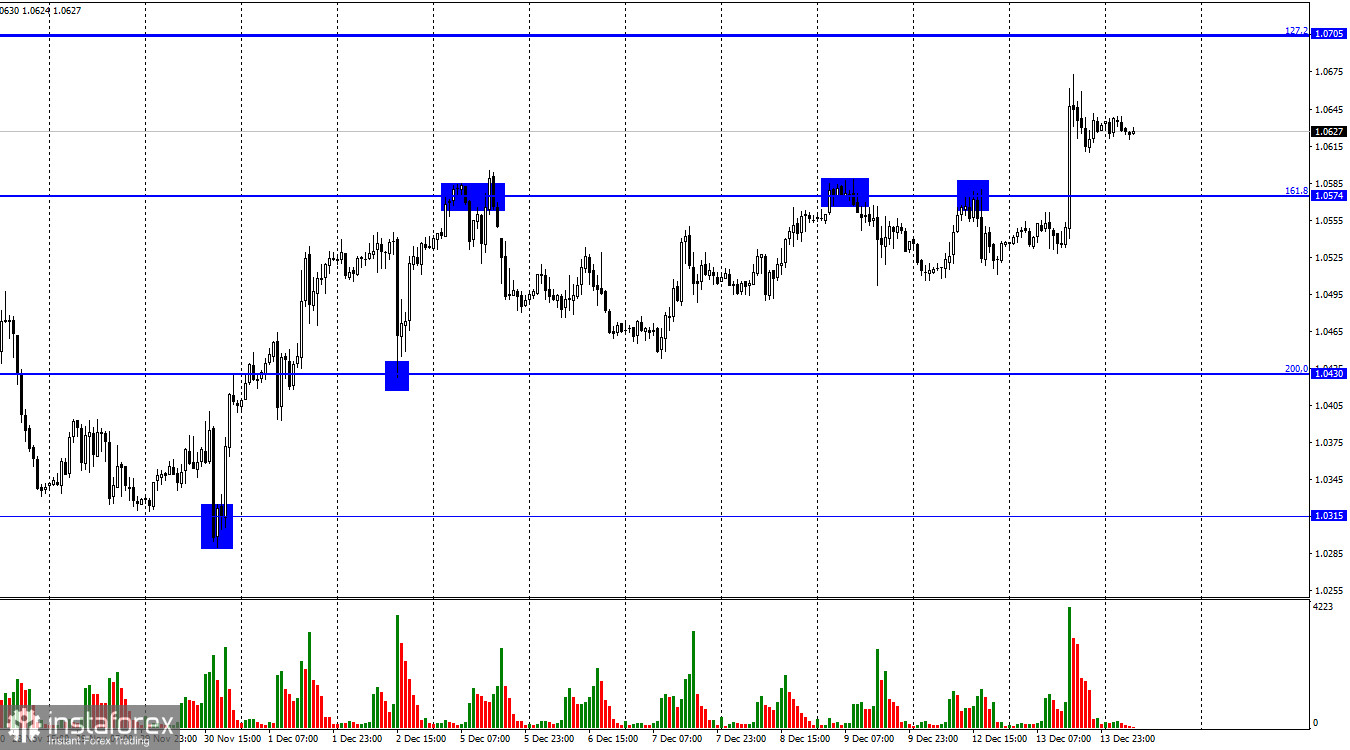

Hi, dear traders! On Tuesday, EUR/USD reversed upwards, settled above the retracement level of 161.8% (1.0574), and continued to rise towards the Fibo level of 127.2% (1.0705). The pair is likely to decrease slightly if it bounces off this level. If EUR/USD settles above 1.0705, it will make further upside movement more likely.

There was only one main event yesterday. The US CPI data for November did not match expectations of traders at all. Market participants did expect inflation to decline, but not such a dramatic drop. It took a while for inflation to begin its downward trajectory in the US. Now, consumer prices are falling at a strong pace. The consumer price index fell to 7.1% from 7.7% in November. Core inflation fell to 6% from 6.3% a month ago. The Fed is mostly focused on core inflation, but it appeared yesterday that traders are more focused on the base CPI data. Core inflation almost matched expectations of traders, who were expecting a decrease to 6.1%. However, core CPI declined more than expected.

