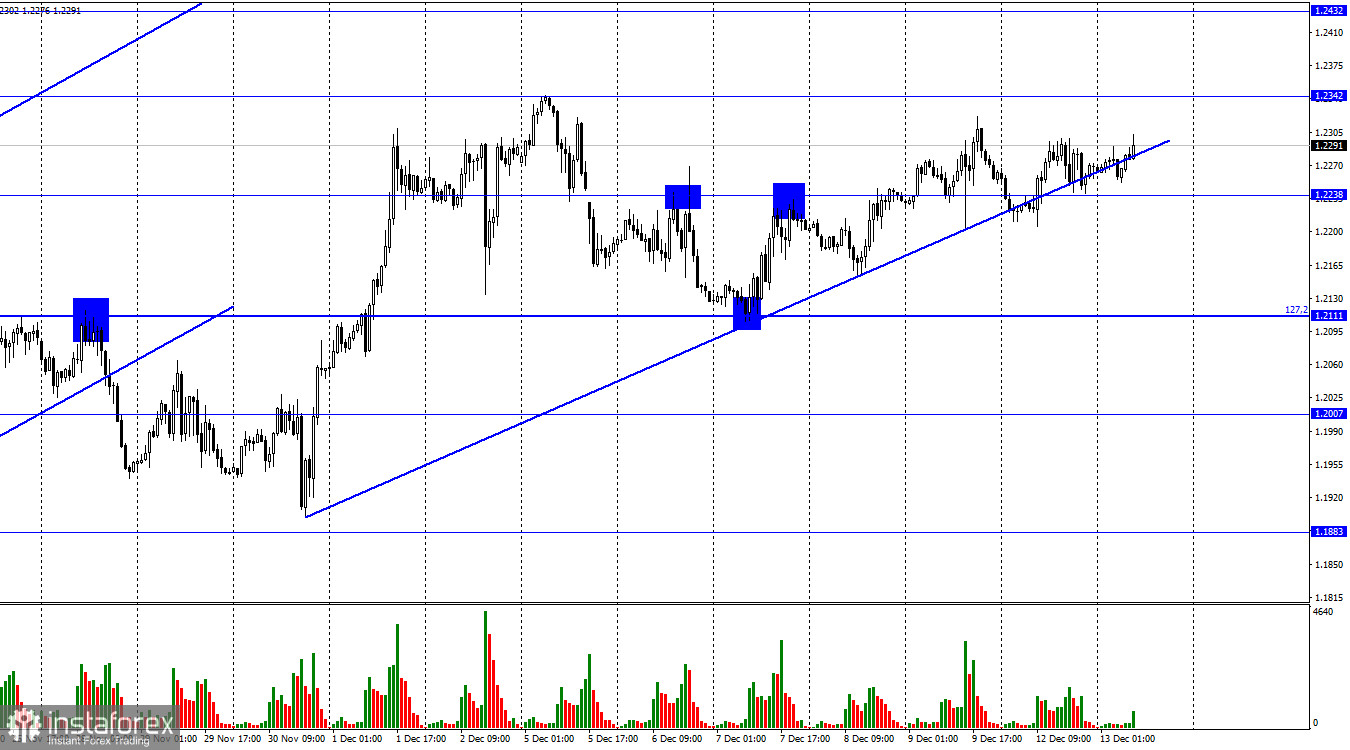

Hello, dear traders! According to the hourly chart, the GBP/USD pair closed above the 1.2238 level, signaling further gains. However, the British pound began trading sideways. Thus, price consolidation above 1.2238 as well as fixation below it does not make a big difference.

Like yesterday, today's macroeconomic calendar was full of important releases from the UK. However, it did not have a severe impact on market sentiment. After all, both the euro and the pound sterling moved almost in the same way. Yesterday, Britain reported data on GDP and industrial production, and today - on unemployment and wages. These releases are rather important, but the market showed no reaction to them. GDP rose in October in line with expectations. Industrial production remained unchanged as expected. The unemployment rate increased to 3.7% from 3.6%. Average earnings were 6.1% higher, again meeting analysts' forecasts. It turns out that two of the four reports were not impressive, one of them was a bit worse than expected, and the other was a little better than predicted. In total, statistics can be considered neutral, since there were no strong deviations from market expectations.

