The Fed announced a 0.50% rate increase, which raises the central bank's interest rate to 4.25% - 4.50%. However, during the press conference, Fed Chairman Jerome Powell's comments attracted the most attention as his views were different from what markets were expecting. Analysts were looking for information about the Fed's forward-looking recommendations for monetary policy, inflation and future rate hikes, which is a likely continuation of tight policy in 2023.

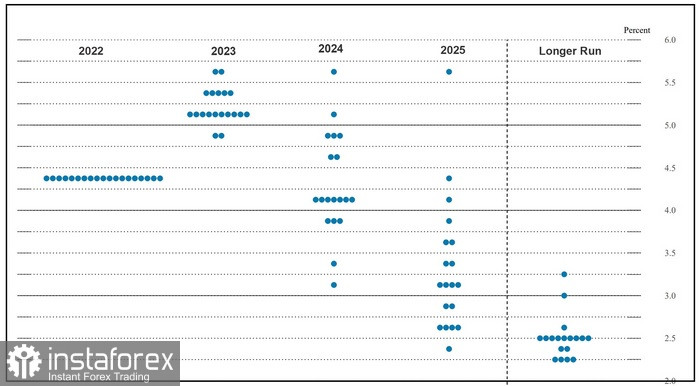

Another topic that was discussed was a summary of the central bank's economic forecasts for 2023-2025. One component of it was a "dot plot", which shows the estimates made by each Fed member.

For 2023, all 19 members projected higher interest rates, with most expecting it to be at 5.0%. Only two members saw rates at 4.0%.

For 2024, 7 members believe interest rates to remain above 4.0%, while the remaining voted to reduce rates.

Lastly, for 2025, all members saw interest rates to be between 4.5% and 3.0% by the end of the year.

Powell said these projections are the best estimate of where the Fed rates will be.