The US dollar immediately fell by 100 pips and continues to slide down today, as yesterday's data release continues to influence the markets. If inflation declines significantly, it means the Fed will raise its interest rate more slowly. The US central bank will announce the results of its two-day policy meeting tonight. Now Jerome Powell may tone down his rhetoric and state that inflation is falling at a good pace, which means fewer interest rate hikes may be required. Expectations of such a shift sent the US dollar tumbling this week.

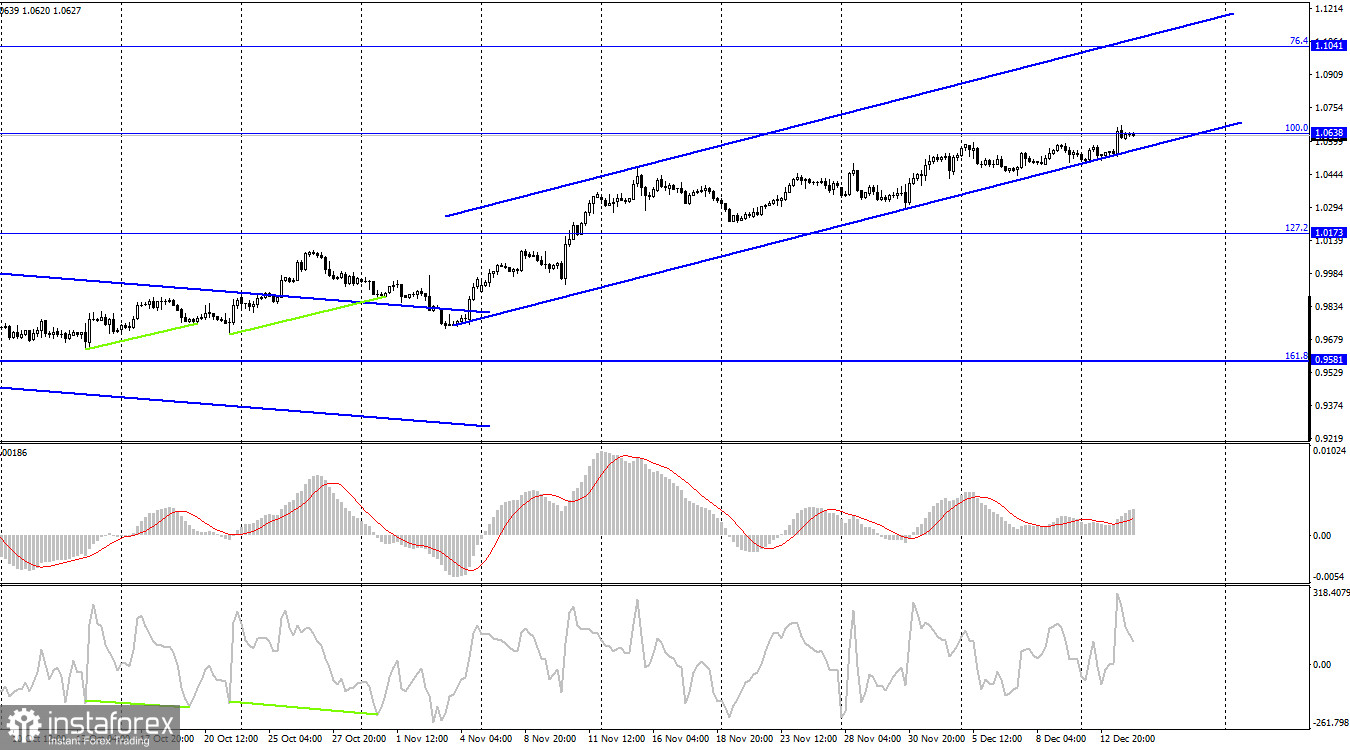

According to the H4 chart, the pair continues to rise towards the retracement level of 100% (1.0638). If it bounces off this level, it will decline slightly towards the Fibo level of 127.2% (1.0173). If EUR/USD settles above 1.0638, it will make further upward movement towards 1.1041 more likely. The ascending trend channel indicates traders are bullish on EUR/USD - if the pair closes below it, a decline is expected.

