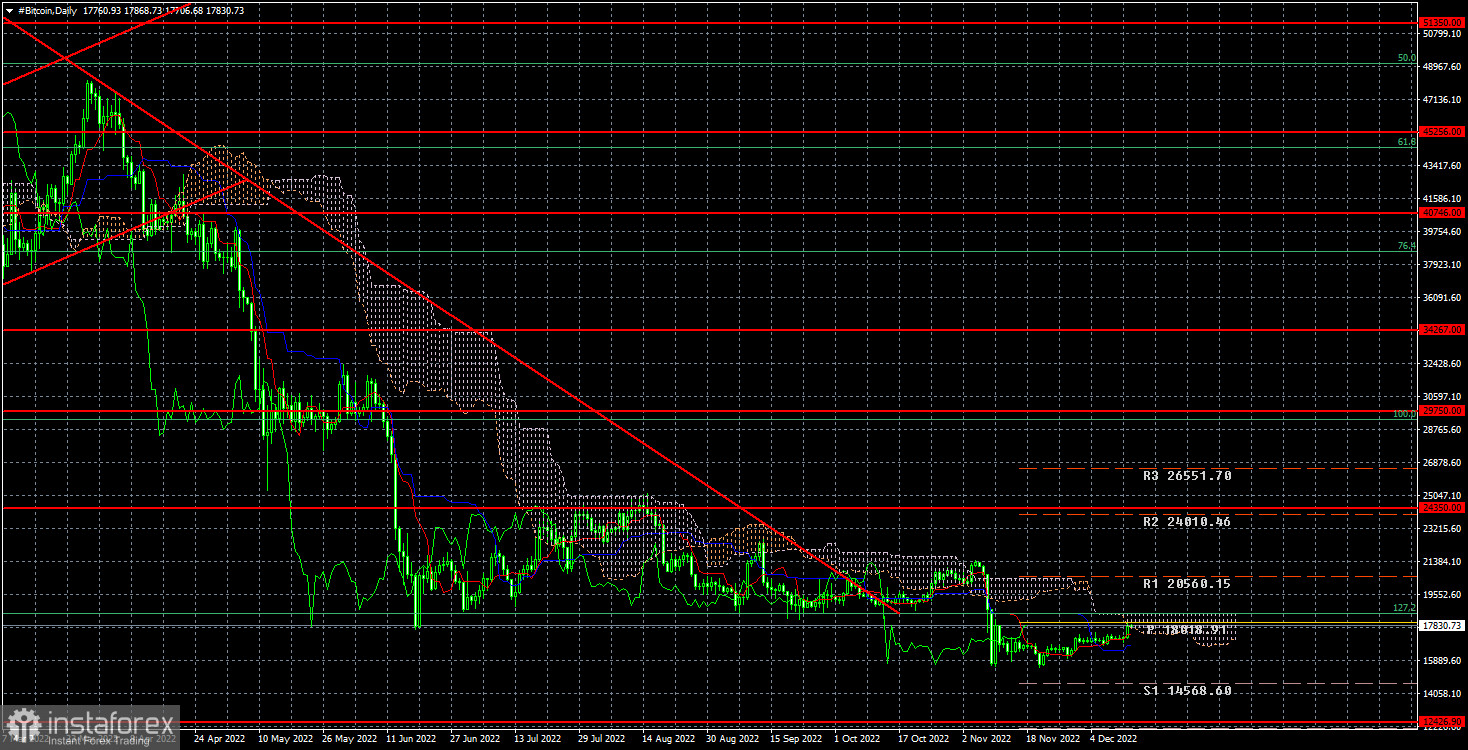

Bitcoin has been consolidating below the Fibonacci level of 127.2%, or $ 18,500, and is now below it. Moreover, it should be noted that the price of "bitcoin" has been steadily ascending over the past few weeks. A $2,000 increase cannot be regarded as the start of a "bullish" trend. Bitcoin has never stood still, not even during previous flat periods that followed collapses. We are not at all surprised that, at this time, the first cryptocurrency in the world is growing unpredictably, as it has also displayed sluggish periods of growth. We don't think the "bearish" trend is over or that there won't be any more declines in the price of bitcoin.

US inflation report and today's Fed meeting.

The abrupt and aggressive tightening of monetary policy by many central banks worldwide in 2022 is one of the primary causes of the decline of cryptocurrencies. But the moment is slowly approaching when the Central Bank starts to tone down its combative stance. As a result, there may be some market support for bitcoin. The Fed can quickly stop raising rates and raise them overall at a lower rate than traders could have anticipated earlier if US inflation sharply declines. Additionally, the overall cryptocurrency market is in a "moderately positive" state at this time. As a result, there are now solid reasons for bitcoin to increase in value. For $1000? For $2000? Whatever the case, we are discussing slow growth.

When the Fed releases the meeting's outcomes later today, bitcoin might increase in price slightly. But once more, we want to draw traders' attention to the fact that while the current easing of monetary policy is a good development, the Fed (and other institutions as well) will continue to tighten monetary policy in the coming months rather than soften it. Not to be overlooked are the QT programs, which do result in a decrease in the amount of money in circulation. Investments decline when there is less money in the economy. We, therefore, anticipate the first cryptocurrency to grow slowly over the next year (until the monetary policy of the Fed and other Central banks starts to soften). Likewise, other cryptocurrencies. However, recent bankruptcy news in the cryptocurrency sector may once more compel investors and holders to throw away the "bitcoin." Many experts think that the price of bitcoin could drop from $5,000 to $10,000 per coin.

The "bitcoin" quotes over the past 24 hours have remained below $18,500. The fall could continue with a $12,426 goal. As we previously stated, since the price was concurrently in a side channel, crossing the downward trend line does not signify the end of the "bearish" trend. The quotes can move further south after reaching the lower channel limit.