Today, the US is set to release data on inflation. This report is much more likely to affect investor sentiment than statistics from the UK. The next important events will be the meetings of the Fed (the situation is almost clear except for Powell's rhetoric) and the Bank of England (the situation is not yet clear). These events are expected to have a strong impact on traders and the British pound's dynamic. At the beginning of the week, trading activity was a bit sluggish.

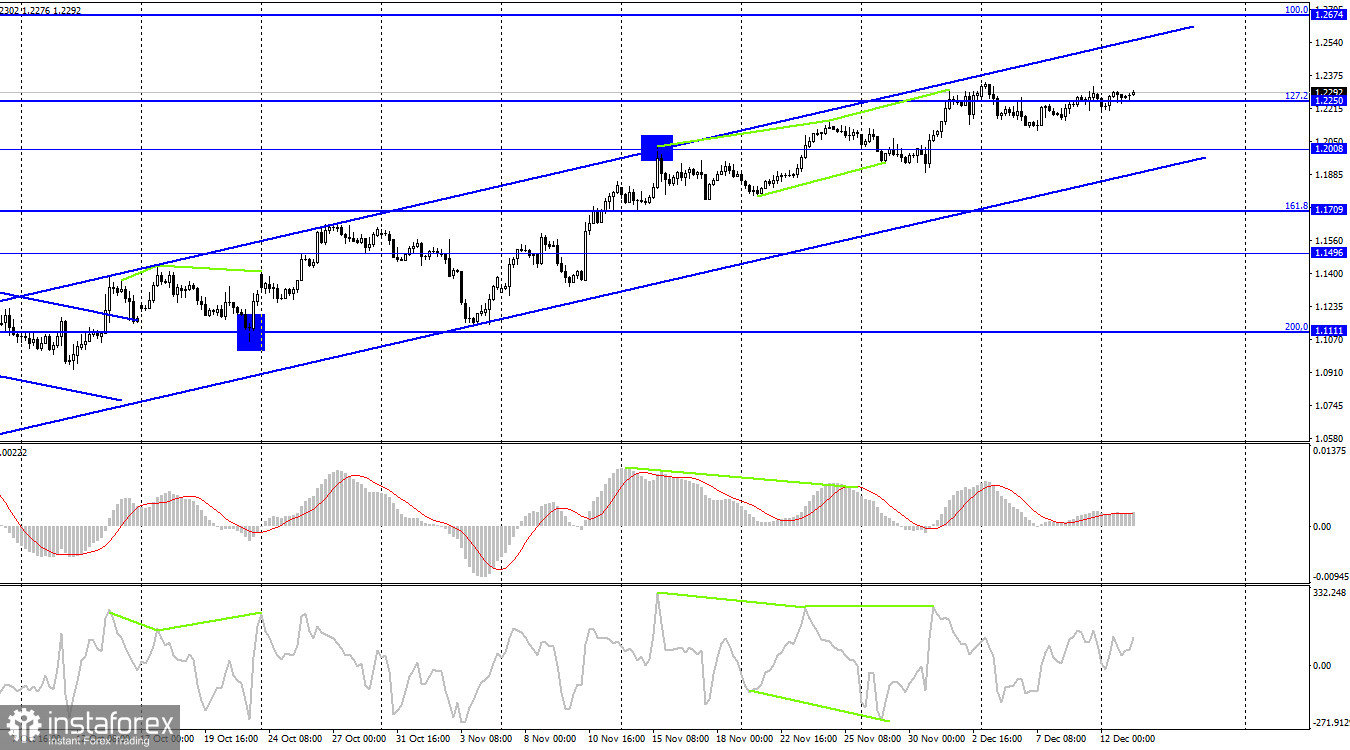

According to the 4-hour chart, the GBP/USD pair has settled above 1.2250, the 127.2% Fibonacci retracement level. However, given the current sideways movement on the 1-hour chart, this means little now. The ascending channel indicates bullish sentiment among traders. So I do not expect a strong drop in the value of the British pound.

