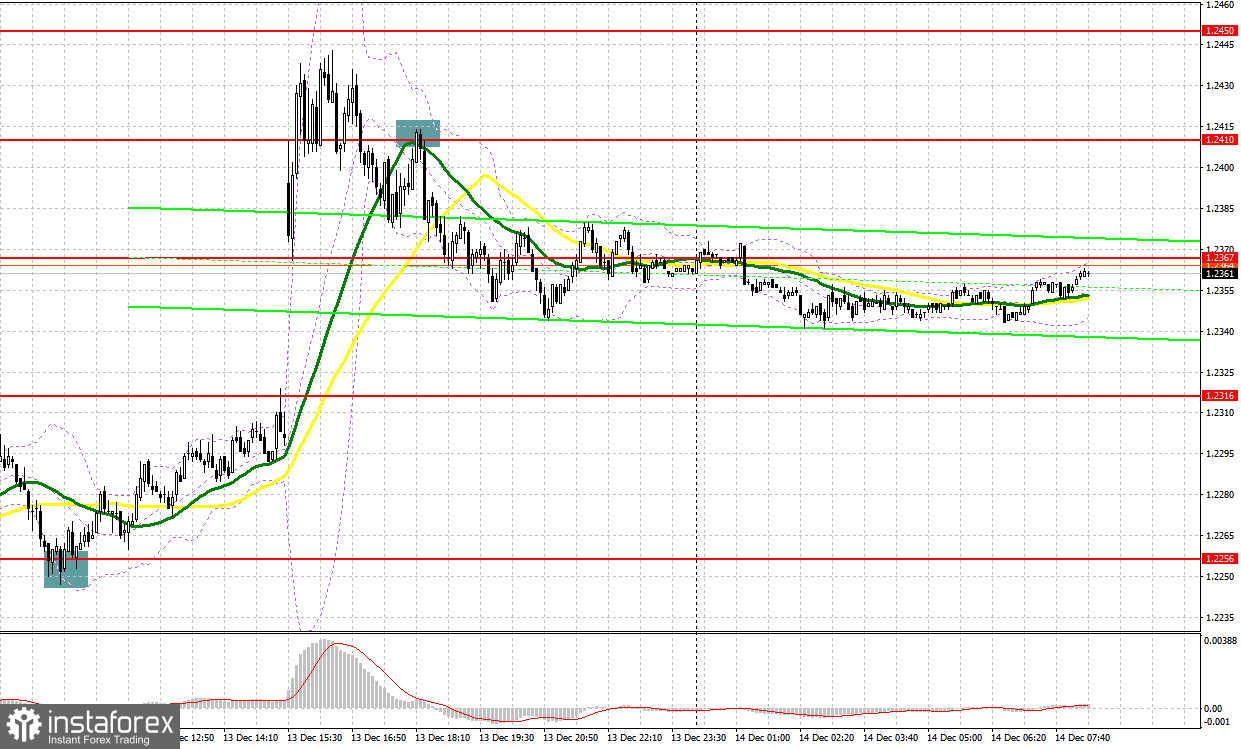

Yesterday, there were several excellent entry points. Let's look at the 5-minute chart and figure out what actually happened. In the morning article, I turned your attention to 1.2256 and recommended making decisions with this level in focus. A drop and breakout of that level created a good buy signal within the uptrend. The GBP/USD pair climbed by 45 pips. Closer to the middle of the day, there was another breakout of 1.2256, which also provided new buying opportunities. The upward movement amounted to more than 200 pips. Only in the afternoon, after rising to the 1.2410 level, a sell signal appeared after an upward retest. It led to a downward correction of 60 pips.

When to open long positions on GBP/USD:

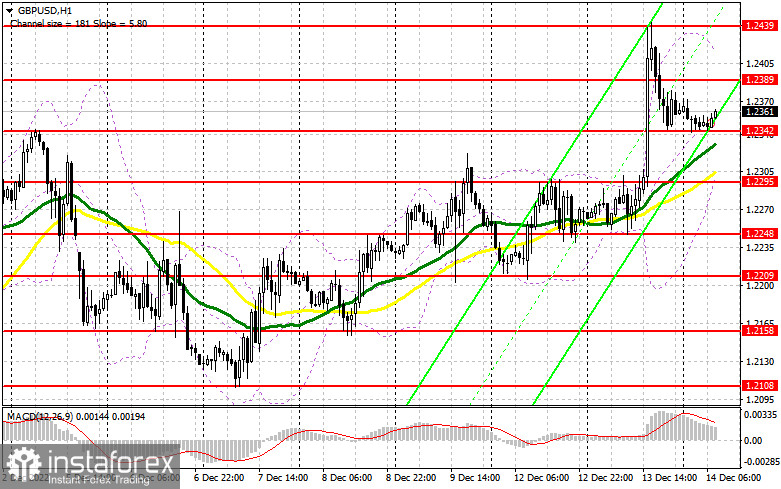

The pound sterling asserted strength following the US inflation report for November. The CPI declined more sharply than expected. It means that the Fed is likely to shift to a less hawkish stance on monetary policy. Besides, it is widely expected to undertake a smaller hike at today's meeting. We will talk about the meeting in more detail in my review of the American session. Today, the UK will unveil its inflation data, which may push the pound sterling to new highs. If inflation advances or tops expectations, such a scenario looks quite likely. If there is a slowdown in consumer prices, the British currency may retreat to 1.2342, providing an excellent entry point into long positions. I would advise you to open long positions after a false breakout of 1.2342. It might help the bulls return the pair to the resistance level of 1.2389. A breakout above this level will be extremely favorable for bulls. They could bet on a rise to a monthly high of 1.2439. A jump above this level will open the way to 1.2484 where I recommend locking in profits. If the bulls miss 1.2342, it is better to postpone long positions until a false breakout of 1.2295 takes place. At this level, moving averages are benefiting bulls. You could buy GBP/USD immediately at a bounce from 1.2248, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Sellers left the market once again yesterday. They are now in no hurry to come back. Bears need to take control of the nearest resistance level of 1.2389 if they want to undermine a bullish bias. Therefore, only a false breakout of 1.2389 will give a good sell signal with the prospect of a decline to the support level of 1.2342. Bulls and bears are likely to fight hard for this level. A breakout and an upward retest of this level will create a sell signal. Shortly after, there might be a test of 1.2295. The price will hardly fall below this level ahead of the Fed's rate decision. A more distant target will be the 1.2248 level where I recommend locking in profits. If GBP/USD rises and bears show no energy at 1.2389, bulls are sure to cement the upward movement. Only a false breakout of 1.2439 gives an entry point into short positions with a likelihood of a further decline. If sellers do not try to take control of that level, you could sell GBP/USD at 1.2484, keeping in mind a downward intraday correction of 30-35 pips.

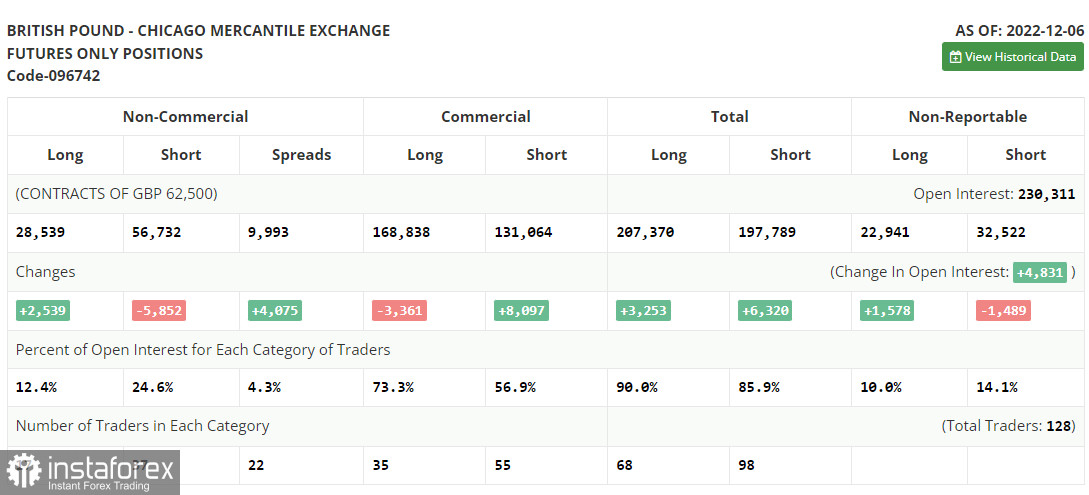

COT report

The COT report (Commitment of Traders) for December 6 logged an increase in long positions and a drop in short ones. Apparently, GBP bulls are confident that the uptrend will persist as the Fed is widely expected to shift to a less hawkish stance. It means that the rate gap between the BoE and the Fed could narrow in the near future. However, the UK Business activity data released last week turned out to be rather disappointing. It clearly indicated a looming recession in the economy. The UK GDP report was slightly better than expected. However, the third straight month of a contraction in economic activity confirms growing recession concerns. Given that the Bank of England is strongly committed to taming inflation and raising the interest rate, the economic prospects are rather grim. It explains why traders are cautious when buying the instrument despite the short-term uptrend. According to the latest COT report, short non-commercial positions dropped by 5,852 to 56,732 and long non-commercial positions grew by 2,539 to 2,8539. Consequently, the non-commercial net position came in at -28,193 versus -36,584 a week ago. The weekly closing price of GBP/USD grew to 1.2149 against 1.1958.

Indicator signals:

Moving averages

Trading is carried out above the 30-day and 50-day moving averages. It indicates that bulls are trying to stimulate further growth of the pair.

Note: The period and prices of moving averages are viewed by the author on the hourly chart and differ from the general definition of classic daily moving averages on the daily chart.

Bollinger Bands

If GBP/USD moves up, the indicator's upper border at 1.2425 will serve as resistance.

Indicator description:

- Moving Average (MA) determines the current trend by smoothing volatility and noise. Period 50. Colored yellow on the chart.

- Moving Average (MA) determines the current trend by smoothing volatility and noise. Period 30. Colored green on the chart.

- Moving Average Convergence/Divergence (MACD). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20

- Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total long position of non-commercial traders.

- Non-commercial short positions are the total short position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.