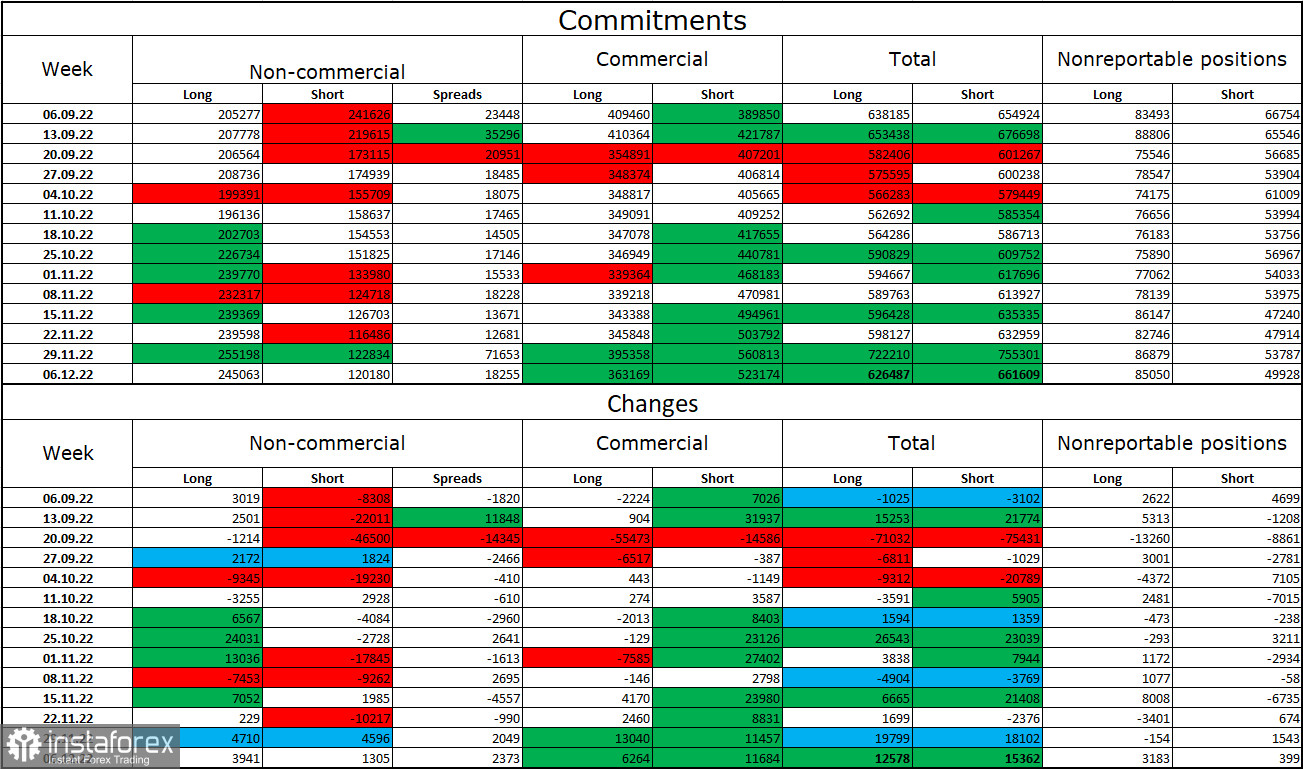

Commitments of Traders (COT) report:

Last week traders opened relatively few positions – only 3,941 Long and 1,305 Short ones. The sentiment of major traders remains bullish and is slowly improving. Market players now have 245,000 Long and 120,000 Short positions open. The euro is currently on the rise, matching the COT report, but net long positioning is two times higher than net short positioning. Over the past several weeks, a EUR uptrend became more and more likely. Now, the situation begs the different question – has the euro advanced too much? Overall, the situation for EUR is becoming more favorable after its long period of losses, and the outlook remains positive. EUR/USD managed to rise above the descending trend channel on the H4 chart, but this close is more likely to push the pair higher only in the longer term.

US and EU economic calendar:

US - FOMC economic projections (19-00 UTC)

US - FOMC statement (19-00 UTC)

US - Fed interest rate decision (19-00 UTC)

US - FOMC press conference (19-30 UTC).

Today's key event on the economic calendar is the Fed policy meeting. It is likely to influence traders significantly.

Outlook for EUR/USD:

New short positions can be opened if the pair bounces off 1.0638 on the H4 chart with 1.0574 and 1.0430 being targets. Traders can go long on EUR/USD if it closes above 1.0638 on the H4 chart targeting 1.1041.