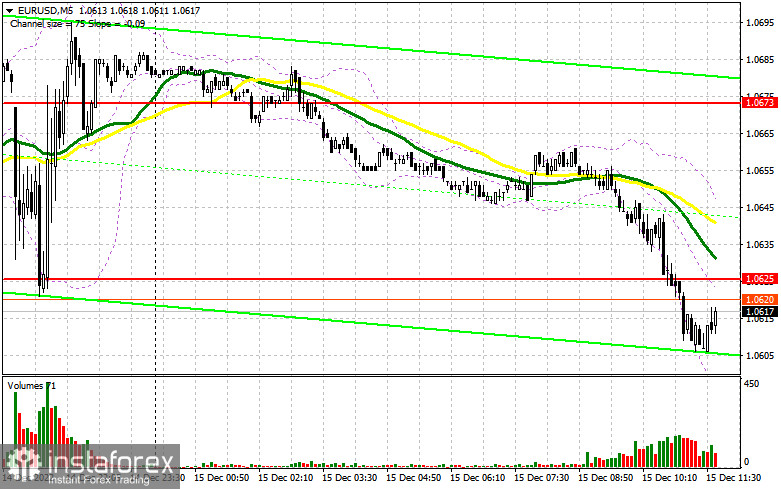

In my morning review, I mentioned the level of 1.0625 and recommended entering the market from there. Let's see what happened on the 5-minute chart. A breakout of this level was not followed by a retest, so we couldn't get an entry point. The technical outlook was changed for the second half of the day.

For long positions on EUR/USD:

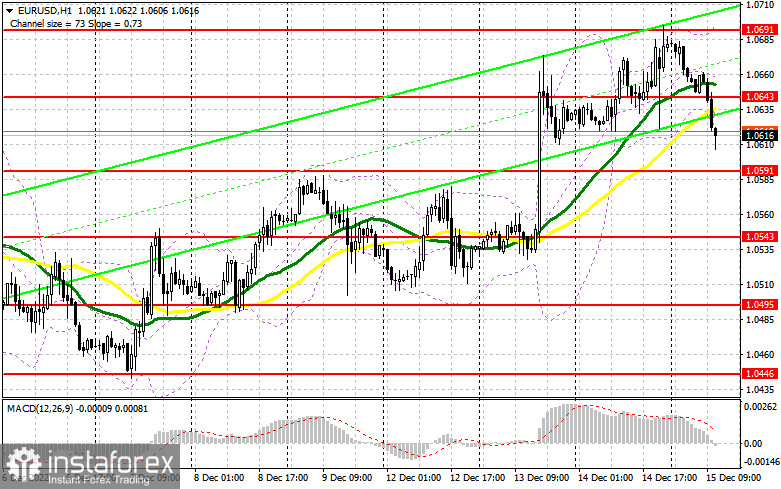

Traders continue to get rid of the euro and buy up the US dollar following Jerome Powell's comments and waiting for the ECB meeting. The European regulator is unlikely to change its stance to a more hawkish one. I think that the more decisive factor today will be the data on US retail sales for November. A sharp decline in sales will raise the demand for the euro and will push the pair higher. In an opposite scenario, if retail sales exceed the forecast, the US dollar will strengthen even more. In this case, we can bet on a downward correction in the pair. Other reports, such as weekly jobless claims and manufacturing production in the US, are unlikely to influence the market sentiment. In case of a decline, only a false breakout at the nearest support of 1.0591 will generate a buy signal with a prospect of a bullish recovery. This will pave the way toward the level of 1.0643 where moving averages support the bears. This level was formed in the first half of the day and may serve as a pivot point for the pair. Its breakout and a downward retest will reinforce the bullish bias, thus paving the way to the higher target at 1.0691. It may be hard to overcome this range but it is still possible. A breakout of the 1.0691 level will open the door to the highest target located at 1.0741 where I recommend profit taking. If EUR/USD declines in the course of the North American session, and bulls are idle at 1.0591, the pressure on the euro will rapidly increase. This will eventually trigger stop-loss orders set by the bulls. If so, only a false breakout at the next support of 1.0543 will be a reason to buy the pair. You can open short positions on EUR/USD immediately after a rebound from 1.0495 or at the low of 1.0446, keeping in mind an upside correction of 30-35 pips within the day.