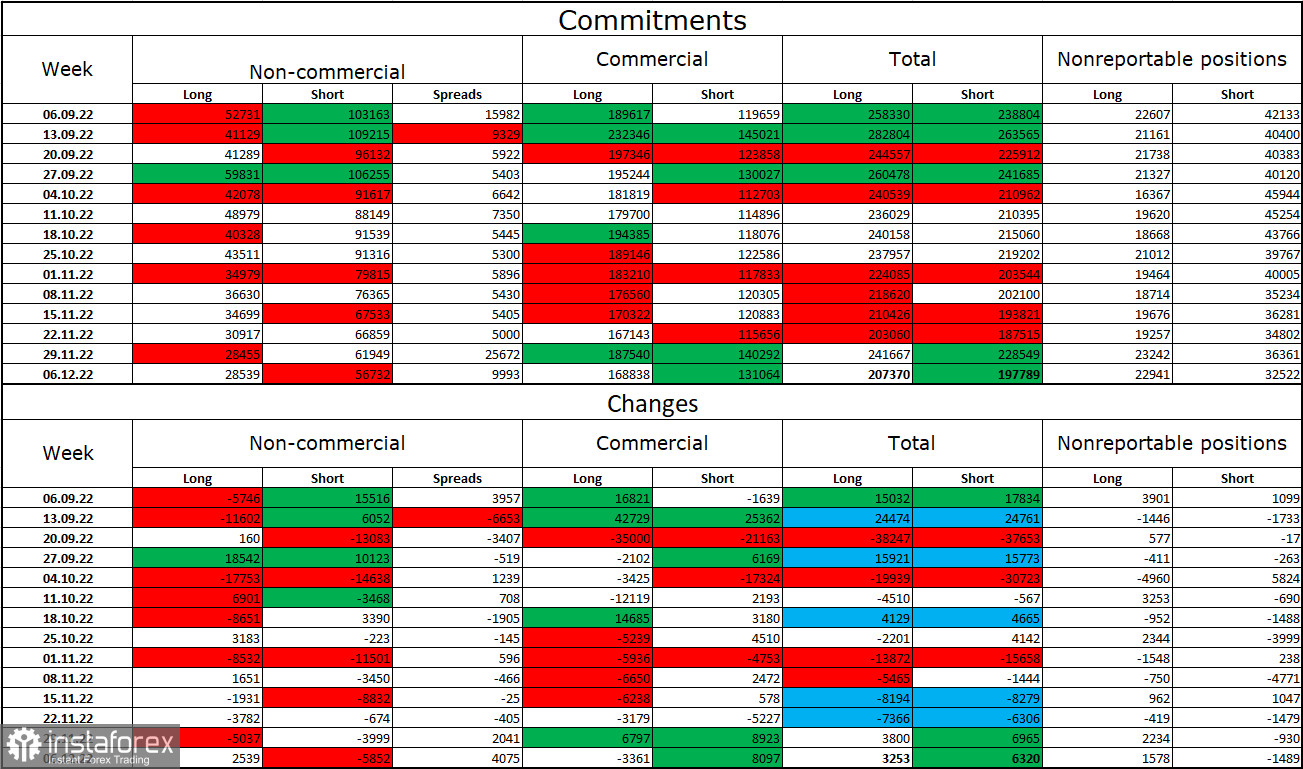

Commitments of Traders (COT) report:

Over the past week, the mood of non-commercial traders became less bearish than a week earlier. The number of long contracts increased by 2,539, while the number of short contracts decreased by 5,852. Nevertheless, the general mood of big market players remains bearish. The number of short contracts is still higher than that of long contracts. Thus, the majority of major traders continue to keep their short positions in the pound sterling open. Investor sentiment has been gradually changing to bullish in recent months, but this process is too slow and prolonged. It has been going on for a few months now, but the number of short contracts is still twice as high. According to technical analysis, in particular, given the trend channel on the 4-hour chart, the British pound is likely to extend gains. However, fundamental analysis shows that the situation is uncertain. There are also conditions for a stronger dollar, or they may appear as early as this week. Nevertheless, the pair is currently gaining value, but this rally seems a bit contrary to the COT reports. On the other hand, the net position of professional players is growing along with the pound sterling.

News releases from US and UK:

UK - Unemployment rate

UK - Average earnings

US - Consumer Price Index (CPI)

On Tuesday, the macroeconomic calendar includes important data on US inflation, while all reports from the UK have already been released. Today's statistics may have a severe impact on market sentiment.

GBP/USD forecast and trading tips:

I recommend going short on the British pound with a view to reaching the target levels of 1.2238 and 1.21111 in case of a rebound from the level of 1.2342 on the 1-hour chart. In my view, long positions in the pound sterling are risky.