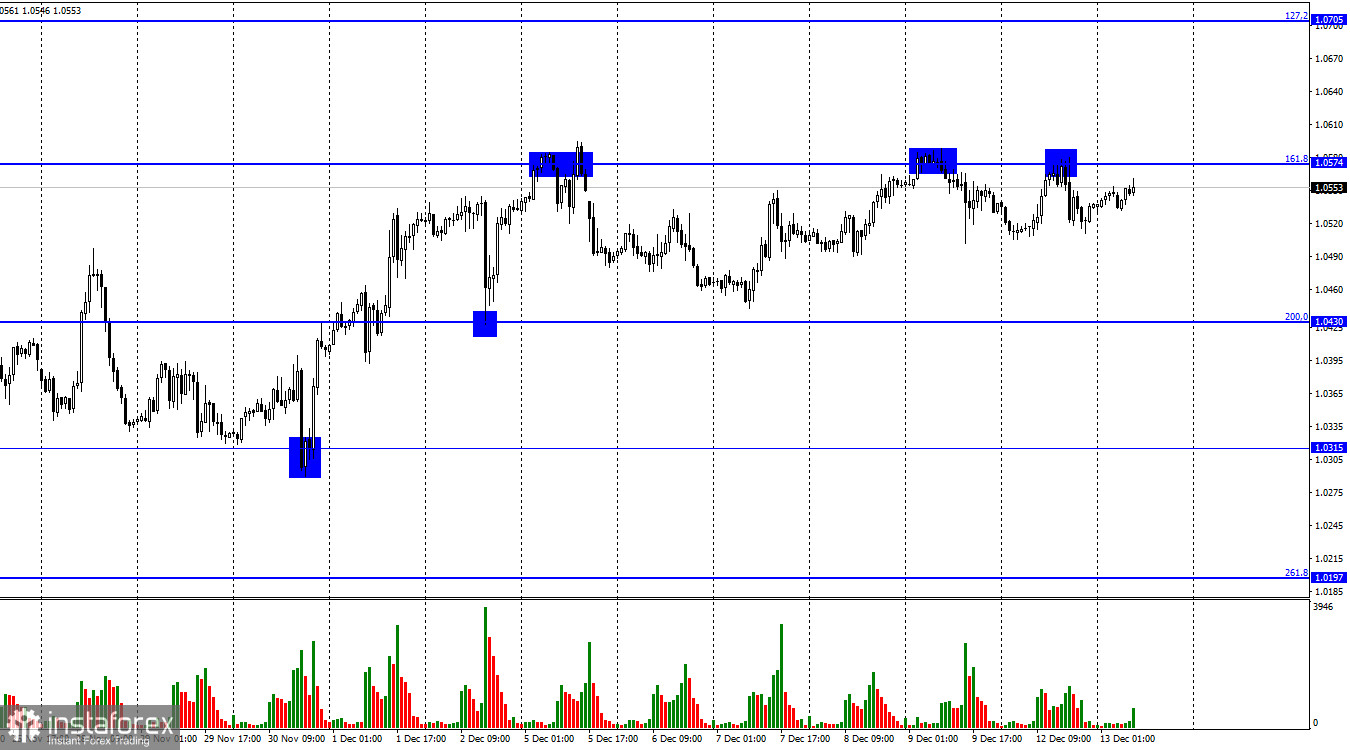

On Monday, the EUR/USD pair rebounded from the correction level of 161.8% at 1.0574 and reversed to the benefit of the US currency. However, we have seen a lot of such rebounds and reversals in favor of the greenback. None of them led to a robust rise in USD. This week, there will be a lot of important events, so we may expect increased trading activity from the euro-dollar pair. However, the beginning of the week shows that traders are not ready to open positions.

On Monday, the economic calendar had no important events. This can partly explain the pair's sideways movement not only during the day but also during the last 6-7 days as the information background was quite weak last week. However, the inflation report that many people are waiting for will be released today in the US. This report is unlikely to affect the results of the Fed meeting, which will be known tomorrow night. We cannot be sure about that though, as the meeting is 2 days long and the inflation report will surely come to the US central bank officials. Thus, the interest rate decision may depend on the inflation data.

Meanwhile, everything is already clear on tomorrow's decision. The rate will be increased by 0.50%, no matter what the inflation report will show. What is much more interesting is how much the rate will rise at the next meeting and later. Tomorrow, the rate could be 4.5%. After that, the Fed may raise it by another 0.50%, 0.75%, or even 1.00%. It is the final rate that really matters. The markets are waiting for Jerome Powell's speech scheduled for tomorrow. His rhetoric could be influenced by today's inflation report. If inflation does not fall enough, we can expect hawkish rhetoric from the Fed chairman.