For short positions on EUR/USD:

Bears are regaining ground and have already approached yesterday's lows. A surge in volatility may come right after the ECB meeting. Let's wait for the bank's decision to see where the pair may move next. If the euro advances, only a false breakout at the resistance level of 1.0643 will create a good entry point into short positions with a possible decline toward 1.0591. A breakout of this range, consolidation below it, and its upward retest will give an additional sell signal, provided that the US data exceeds expectations. This signal will trigger stop-loss orders set by the bulls and may send the euro down to 1.0543. This move may significantly limit the upside potential of the pair. The level of 1.0495 will serve as the lowest target where the buyers may attempt to step in and buy the pound at the lows. If EUR/USD rises in the course of the North American session and bears are idle at 1.0643, bulls may seize this opportunity and may try to retest a monthly high of 1.0691. Selling from this level can be done only after a false breakout. You can open short positions on EUR/USD immediately after a rebound from the high of 1.0741, considering a downward correction of 30-35 pips.

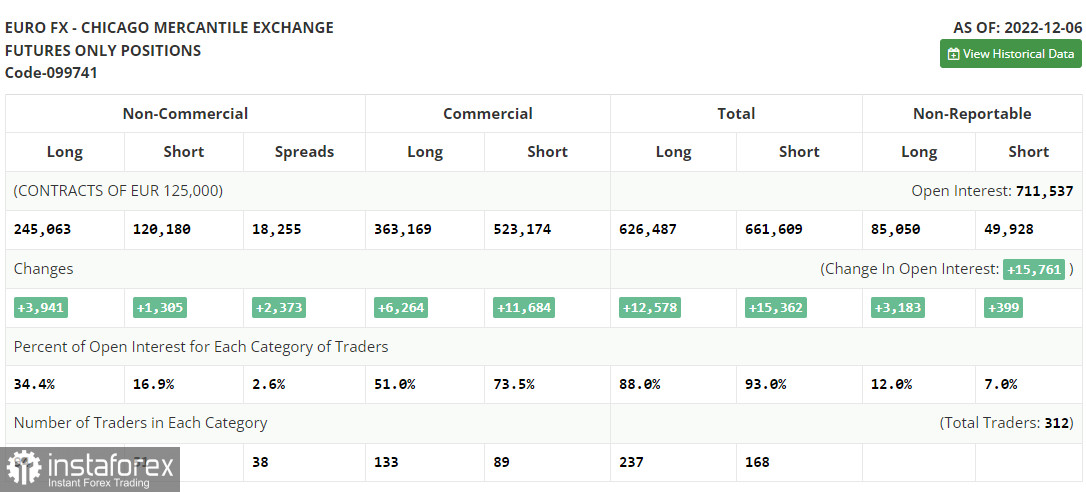

COT report

The Commitments of Traders (COT) report for December 6 showed a rise in both long and short positions. Strong data on business activity in the US has offset the positive eurozone data on GDP for the third quarter. The latter was eventually revised upwards which supported the demand for risk assets. However, the situation may change this week ahead of the inflation data in the US. Unlike prevailing forecasts, US consumer prices are likely to have increased in November. If so, this data will again shake the market. In addition, the US Federal Reserve meeting will take place this week. Fed Chair Jerome Powell may change his stance to more hawkish, thus supporting the US dollar. In a different scenario, inflation may ease, and this will allow the euro to develop a strong uptrend by the end of the year. According to the latest COT report, long positions of the non-commercial group of traders increased by 3,941 to 245,063, while short positions jumped by 1,305 to 120,180. By the end of the week, the total non-commercial net position increased to 123,113 from 122,234. This is a clear sign that inverters are still optimistic about the euro and are ready to buy at the current levels if the fundamental background is favorable. The weekly closing price dropped to 1.0315 from 1.0342.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates that bears are trying to take over the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If the price goes up, the upper band of the indicator at 1.0691 will act as resistance.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.