monday during regular trading after traders abruptly concluded that the US consumer price index would only grow by 7.3% annually in November. If these predictions come true, it will be the index's fifth consecutive decline and its lowest value in 11 months. And while this will still leave inflation well above the Fed's 2% target, the projected movement of half a point at tomorrow's open market committee meeting may justify a slowdown in the pace of monetary policy tightening.

The US consumer price index data from today will also give us a sense of how the Federal Reserve System will proceed and where the markets can still find the interest rate floor, which is currently expected to be in the range of 4.75%-5.00%. However, it must be understood that even if the consumer price index report is excellent today and the market is doing well, tomorrow's Fed decision and Jerome Powell's remarks could cause everything to change. For this reason, even though the market ought to be fairly jarred, I wouldn't bet particularly on a strong bullish rally.

As traders continue to speculate about the European Central Bank's interest rate decision, the European stock index Stoxx 600 reversed some minor losses from the previous day. It is anticipated that policymakers will follow the Fed's lead and raise interest rates by half a percentage point.

The Bank of England will be forced to raise interest rates in response to high inflation just as the economy's prospects deteriorate, which is not the best news for the central bank. The data released today also revealed that wages in the UK have increased to their annual maximum and are rising at a record rate.

West Texas Intermediate futures rose above $74 per barrel as crude oil prices increased.

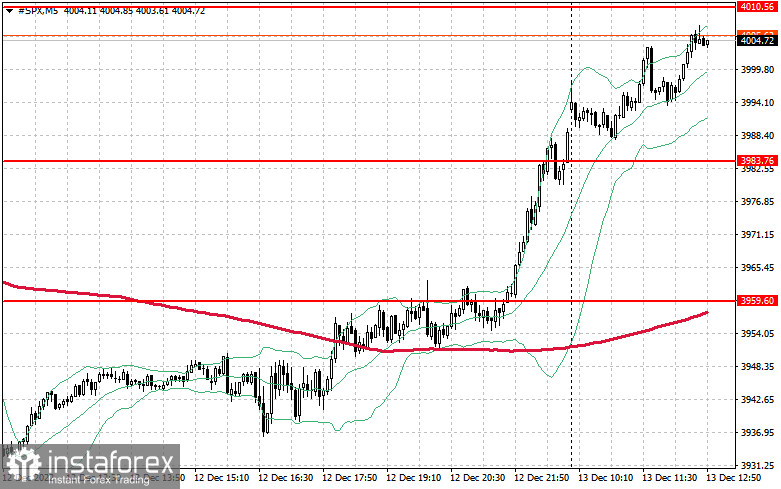

Regarding the S&P 500's technical picture, the index is still growing, which could end abruptly. Today, securing $3,983 will be of utmost importance. We anticipate continued growth as long as trading is done above this range. Additionally, this establishes favorable conditions for boosting the trading instrument to $4,010, potentially reaching $4,038. Although $4,064 is a little higher, surpassing it before the Fed meeting will be very challenging. Buyers have to declare themselves in the vicinity of $3,983 in the event of a downward movement, as pressure on the index will increase below this level. The trading instrument will move to $3,959 if this range is broken, with the $3,923 region serving as the farthest target.