On the 4-hour chart, the pair continues to grow towards the correctional level of 100.0% at 1.0638. If the price rebounds from this level, it may strengthen the US currency and drag the pair towards the Fibo level of 127.2% - 1.0173. If the price settles above the level of 1.0638, it may grow to 1.1041. The ascending trading channel confirms bullish sentiment in the market. Closing below this level, the US dollar may receive support and send the EUR/USD pair to lower levels.

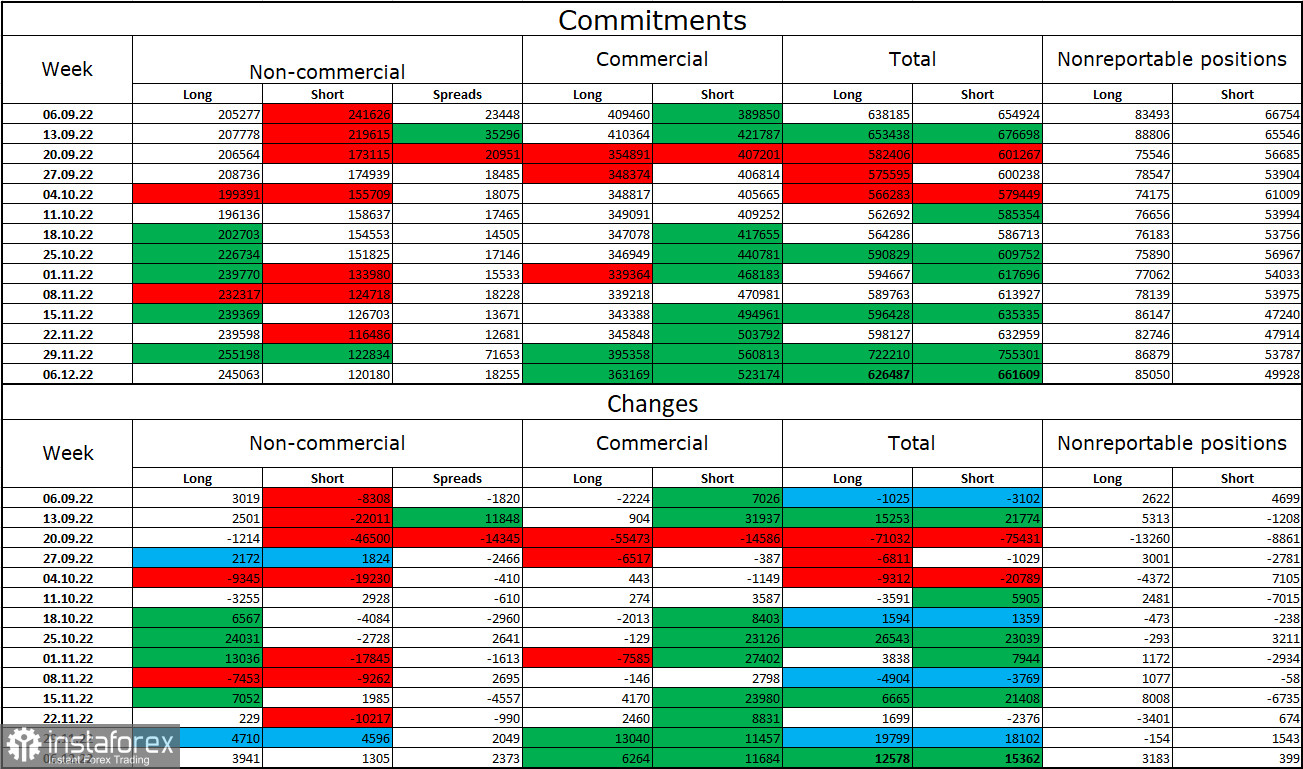

COT report:

Last reporting week, speculators opened just 3,941 long positions and 1,305 short positions. That was quite a low figure. Large traders remain bullish and their sentiment is increasing slowly. The total number of longs held by speculators is now 245,000, and shorts stand at 120,000. The European currency is growing at the moment, which corresponds to the COT reports. At the same time, the number of longs is twice as high as the number of shorts. In the last few weeks, the euro has been rising steadily. Maybe, the euro has grown too much? The situation continues to become more favorable for the euro after a long difficult period, so its prospects remain positive. The downward channel on the 4-hour chart has been broken through. Thus, the euro may continue to grow but this is more of a long-term perspective.

US and EU economic calendars:

US - Consumer Price Index (CPI) (13-30 UTC).

On December 13, the EU and US economic calendars contain one important report. The influence of the information background on the market for the rest of the day could be strong.

Forecast on EUR/USD and recommendations for traders:

One may sell the euro on a rebound from 1.0574 on the hourly chart with a target of 1.0430. This target has almost been reached. New short positions may be opened on a rebound from 1.0638 on the 4-hour chart. You may buy the euro on a rebound from 1.0430 with the target at 1.0574 on the hourly chart.